Global Industrial Lasers Market Overview

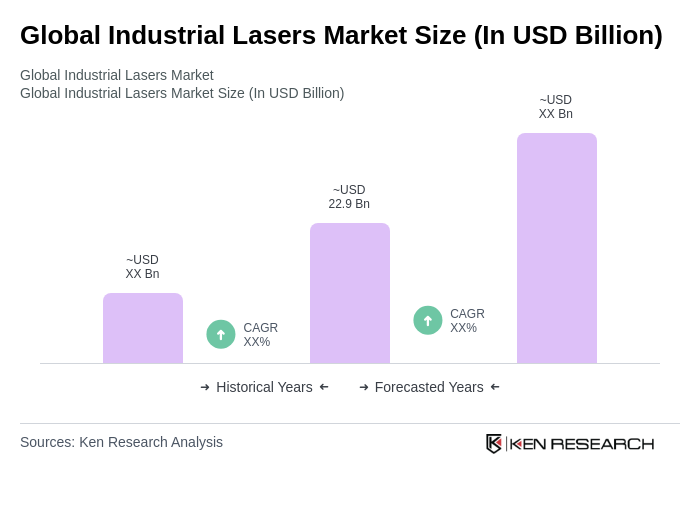

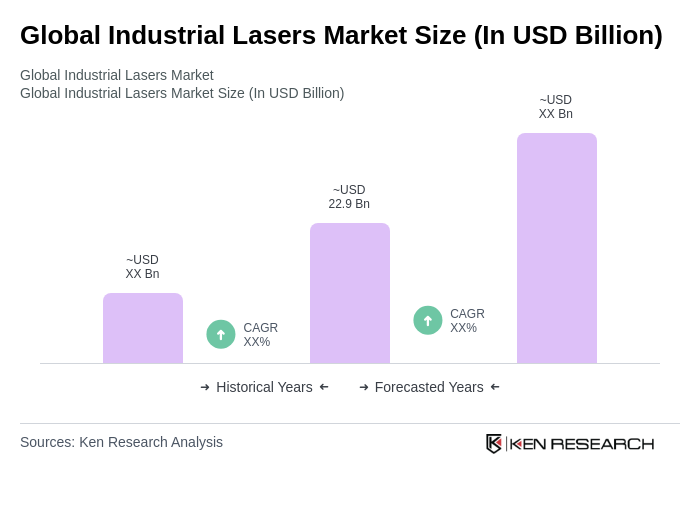

- The Global Industrial Lasers Market is valued at USD 22.9 billion, based on a five-year historical analysis. This growth is primarily driven by advancements in laser technology, increasing demand for precision manufacturing, and the rising adoption of automation in various industries. The market has seen a surge in applications across sectors such as automotive, aerospace, and electronics, contributing to its robust expansion .

- Key players in this market include the United States, Germany, and Japan, which dominate due to their strong industrial base, technological advancements, and significant investments in research and development. The presence of leading manufacturers and a well-established supply chain further enhance their competitive edge in the global market .

- In 2023, the European Union implemented the Ecodesign for Sustainable Products Regulation (ESPR), issued by the European Parliament and the Council, which sets mandatory requirements for improving the energy efficiency and environmental sustainability of industrial equipment, including laser systems. This regulation requires companies to adopt energy-efficient technologies and advanced laser systems to minimize environmental impact, thereby driving the demand for innovative laser solutions .

Global Industrial Lasers Market Segmentation

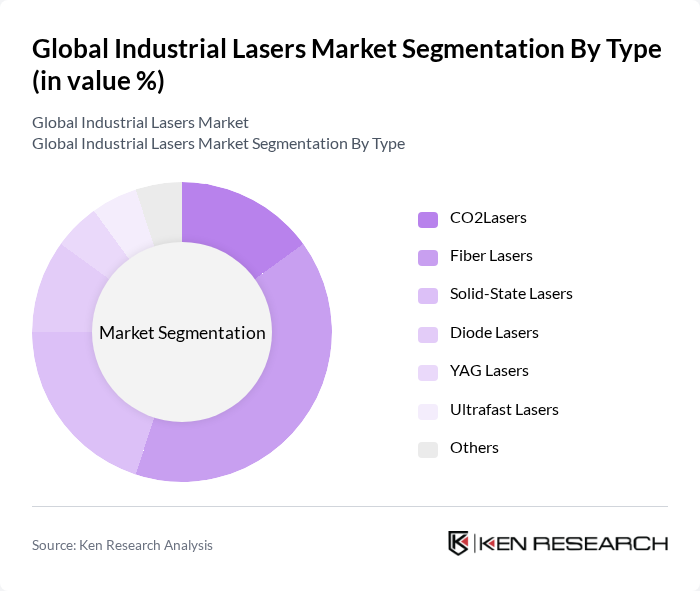

By Type:The market is segmented into various types of lasers, including COLasers, Fiber Lasers, Solid-State Lasers, Diode Lasers, YAG Lasers, Ultrafast Lasers, and Others. Among these, Fiber Lasers are currently leading the market due to their efficiency, versatility, and lower operational costs. They are widely used in cutting and welding applications, making them a preferred choice for manufacturers looking to enhance productivity and reduce costs .

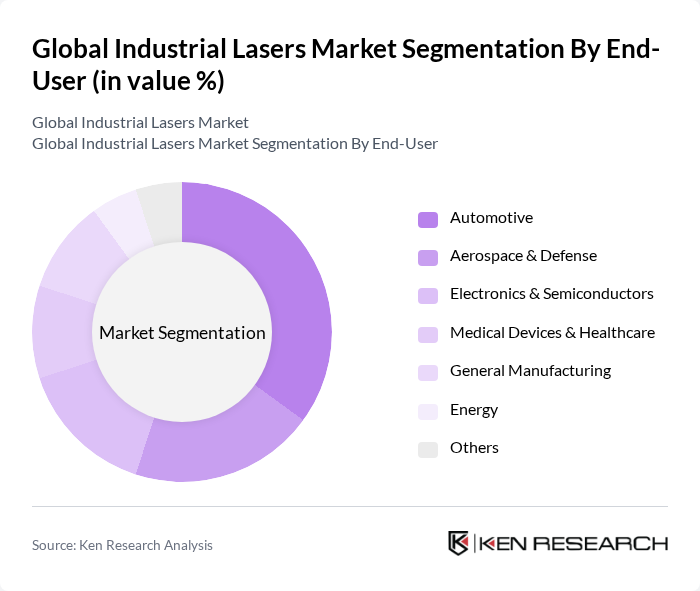

By End-User:The industrial lasers market is also segmented by end-user industries, including Automotive, Aerospace & Defense, Electronics & Semiconductors, Medical Devices & Healthcare, General Manufacturing, Energy, and Others. The Automotive sector is the leading end-user, driven by the increasing need for precision in manufacturing processes and the growing trend of automation in vehicle production .

Global Industrial Lasers Market Competitive Landscape

The Global Industrial Lasers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coherent, Inc., IPG Photonics Corporation, TRUMPF GmbH + Co. KG, Lumentum Operations LLC, Han's Laser Technology Industry Group Co., Ltd., Rofin-Sinar Technologies Inc., Newport Corporation (MKS Instruments, Inc.), Laserline GmbH, Amada Co., Ltd., Sisma S.p.A., Epilog Laser, Universal Laser Systems, Inc., Prima Industrie S.p.A., ACSYS Lasertechnik GmbH, Lumibird SA contribute to innovation, geographic expansion, and service delivery in this space.

Global Industrial Lasers Market Industry Analysis

Growth Drivers

- Increasing Demand for Precision Manufacturing:The global precision manufacturing sector is projected to reach $1.2 trillion in future, driven by the need for high-quality products. This surge is largely attributed to industries such as electronics and aerospace, which require intricate designs and tolerances. The adoption of industrial lasers enhances production efficiency, reducing waste and improving accuracy. As manufacturers strive for operational excellence, the demand for advanced laser technologies is expected to rise significantly, supporting market growth in future.

- Advancements in Laser Technology:Continuous innovations in laser technology, including the development of high-power fiber lasers, are transforming industrial applications. For instance, the efficiency of fiber lasers can exceed 30% compared to traditional CO2 lasers. This advancement not only reduces operational costs but also enhances processing speeds. As industries increasingly adopt these technologies, the market for industrial lasers is anticipated to expand, with an estimated increase in laser system installations by 15% annually in future.

- Rising Adoption in Automotive and Aerospace Industries:The automotive and aerospace sectors are projected to invest over $200 billion in advanced manufacturing technologies in future. Industrial lasers play a crucial role in these industries for applications such as cutting, welding, and marking. The shift towards lightweight materials and complex geometries necessitates precise laser solutions, driving demand. As these sectors continue to innovate, the integration of laser technologies is expected to grow, further propelling market expansion in future.

Market Challenges

- High Initial Investment Costs:The initial capital required for industrial laser systems can exceed $100,000, posing a significant barrier for small and medium-sized enterprises (SMEs). This high upfront cost limits access to advanced technologies, hindering market penetration. Additionally, ongoing maintenance and operational costs can further strain budgets. As a result, many potential users may delay investments, impacting overall market growth in future and creating a challenge for manufacturers seeking wider adoption.

- Technical Complexity and Skill Shortage:The operation and maintenance of industrial laser systems require specialized skills, which are currently in short supply. According to the World Economic Forum, 54% of companies report difficulties in finding qualified personnel. This skill gap can lead to inefficiencies and increased downtime, ultimately affecting productivity. As industries strive to implement advanced laser technologies, addressing this challenge is crucial for sustaining growth in future's industrial laser market.

Global Industrial Lasers Market Future Outlook

The future of the industrial lasers market in future appears promising, driven by technological advancements and increasing applications across various sectors. The integration of automation and artificial intelligence is expected to enhance operational efficiency, while the demand for eco-friendly solutions will likely spur innovation. As industries adapt to changing market dynamics, the focus on energy-efficient and compact laser systems will shape the landscape, fostering growth and creating new opportunities for manufacturers and end-users alike.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets in Asia-Pacific are projected to witness a 20% increase in industrial laser adoption in future. This growth is driven by rapid industrialization and increasing investments in manufacturing infrastructure. Companies entering these markets can capitalize on the rising demand for precision manufacturing, creating significant opportunities for growth and expansion in future.

- Development of Eco-Friendly Laser Solutions:The push for sustainability is leading to the development of eco-friendly laser technologies. Innovations such as low-energy consumption lasers and recyclable materials are gaining traction. With environmental regulations tightening, companies that invest in green technologies can differentiate themselves and capture a growing segment of environmentally conscious consumers, presenting a lucrative opportunity in future's industrial laser market.