Region:Middle East

Author(s):Geetanshi

Product Code:KRAB1159

Pages:86

Published On:January 2026

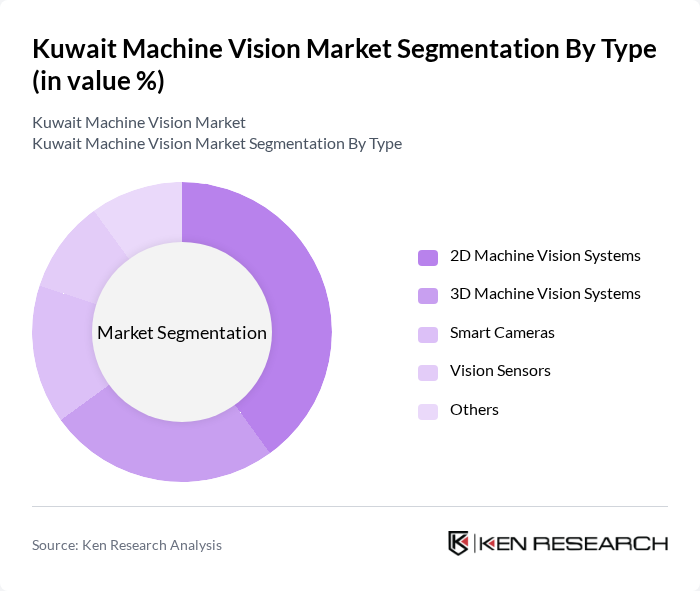

By Type:The machine vision market can be segmented into various types, including 2D Machine Vision Systems, 3D Machine Vision Systems, Smart Cameras, Vision Sensors, and Others. Among these, 2D Machine Vision Systems are currently leading the market due to their widespread application in quality control and inspection processes across various industries. The simplicity and cost-effectiveness of 2D systems make them a preferred choice for many manufacturers, driving their dominance in the market.

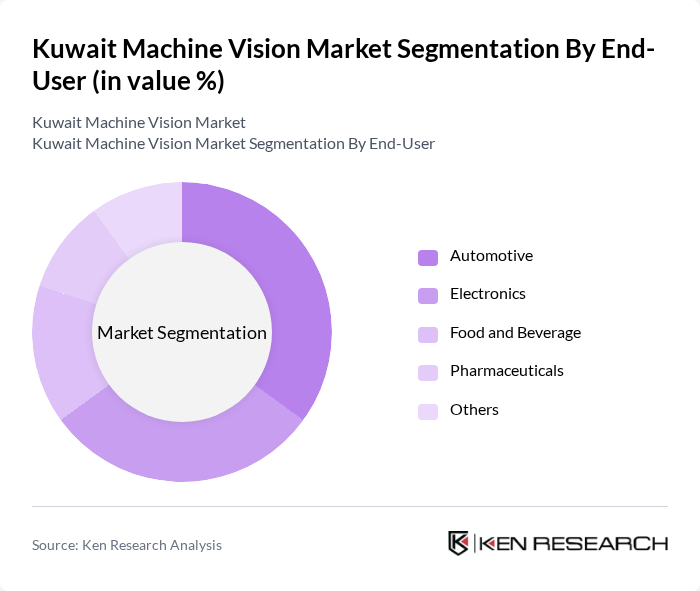

By End-User:The end-user segmentation includes Automotive, Electronics, Food and Beverage, Pharmaceuticals, and Others. The Automotive sector is the leading end-user of machine vision systems, driven by the need for precision and quality assurance in manufacturing processes. The increasing complexity of automotive components and the demand for high-quality standards necessitate the integration of advanced machine vision technologies in this sector.

The Kuwait Machine Vision Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cognex Corporation, Keyence Corporation, Omron Corporation, Basler AG, Teledyne Technologies, Siemens AG, National Instruments, Datalogic S.p.A., SICK AG, Panasonic Corporation, Zebra Technologies, Allied Vision Technologies, MVTec Software GmbH, Ametek, Inc., Cognex VisionPro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait machine vision market is poised for significant growth, driven by the ongoing digitization of industries and the adoption of Industry 4.0 principles. With a focus on smart infrastructure and enhanced surveillance systems, the integration of machine vision technologies will become increasingly vital. Additionally, as the government continues to invest in digital transformation and cybersecurity, the market will likely see a rise in demand for advanced machine vision solutions that enhance operational efficiency and safety across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | D Machine Vision Systems D Machine Vision Systems Smart Cameras Vision Sensors Others |

| By End-User | Automotive Electronics Food and Beverage Pharmaceuticals Others |

| By Application | Quality Control Robotics Guidance Measurement and Inspection Identification and Verification Others |

| By Industry Vertical | Manufacturing Healthcare Retail Logistics and Warehousing Others |

| By Technology | Image Processing Optical Character Recognition (OCR) Barcode and QR Code Scanning Machine Learning Algorithms Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Eastern Kuwait |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Automation | 100 | Production Managers, Automation Engineers |

| Healthcare Imaging Solutions | 75 | Radiologists, Medical Equipment Managers |

| Security and Surveillance Systems | 60 | Security Managers, IT Directors |

| Quality Control in Food Processing | 50 | Quality Assurance Managers, Food Technologists |

| Retail Checkout Automation | 80 | Store Managers, Retail Technology Specialists |

The Kuwait Machine Vision Market is valued at approximately USD 460 million, reflecting significant growth driven by automation trends, AI-enabled inspection systems, and modernization of manufacturing processes.