Region:Africa

Author(s):Geetanshi

Product Code:KRAA3256

Pages:98

Published On:September 2025

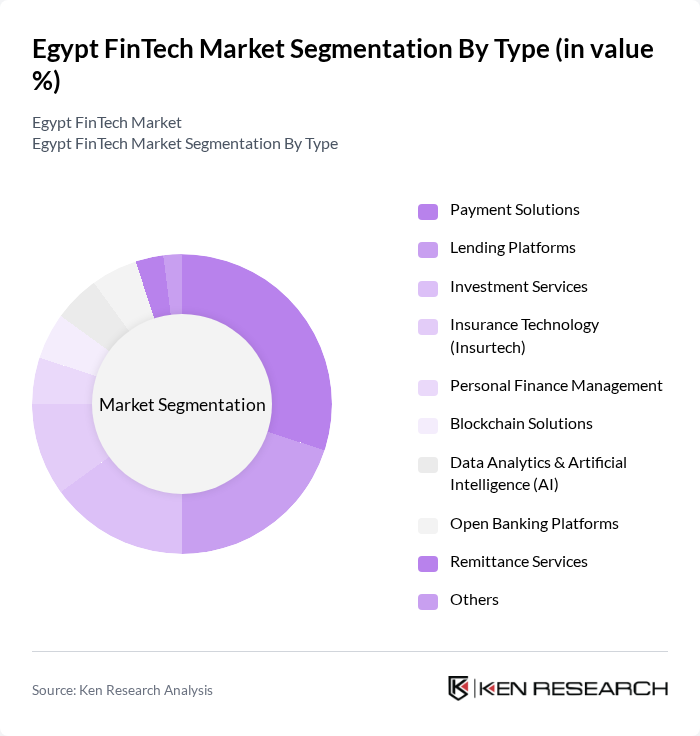

By Type:The Egypt FinTech Market encompasses a diverse range of solutions, includingPayment Solutions(digital wallets, mobile payments, and POS systems),Lending Platforms(peer-to-peer and digital lending),Investment Services(robo-advisory and wealth management),Insurance Technology (Insurtech)(digital insurance distribution and claims management),Personal Finance Management(budgeting and expense tracking apps),Blockchain Solutions(digital asset management and smart contracts),Data Analytics & Artificial Intelligence (AI)(fraud detection and credit scoring),Open Banking Platforms(API-based data sharing),Remittance Services(cross-border and domestic money transfers), andOthers(including RegTech and crowdfunding). Each segment plays a vital role in shaping Egypt’s evolving fintech ecosystem .

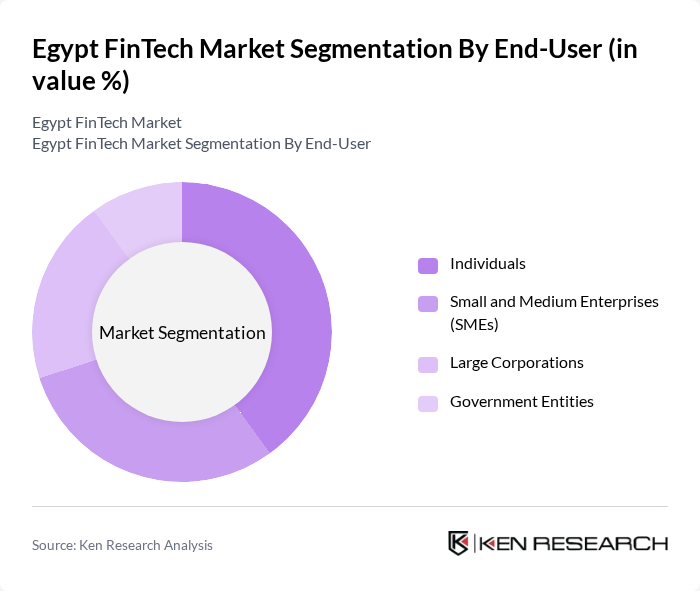

By End-User:The market is further segmented by end-user categories, includingIndividuals(consumers utilizing digital wallets, personal finance, and investment apps),Small and Medium Enterprises (SMEs)(leveraging payment gateways, lending, and accounting tools),Large Corporations(adopting enterprise-grade fintech solutions for treasury, payroll, and procurement), andGovernment Entities(implementing digital payment and financial inclusion programs). Each segment exhibits distinct adoption patterns and solution requirements .

The Egypt FinTech Market features a dynamic mix of regional and international players. Leading participants such as Fawry for Banking and Payment Technology, EFG Hermes, Paymob, Aman for E-Payment Solutions, Commercial International Bank (CIB), National Bank of Egypt (NBE), Masary, TPAY Mobile, valU, Raseedi, MoneyFellows, MNT-Halan, Khazna, Bee, and FinTech Egypt drive market innovation, geographic expansion, and service delivery. These firms are instrumental in scaling digital payments, lending, and embedded finance solutions, attracting significant investment and contributing to Egypt’s position as a leading fintech hub in Africa .

The future of the Egypt FinTech market appears promising, driven by technological advancements and increasing consumer demand for digital financial solutions. As the government continues to support digital transformation, the adoption of innovative technologies such as artificial intelligence and blockchain is expected to accelerate. Additionally, the growing trend of open banking will likely enhance collaboration between FinTech firms and traditional banks, fostering a more integrated financial ecosystem that benefits consumers and businesses alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Solutions Lending Platforms Investment Services Insurance Technology (Insurtech) Personal Finance Management Blockchain Solutions Data Analytics & Artificial Intelligence (AI) Open Banking Platforms Remittance Services Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Digital Payments Wealth Management Crowdfunding Regulatory Technology (RegTech) Embedded Finance |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Clients High Net-Worth Individuals |

| By Investment Source | Venture Capital Private Equity Government Grants |

| By Policy Support | Tax Incentives Subsidies for Startups Regulatory Sandboxes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Payment Users | 100 | Consumers aged 18-45 using mobile wallets |

| FinTech Startup Founders | 40 | Founders and co-founders of FinTech companies |

| Traditional Bank Executives | 50 | Senior management from banks exploring FinTech partnerships |

| Regulatory Authorities | 40 | Officials from the Egyptian Financial Regulatory Authority |

| Investors in FinTech | 40 | Venture capitalists and angel investors focused on FinTech |

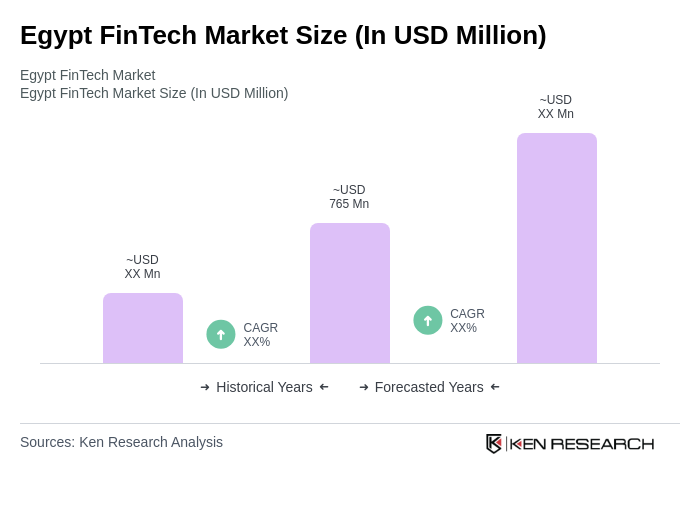

The Egypt FinTech market is valued at approximately USD 765 million, driven by the rapid adoption of digital payment solutions, mobile banking services, and a growing number of fintech startups, alongside increasing internet penetration and smartphone usage.