Region:Asia

Author(s):Dev

Product Code:KRAA8308

Pages:100

Published On:November 2025

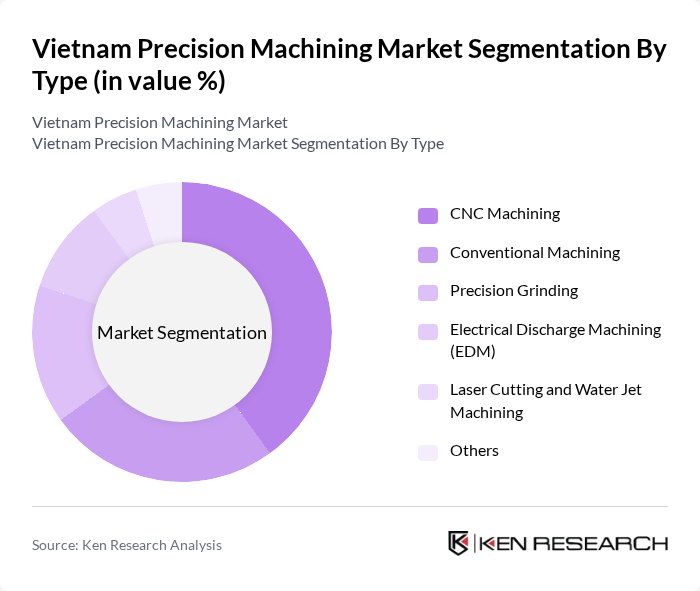

By Type:The precision machining market is segmented into CNC Machining, Conventional Machining, Precision Grinding, Electrical Discharge Machining (EDM), Laser Cutting and Water Jet Machining, and Others. CNC Machining remains the most dominant segment, driven by its high precision, efficiency, and capability to produce complex geometries. The rapid adoption of CNC machines across industries, fueled by automation trends and the need for high-quality components, has reinforced its leading position in the market .

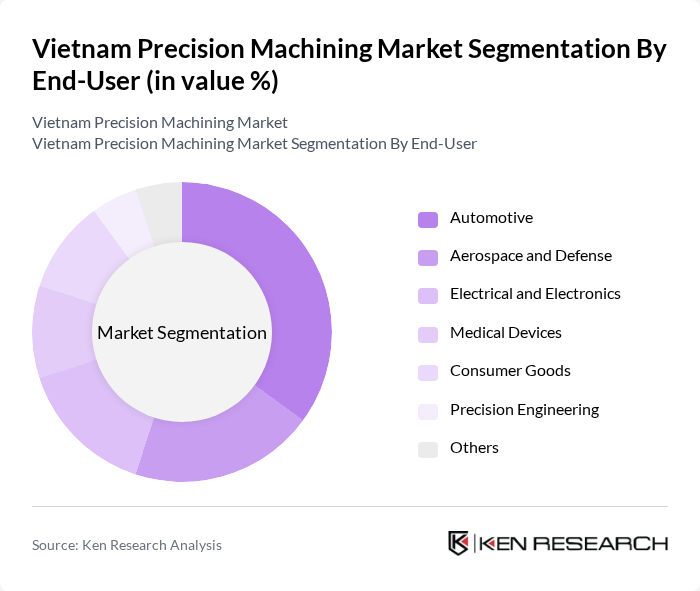

By End-User:The end-user segmentation of the precision machining market includes Automotive, Aerospace and Defense, Electrical and Electronics, Medical Devices, Consumer Goods, Precision Engineering, and Others. The Automotive sector is the largest end-user, driven by the rising demand for lightweight, high-performance components and the transition toward electric vehicles. Growth in electronics and medical device manufacturing also contributes significantly to the demand for precision machining technologies .

The Vietnam Precision Machining Market is characterized by a dynamic mix of regional and international players. Leading participants such as CNC Vietnam Technology Co., Ltd., Viet Precision Industrial Co., Ltd., Huu Nghi Precision Engineering Co., Ltd., Tuan Minh Precision Machining Co., Ltd., Vina Takahashi Co., Ltd., Duy Tan Precision Co., Ltd., Minh Phat Precision Engineering Co., Ltd., An Phat Holdings (Precision Engineering Division), Hoang Ha Precision Engineering Co., Ltd., Vietnam Precision Industrial No. 1 Co., Ltd. (VPIC1), Long Thanh Precision Co., Ltd., Phuoc Thanh Precision Engineering Co., Ltd., Tan Phat Precision Engineering Co., Ltd., Gia Phat Precision Co., Ltd., Dong Nai Precision Engineering Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Vietnam precision machining market is poised for significant transformation, driven by technological advancements and evolving industry needs. The adoption of Industry 4.0 technologies is expected to enhance operational efficiency and product quality, while the integration of IoT in machining processes will facilitate real-time monitoring and data analysis. As companies increasingly focus on sustainability, the shift towards eco-friendly manufacturing practices will also shape the market landscape, creating new avenues for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | CNC Machining Conventional Machining Precision Grinding Electrical Discharge Machining (EDM) Laser Cutting and Water Jet Machining Others |

| By End-User | Automotive Aerospace and Defense Electrical and Electronics Medical Devices Consumer Goods Precision Engineering Others |

| By Application | Component Manufacturing Tooling Prototyping Maintenance and Repair Mold and Die Manufacturing Others |

| By Material | Metals (Steel, Aluminum, Titanium, Others) Plastics Composites Ceramics Others |

| By Technology | Additive Manufacturing (3D Printing) Subtractive Manufacturing Hybrid Manufacturing Automation and Robotics Integration Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Research and Development Grants Export Promotion Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Precision Machining | 100 | Production Managers, Quality Control Engineers |

| Aerospace Component Manufacturing | 80 | Design Engineers, Operations Directors |

| Electronics Parts Fabrication | 90 | Supply Chain Managers, Technical Leads |

| Medical Device Machining | 70 | Regulatory Affairs Specialists, Manufacturing Engineers |

| General Precision Machining Services | 110 | Business Development Managers, Plant Supervisors |

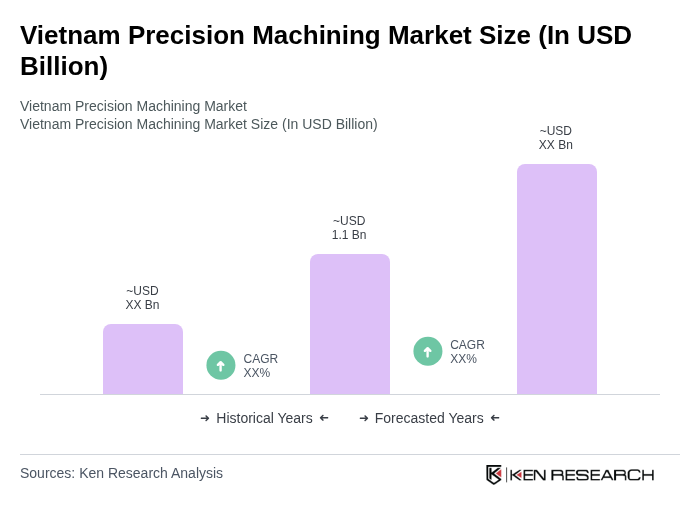

The Vietnam Precision Machining Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the demand for high-precision components across various industries, including automotive, aerospace, electronics, and medical devices.