Region:Global

Author(s):Geetanshi

Product Code:KRAE2330

Pages:118

Published On:December 2025

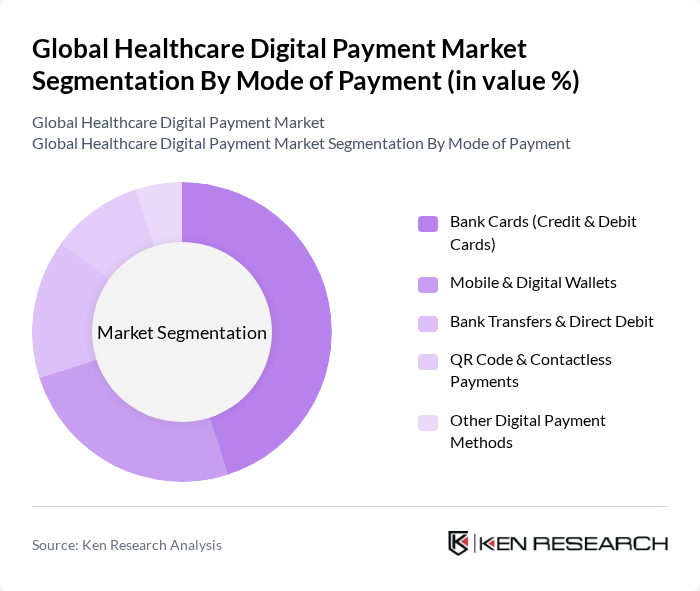

By Mode of Payment:The market is segmented into various modes of payment, including Bank Cards (Credit & Debit Cards), Mobile & Digital Wallets, Bank Transfers & Direct Debit, QR Code & Contactless Payments, and Other Digital Payment Methods. Among these, Bank Cards are the most widely used due to their convenience and widespread acceptance in healthcare facilities. Mobile wallets are gaining traction, especially among younger consumers who prefer digital solutions for their transactions. The increasing adoption of contactless payments is also notable, driven by the COVID-19 pandemic and the demand for safer payment methods.

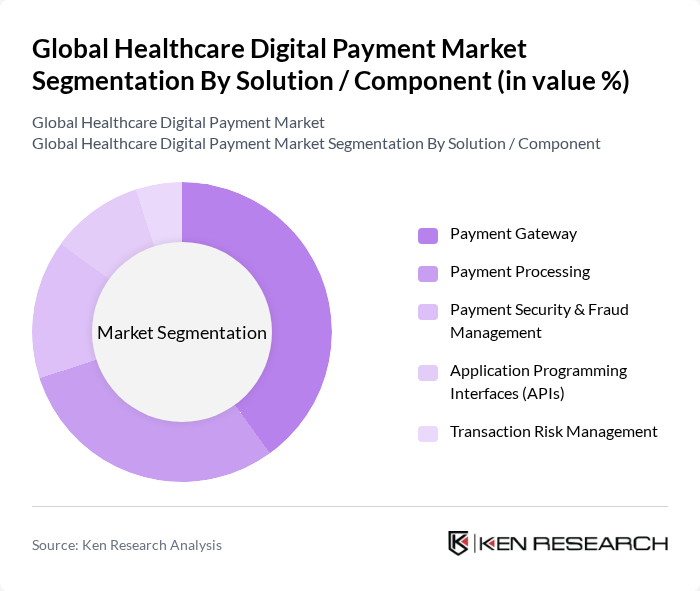

By Solution / Component:This segment includes Payment Gateway, Payment Processing, Payment Security & Fraud Management, Application Programming Interfaces (APIs), Transaction Risk Management, and Other Solutions. Payment Gateway solutions are leading the market due to their critical role in facilitating secure transactions between healthcare providers and patients. Payment Processing is also significant, as it ensures the smooth execution of transactions. The increasing focus on security and fraud management solutions is driven by the rising concerns over data breaches and cyber threats in the healthcare sector.

The Global Healthcare Digital Payment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Change Healthcare, Inc. (Optum-owned), Waystar, Inc., InstaMed Communications LLC (J.P. Morgan company), Zelis Healthcare, LLC, Flywire Corporation, Cedar, Inc., Epic Systems Corporation (MyChart & integrated payment solutions), Cerner Corporation (Oracle Health) – Revenue Cycle & Payments, athenahealth, Inc., Allscripts Healthcare Solutions, Inc. (Veradigm), R1 RCM Inc., Experian Health (Experian plc), Fiserv, Inc. – Healthcare Payment Solutions, Fortune Business Services, LLC d/b/a Fortis (formerly Payment Logistics) – Healthcare, Salucro Healthcare Solutions, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare digital payment market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As healthcare providers increasingly adopt integrated payment solutions, the focus will shift towards enhancing user experience and security. Additionally, the integration of AI and blockchain technologies is expected to streamline payment processes, improve fraud detection, and enhance data security, ultimately fostering greater trust and efficiency in healthcare transactions.

| Segment | Sub-Segments |

|---|---|

| By Mode of Payment | Bank Cards (Credit & Debit Cards) Mobile & Digital Wallets Bank Transfers & Direct Debit QR Code & Contactless Payments Other Digital Payment Methods |

| By Solution / Component | Payment Gateway Payment Processing Payment Security & Fraud Management Application Programming Interfaces (APIs) Transaction Risk Management Other Solutions |

| By Deployment Mode | On-premise Cloud-based Hybrid |

| By Enterprise Size | Large Enterprises Small & Medium-sized Enterprises (SMEs) |

| By End-User | Hospitals Medical Clinics Pharmacies & Retail Drug Stores Health Insurance Companies & Payers Telemedicine & Remote Health Services Other Healthcare Providers |

| By Transaction Type | Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Business (C2B) Other Transaction Types |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Payment Systems | 120 | Chief Financial Officers, Billing Managers |

| Telehealth Payment Solutions | 90 | Telehealth Service Providers, IT Managers |

| Insurance Claim Processing | 70 | Claims Adjusters, Insurance Analysts |

| Patient Payment Experience | 110 | Patient Experience Officers, Customer Service Managers |

| Healthcare Payment Technology | 80 | Product Managers, Technology Officers |

The Global Healthcare Digital Payment Market is valued at approximately USD 14 billion. This growth is driven by the increasing adoption of digital payment solutions in healthcare, enhancing transaction efficiency and patient experiences.