Region:Global

Author(s):Geetanshi

Product Code:KRAB0037

Pages:81

Published On:August 2025

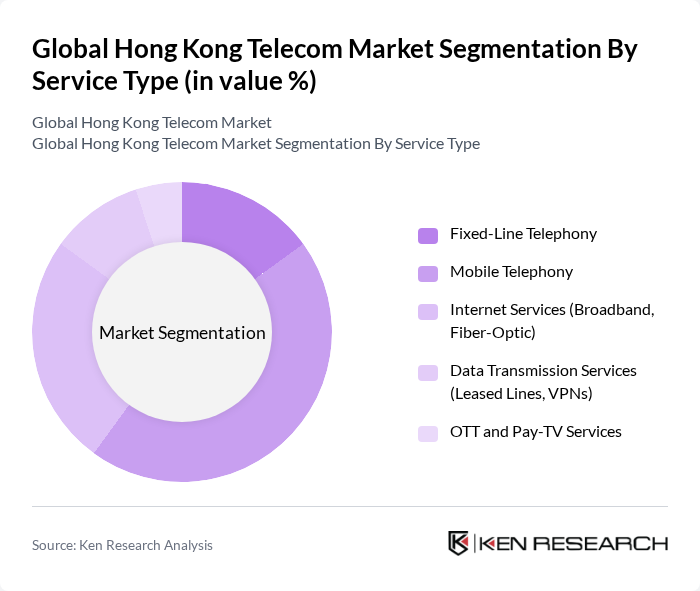

By Service Type:The service type segmentation includes Fixed-Line Telephony, Mobile Telephony, Internet Services (Broadband, Fiber-Optic), Data Transmission Services (Leased Lines, VPNs), and OTT and Pay-TV Services. Among these,Mobile Telephonyis the leading sub-segment, driven by the increasing smartphone penetration, high mobile data consumption, and the demand for advanced mobile data services. The shift towards digital communication, the proliferation of data-intensive applications, and the growing trend of remote work have further accelerated the adoption of mobile services .

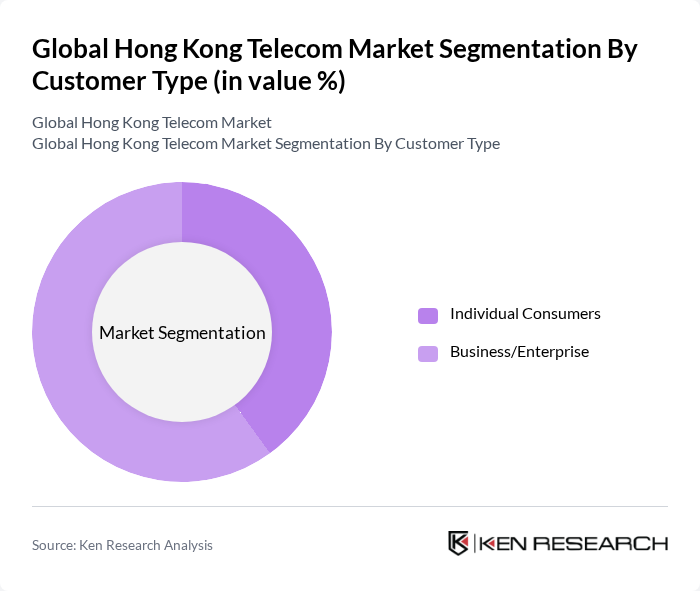

By Customer Type:The customer type segmentation includes Individual Consumers and Business/Enterprise. TheBusiness/Enterprisesegment is currently the dominant sub-segment, as companies increasingly rely on telecom services for their operations. The demand for reliable communication solutions, secure data services, and advanced connectivity has surged, particularly in the wake of accelerated digital transformation initiatives across industries .

The Global Hong Kong Telecom Market is characterized by a dynamic mix of regional and international players. Leading participants such as PCCW Limited, HKT Limited, China Mobile Hong Kong Company Limited, SmarTone Telecommunications Holdings Limited, 3 Hong Kong (Hutchison Telecommunications Hong Kong Holdings Limited), Hong Kong Broadband Network Limited (HKBN), China Unicom (Hong Kong) Limited, i-CABLE Communications Limited, New World Telecommunications Limited, Wharf T&T Limited, HKBN Enterprise Solutions Limited, CMHK (China Mobile Hong Kong), TPG Telecom Limited, Netvigator (subsidiary of PCCW), Hong Kong Telecommunications (HKT) Limited contribute to innovation, geographic expansion, and service delivery in this space .

The future of the telecom market in Hong Kong appears promising, driven by technological advancements and increasing consumer demand for digital services. The rollout of 5G networks is expected to enhance connectivity and enable new applications, such as smart city initiatives and IoT solutions. Additionally, as businesses continue to embrace digital transformation, telecom providers will likely focus on improving customer experience and leveraging AI technologies to optimize service delivery and operational efficiency.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Fixed-Line Telephony Mobile Telephony Internet Services (Broadband, Fiber-Optic) Data Transmission Services (Leased Lines, VPNs) OTT and Pay-TV Services |

| By Customer Type | Individual Consumers Business/Enterprise |

| By Technology | G/LTE G Fiber Broadband |

| By Pricing Model | Subscription-based Pay-as-you-go Bundled Services |

| By Distribution Channel | Direct Sales Retail Outlets Online Platforms |

| By End-User | Residential Commercial Government Industrial |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Service Users | 120 | Consumers aged 18-65, diverse income levels |

| Broadband Subscribers | 90 | Households with internet access, varying service plans |

| Corporate Telecom Clients | 60 | IT Managers, Procurement Officers from SMEs and Corporates |

| Regulatory Stakeholders | 40 | Government Officials, Policy Makers in telecommunications |

| Industry Experts | 40 | Telecom Analysts, Consultants with market insights |

The Global Hong Kong Telecom Market is valued at approximately USD 7.6 billion, reflecting significant growth driven by the increasing demand for mobile and internet services, as well as the adoption of advanced technologies like 5G and IoT.