Region:Global

Author(s):Geetanshi

Product Code:KRAA2795

Pages:92

Published On:August 2025

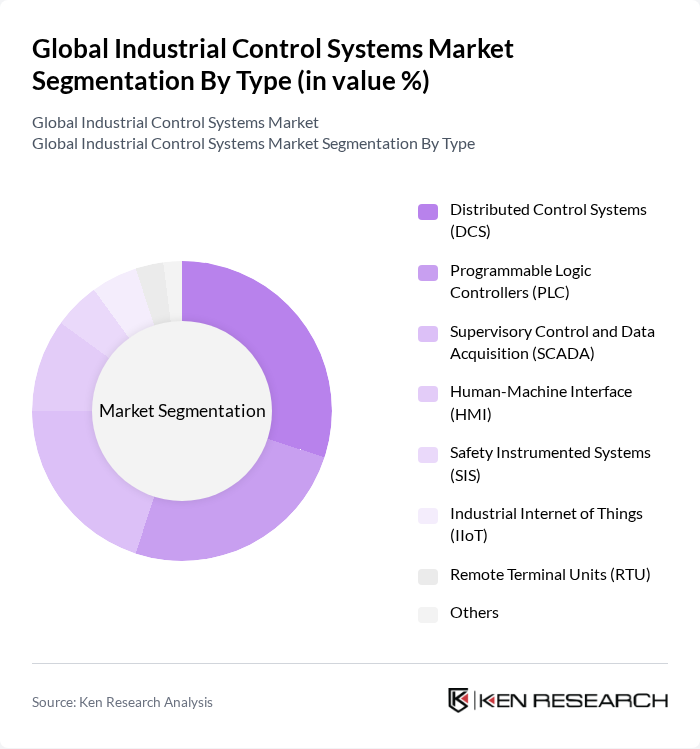

By Type:The market is segmented into various types, including Distributed Control Systems (DCS), Programmable Logic Controllers (PLC), Supervisory Control and Data Acquisition (SCADA), Human-Machine Interface (HMI), Safety Instrumented Systems (SIS), Industrial Internet of Things (IIoT), Remote Terminal Units (RTU), and Others. Among these, the Distributed Control Systems (DCS) segment is leading due to its widespread application in large-scale industrial processes, providing enhanced control, centralized monitoring, and seamless integration with other automation technologies. DCS solutions are particularly favored in industries requiring continuous, complex process management, such as oil & gas, power generation, and chemicals .

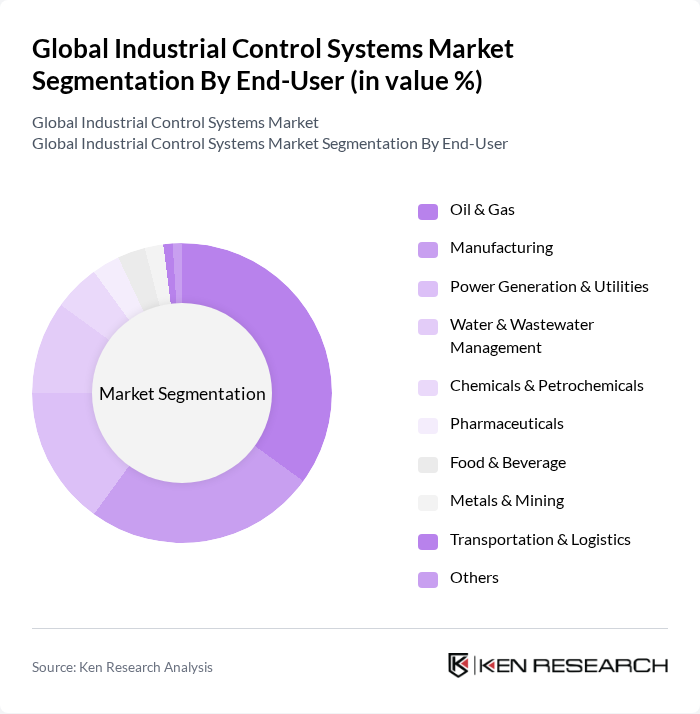

By End-User:The end-user segmentation includes Oil & Gas, Manufacturing, Power Generation & Utilities, Water & Wastewater Management, Chemicals & Petrochemicals, Pharmaceuticals, Food & Beverage, Metals & Mining, Transportation & Logistics, and Others. The Oil & Gas sector is the dominant end-user, driven by the need for efficient monitoring and control of complex processes, ensuring safety, regulatory compliance, and operational continuity in hazardous environments. The manufacturing sector is also witnessing rapid adoption of ICS, propelled by digital transformation initiatives and the integration of smart factory solutions .

The Global Industrial Control Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Schneider Electric SE, Rockwell Automation, Inc., ABB Ltd., Emerson Electric Co., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, General Electric Company, Bosch Rexroth AG, National Instruments Corporation, B&R Industrial Automation GmbH, Omron Corporation, Delta Electronics, Inc., Advantech Co., Ltd., Phoenix Contact GmbH & Co. KG, Hitachi, Ltd., Schneider Electric Infrastructure Ltd., ABB Ability™ (ABB Group), Honeywell Process Solutions contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial control systems market is poised for significant transformation, driven by technological advancements and evolving industry needs. The integration of artificial intelligence and machine learning will enhance system capabilities, enabling predictive maintenance and real-time decision-making. Additionally, the shift towards cloud-based solutions will facilitate greater scalability and flexibility, allowing companies to adapt to changing market demands. As industries increasingly prioritize sustainability, the adoption of green technologies will further shape the landscape of industrial control systems.

| Segment | Sub-Segments |

|---|---|

| By Type | Distributed Control Systems (DCS) Programmable Logic Controllers (PLC) Supervisory Control and Data Acquisition (SCADA) Human-Machine Interface (HMI) Safety Instrumented Systems (SIS) Industrial Internet of Things (IIoT) Remote Terminal Units (RTU) Others |

| By End-User | Oil & Gas Manufacturing Power Generation & Utilities Water & Wastewater Management Chemicals & Petrochemicals Pharmaceuticals Food & Beverage Metals & Mining Transportation & Logistics Others |

| By Component | Hardware Software Services |

| By Application | Process Automation Factory Automation Building Automation Transportation Systems Energy Management Others |

| By Sales Channel | Direct Sales Distributors Online Sales System Integrators Others |

| By Distribution Mode | Offline Distribution Online Distribution |

| By Price Range | Low Price Mid Price High Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Automation | 120 | Production Managers, Automation Engineers |

| Energy Management Systems | 60 | Energy Analysts, Facility Managers |

| Transportation Control Systems | 50 | Logistics Coordinators, Fleet Managers |

| Process Control in Chemicals | 40 | Process Engineers, Safety Managers |

| Smart Building Automation | 45 | Building Managers, IT Infrastructure Specialists |

The Global Industrial Control Systems Market is valued at approximately USD 207 billion, driven by increasing automation, operational efficiency, and the adoption of Industry 4.0 and IoT technologies across various industries.