Region:Global

Author(s):Rebecca

Product Code:KRAA2895

Pages:96

Published On:August 2025

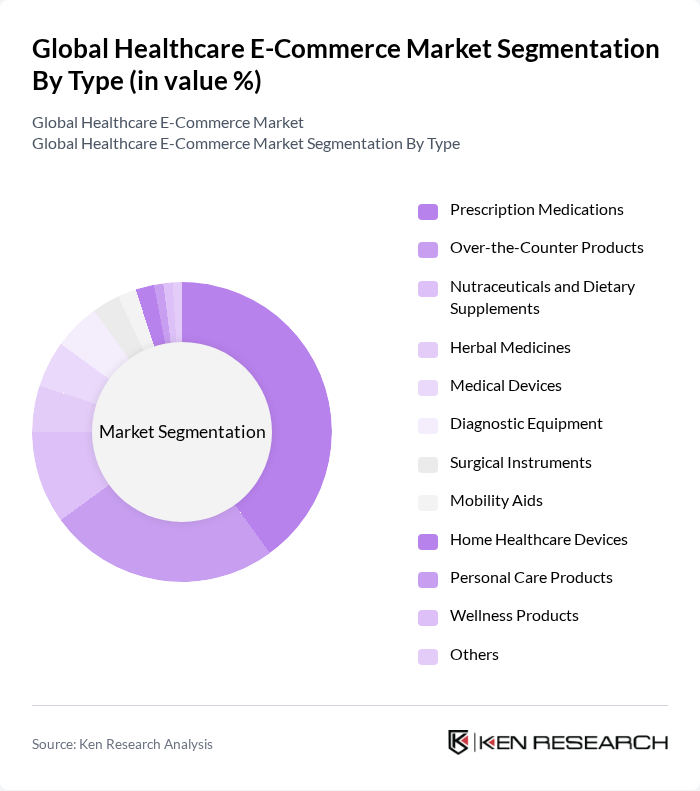

By Type:The healthcare e-commerce market is segmented into Prescription Medications, Over-the-Counter Products, Nutraceuticals and Dietary Supplements, Herbal Medicines, Medical Devices, Diagnostic Equipment, Surgical Instruments, Mobility Aids, Home Healthcare Devices, Personal Care Products, Wellness Products, and Others. Among these, Prescription Medications and Over-the-Counter Products are the leading segments, driven by consumer preference for online purchasing due to convenience and accessibility. The rise in chronic diseases has led to higher demand for prescription medications, while growing health and wellness awareness has boosted sales of over-the-counter products .

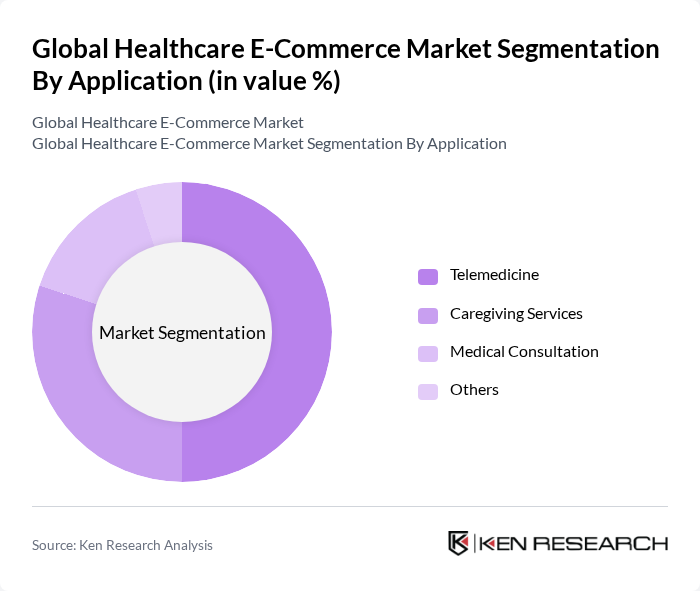

By Application:This segment includes Telemedicine, Caregiving Services, Medical Consultation, and Others. Telemedicine is the dominant application, driven by the increasing need for remote healthcare services and the convenience of accessing healthcare professionals from home. Caregiving services and medical consultations are also gaining traction as more individuals seek personalized healthcare solutions .

The Global Healthcare E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon Pharmacy, CVS Health, Walgreens Boots Alliance, Alibaba Health Information Technology, JD Health International, Walmart Health, McKesson Corporation, UnitedHealth Group, Siemens Healthineers, Philips Healthcare, Johnson & Johnson, Medtronic, Bayer AG, GE Healthcare, Zuellig Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the healthcare e-commerce market appears promising, driven by technological innovations and changing consumer behaviors. As telemedicine continues to gain traction, the integration of AI and machine learning will enhance service personalization and operational efficiency. Additionally, the shift towards subscription-based models is likely to reshape revenue streams, providing consumers with more predictable healthcare costs and fostering long-term patient relationships. These trends indicate a dynamic evolution in the healthcare e-commerce landscape, with significant implications for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter Products Nutraceuticals and Dietary Supplements Herbal Medicines Medical Devices Diagnostic Equipment Surgical Instruments Mobility Aids Home Healthcare Devices Personal Care Products Wellness Products Others |

| By Application | Telemedicine Caregiving Services Medical Consultation Others |

| By End-User | Individual Consumers Healthcare Professionals Hospitals Clinics Pharmacies Corporate Clients Others |

| By Sales Channel | Direct-to-Consumer (D2C) Third-Party Marketplaces B2B E-Commerce Platforms Mobile Applications Social Media Platforms Others |

| By Product Category | Pharmaceuticals Medical Equipment Health and Wellness Personal Care Others |

| By Distribution Mode | Online Retail Home Delivery Services Click-and-Collect Services Others |

| By Pricing Strategy | Competitive Pricing Value-Based Pricing Discount Pricing Premium Pricing Others |

| By Customer Segment | B2C B2B C2C Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical E-commerce | 100 | Pharmacy Managers, E-commerce Directors |

| Medical Devices Online Sales | 60 | Product Managers, Sales Executives |

| Health and Wellness Products | 50 | Marketing Managers, Consumer Insights Analysts |

| Telehealth Services | 40 | Healthcare Providers, Telehealth Coordinators |

| Consumer Health Products | 60 | Retail Managers, Customer Experience Specialists |

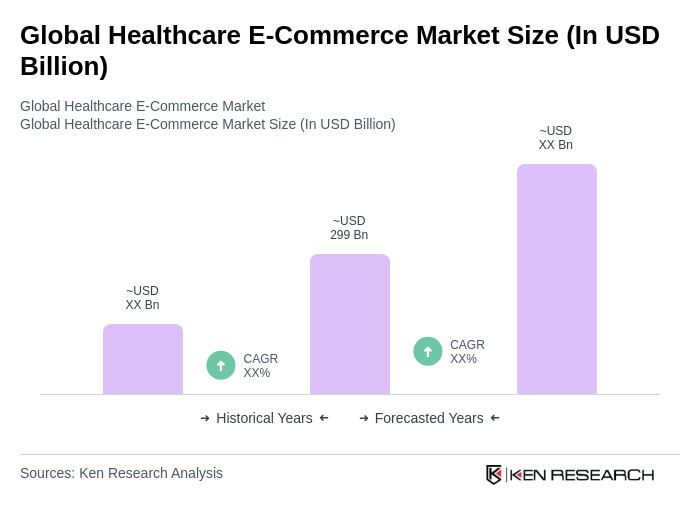

The Global Healthcare E-Commerce Market is valued at approximately USD 299 billion, reflecting significant growth driven by the increasing adoption of digital health solutions and the rising prevalence of chronic diseases.