Region:Global

Author(s):Rebecca

Product Code:KRAD6249

Pages:91

Published On:December 2025

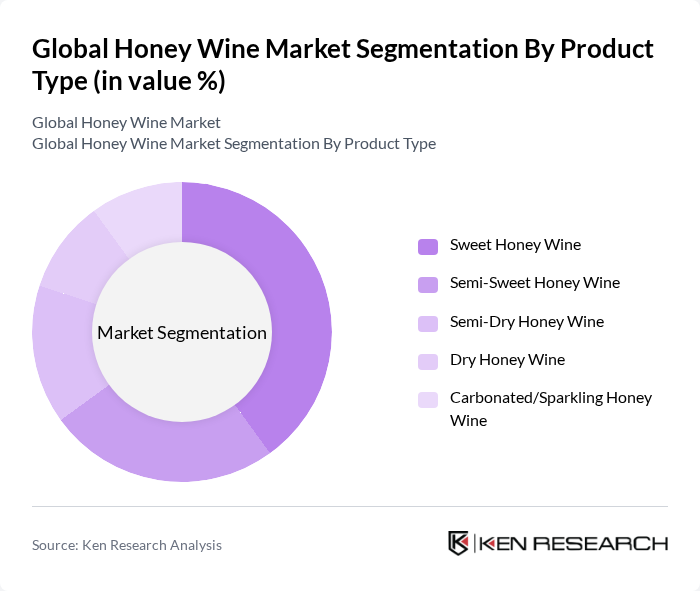

By Product Type:The product type segmentation includes various styles of honey wine, catering to diverse consumer preferences. The subsegments are Sweet Honey Wine, Semi-Sweet Honey Wine, Semi-Dry Honey Wine, Dry Honey Wine, and Carbonated/Sparkling Honey Wine. Among these, Sweet Honey Wine is currently the most popular choice in volume terms, as many new consumers entering the category prefer approachable, dessert?like profiles before experimenting with drier styles. The trend towards sweeter options is reinforced by younger consumers and flavored?beverage drinkers seeking unique, naturally sweet alternatives to traditional grape wines, ciders, and ready?to?drink cocktails.

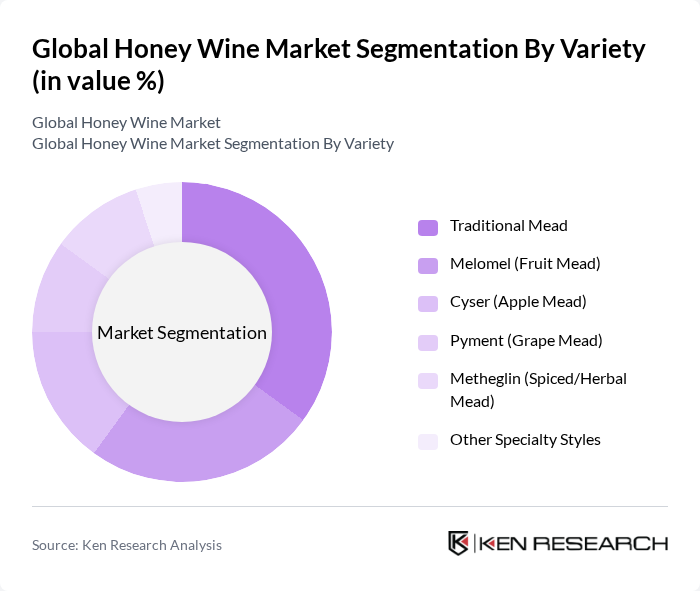

By Variety:This segmentation focuses on the different styles of honey wine, including Traditional Mead, Melomel (Fruit Mead), Cyser (Apple Mead), Pyment (Grape Mead), Metheglin (Spiced/Herbal Mead), and Other Specialty Styles. Traditional Mead remains the leading variety globally, reflecting its role as the core, heritage expression of honey wine and the entry point for many consumers discovering mead for the first time. At the same time, the growing interest in innovative flavors and culinary pairings is driving faster growth for fruit?based and spiced meads such as Melomel and Metheglin, which align with broader trends for flavored craft beverages and experimental releases from small meaderies.

The Global Honey Wine Market is characterized by a dynamic mix of regional and international players. Leading participants such as Schramm's Mead (USA), B. Nektar Meadery (USA), Redstone Meadery (USA), Moonlight Meadery (USA), Superstition Meadery (USA), Brothers Drake Meadery (USA), Medovina Meadery (USA), Golden Coast Mead (USA), The Honey Wine Company (USA), Martin Brothers Winery & Meadery (USA), Moonshine Meadery (India), Gosnells of London (UK), Dansk Mjød A/S (Denmark), Lindisfarne Mead (UK), and other prominent regional meaderies contribute to innovation, geographic expansion, and service delivery in this space.

The future of honey wine in the None region appears promising, driven by increasing consumer demand for natural products and the growing popularity of mead in social settings. As e-commerce continues to expand, honey wine producers will have greater opportunities to reach diverse consumer segments. Additionally, innovative marketing strategies and collaborations with local artisans can enhance brand visibility, further solidifying honey wine's position in the beverage market. The focus on sustainability will also play a crucial role in shaping future trends.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Sweet Honey Wine Semi-Sweet Honey Wine Semi-Dry Honey Wine Dry Honey Wine Carbonated/Sparkling Honey Wine |

| By Variety | Traditional Mead Melomel (Fruit Mead) Cyser (Apple Mead) Pyment (Grape Mead) Metheglin (Spiced/Herbal Mead) Other Specialty Styles |

| By Nature | Conventional Organic |

| By End-Use Application | Personal / At-Home Consumption HoReCa (Hotels, Restaurants, Bars) Events, Festivals & Catering Gifting & Occasional Purchases |

| By Packaging Type | Glass Bottles Cans Kegs Bag-in-Box & Others |

| By Distribution Channel | Online Retail & Direct-to-Consumer Supermarkets/Hypermarkets Specialty Liquor & Wine Stores Convenience Stores & Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Alcohol Content | Low Alcohol (up to 5%) Medium Alcohol (5% - 12%) High Alcohol (above 12%) |

| By Price Range | Premium Mid-range Budget |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Honey Wine Producers | 60 | Owners, Production Managers |

| Retailers of Honey Wine | 50 | Store Managers, Beverage Buyers |

| Consumers of Honey Wine | 120 | Wine Enthusiasts, Health-Conscious Consumers |

| Distributors and Wholesalers | 55 | Sales Representatives, Distribution Managers |

| Industry Experts and Sommeliers | 45 | Wine Critics, Beverage Consultants |

The Global Honey Wine Market is valued at approximately USD 0.75 billion, reflecting a growing consumer preference for natural and organic beverages, alongside the rising popularity of artisanal and craft alcoholic drinks.