Region:Global

Author(s):Shubham

Product Code:KRAA2660

Pages:96

Published On:August 2025

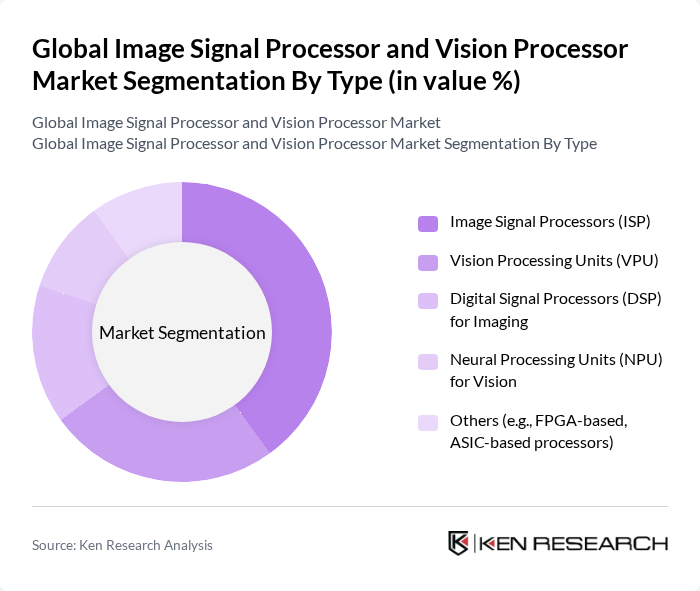

By Type:The market is segmented into various types, including Image Signal Processors (ISP), Vision Processing Units (VPU), Digital Signal Processors (DSP) for Imaging, Neural Processing Units (NPU) for Vision, and Others (e.g., FPGA-based, ASIC-based processors). Among these, Image Signal Processors (ISP) are leading the market due to their critical role in enhancing image quality in consumer electronics and automotive applications. The increasing demand for high-resolution imaging in smartphones and cameras, as well as the adoption of AI-powered ISP architectures for real-time denoising and object recognition, is driving the growth of this segment .

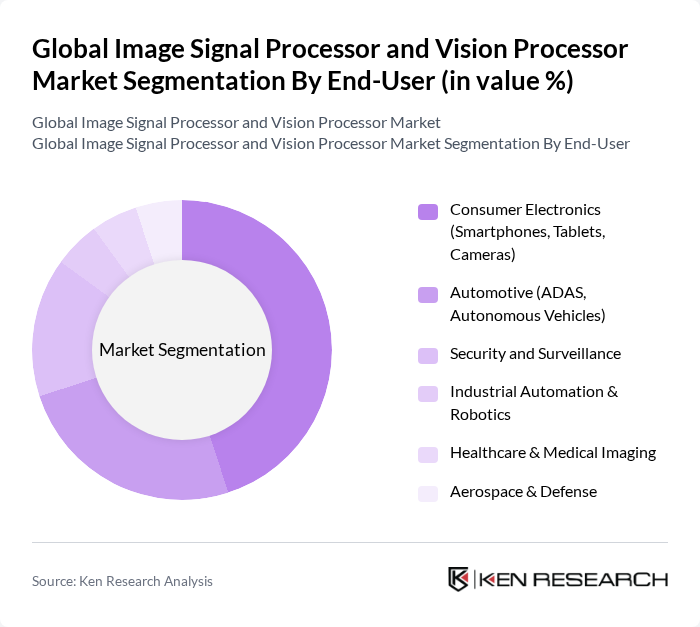

By End-User:The end-user segmentation includes Consumer Electronics (Smartphones, Tablets, Cameras), Automotive (ADAS, Autonomous Vehicles), Security and Surveillance, Industrial Automation & Robotics, Healthcare & Medical Imaging, and Aerospace & Defense. The Consumer Electronics segment is currently dominating the market, driven by the increasing adoption of high-resolution cameras in smartphones and tablets. The demand for enhanced imaging capabilities in personal devices, along with the proliferation of AI-powered imaging features and increased internet penetration, is a significant factor contributing to the growth of this segment .

The Global Image Signal Processor and Vision Processor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sony Corporation, Samsung Electronics Co., Ltd., Qualcomm Technologies, Inc., Texas Instruments Incorporated, ON Semiconductor Corporation, NXP Semiconductors N.V., STMicroelectronics N.V., Analog Devices, Inc., Infineon Technologies AG, Renesas Electronics Corporation, OmniVision Technologies, Inc., Ambarella, Inc., Sigma Corporation, Fujitsu Ltd., Himax Technologies, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the image signal processor and vision processor market appears promising, driven by continuous technological advancements and increasing integration into various applications. The rise of smart home devices and the expansion of 5G technology are expected to enhance image processing capabilities significantly. Additionally, the growing focus on energy-efficient solutions will likely lead to innovations that cater to both consumer demand and environmental regulations, fostering a more sustainable market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Image Signal Processors (ISP) Vision Processing Units (VPU) Digital Signal Processors (DSP) for Imaging Neural Processing Units (NPU) for Vision Others (e.g., FPGA-based, ASIC-based processors) |

| By End-User | Consumer Electronics (Smartphones, Tablets, Cameras) Automotive (ADAS, Autonomous Vehicles) Security and Surveillance Industrial Automation & Robotics Healthcare & Medical Imaging Aerospace & Defense |

| By Application | Image Enhancement & Noise Reduction Object Detection & Recognition Facial & Gesture Recognition Video Analytics & Real-Time Processing D Imaging & Depth Sensing Others |

| By Component | Hardware Software (Firmware, SDKs, Middleware) Services (Integration, Consulting, Support) |

| By Distribution Channel | Direct Sales (OEMs, ODMs) Online Retail Distributors & Value-Added Resellers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low-End Mid-Range High-End |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Imaging Solutions | 100 | Automotive Engineers, Product Development Managers |

| Consumer Electronics Imaging | 80 | Product Managers, R&D Engineers |

| Medical Imaging Technologies | 70 | Healthcare Technology Specialists, Biomedical Engineers |

| Surveillance and Security Systems | 90 | Security System Integrators, Technical Directors |

| Industrial Vision Systems | 50 | Manufacturing Engineers, Automation Specialists |

The Global Image Signal Processor and Vision Processor Market is valued at approximately USD 17.5 billion, reflecting significant growth driven by the demand for high-quality imaging in various sectors, including consumer electronics and automotive applications.