Region:Global

Author(s):Geetanshi

Product Code:KRAA2779

Pages:87

Published On:August 2025

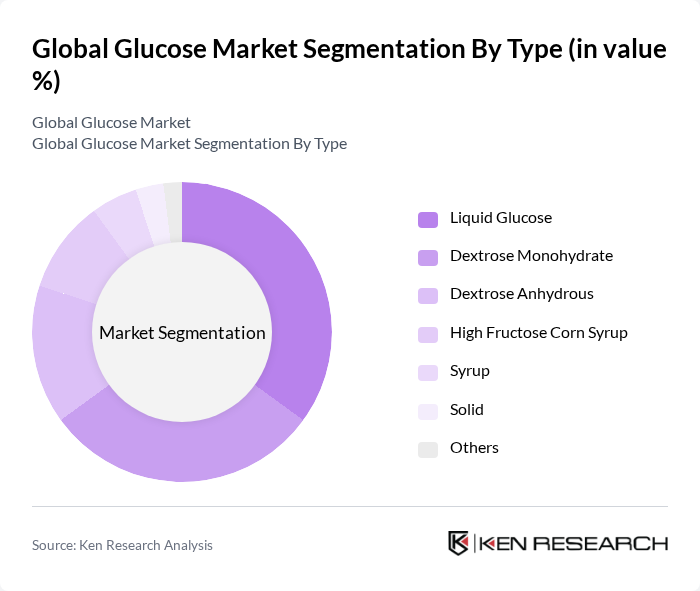

By Type:The glucose market is segmented into various types, including Liquid Glucose, Dextrose Monohydrate, Dextrose Anhydrous, High Fructose Corn Syrup, Syrup, Solid, and Others. Among these, Liquid Glucose and Dextrose Monohydrate are the leading subsegments. Liquid Glucose is widely used in the food and beverage industry due to its versatility and ability to enhance sweetness and texture. Dextrose Monohydrate is favored in the pharmaceutical sector for its quick absorption properties. The increasing demand for convenience foods, functional beverages, and health supplements is driving the growth of these subsegments .

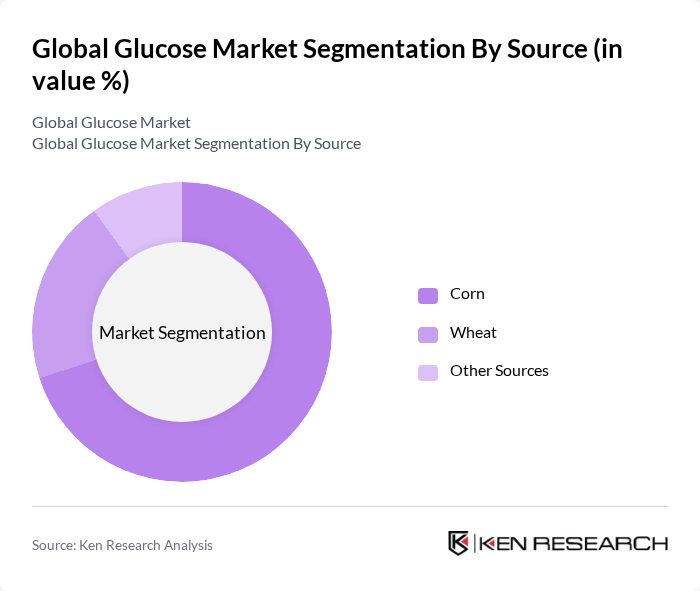

By Source:The glucose market is also segmented by source, including Corn, Wheat, and Other Sources. Corn is the dominant source due to its high starch content, which is easily converted into glucose. The increasing cultivation of corn and advancements in processing technologies have further solidified its position. Wheat is also utilized, but to a lesser extent, primarily in regions where corn is less accessible. The trend towards sustainable sourcing and the exploration of alternative starch sources is gaining momentum, but corn remains the primary choice for glucose production .

The Global Glucose Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cargill, Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Ingredion Incorporated, Roquette Frères, DSM Nutritional Products, Sweetener Supply Corporation, Global Sweeteners Holdings Limited, Nissin Sugar Co., Ltd., Avebe Group, Grain Processing Corporation, AGRANA Beteiligungs-AG, Gulshan Polyols Ltd., Tereos S.A., Sigma-Aldrich Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the glucose market appears promising, driven by increasing health awareness and the demand for natural sweeteners. As consumers continue to prioritize health, the market is likely to see a rise in innovative glucose products tailored for specific dietary needs. Furthermore, the expansion into emerging markets, where urbanization and disposable incomes are rising, will provide new avenues for growth. Companies that adapt to these trends will be well-positioned to capitalize on the evolving landscape of the glucose market.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Glucose Dextrose Monohydrate Dextrose Anhydrous High Fructose Corn Syrup Syrup Solid Others |

| By Source | Corn Wheat Other Sources |

| By Application | Food and Beverages Pharmaceuticals Personal Care Products Animal Feed Bakery Products Dairy Products Snacks and Breakfast Foods Others |

| By End-User | Food Manufacturers Beverage Companies Pharmaceutical Companies Nutraceutical Companies Animal Husbandry Industry Retail Consumers Others |

| By Distribution Channel | Direct Sales Online Retail Supermarkets/Hypermarkets Specialty Stores Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bulk Packaging Retail Packaging Custom Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Manufacturers | 120 | Product Development Managers, Quality Assurance Specialists |

| Pharmaceutical Companies | 90 | Formulation Scientists, Regulatory Affairs Managers |

| Biotechnology Firms | 60 | Research Directors, Process Development Engineers |

| Retail Sector (Glucose Products) | 80 | Category Managers, Supply Chain Analysts |

| Health and Wellness Product Developers | 50 | Marketing Managers, Product Line Managers |

The Global Glucose Market is valued at approximately USD 54 billion, reflecting a robust growth trajectory driven by increasing demand across various sectors, including food and beverages, pharmaceuticals, and personal care products.