Region:Global

Author(s):Shubham

Product Code:KRAA3186

Pages:90

Published On:August 2025

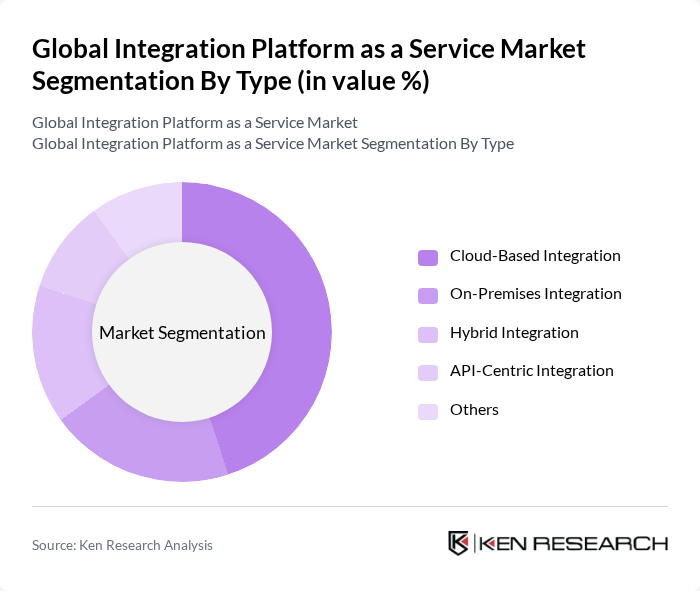

By Type:

The market is segmented into various types, including Cloud-Based Integration, On-Premises Integration, Hybrid Integration, API-Centric Integration, and Others. Among these, Cloud-Based Integration is the leading sub-segment, driven by its scalability, cost-effectiveness, and ease of deployment. Organizations are increasingly shifting towards cloud solutions to facilitate real-time data access, automation, and collaboration across distributed teams. The demand for seamless integration of cloud applications and the adoption of low-code/no-code integration tools is propelling the growth of this segment, making it a preferred choice for businesses looking to enhance their operational efficiency .

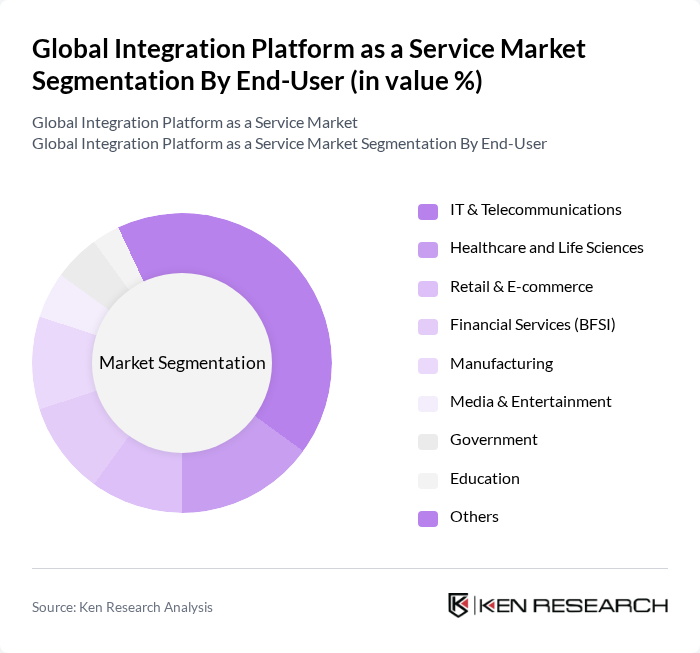

By End-User:

The end-user segmentation includes IT & Telecommunications, Healthcare and Life Sciences, Retail & E-commerce, Financial Services (BFSI), Manufacturing, Media & Entertainment, Government, Education, and Others. The IT & Telecommunications sector is the dominant segment, as organizations in this field require robust integration solutions to manage vast amounts of data and ensure seamless communication between various systems. The increasing reliance on digital services, cloud-native architectures, and the need for real-time data processing are driving the demand for integration platforms in this sector .

The Global Integration Platform as a Service Market is characterized by a dynamic mix of regional and international players. Leading participants such as MuleSoft, LLC, Boomi LP, Informatica LLC, SnapLogic, Inc., Microsoft Corporation, IBM Corporation, Oracle Corporation, TIBCO Software Inc., Jitterbit, Inc., Workato, Inc., Celigo, Inc., Talend S.A., SAP SE, Amazon Web Services, Inc. (AWS), Google LLC (Google Cloud Platform), Software AG, Salesforce, Inc., Adeptia Inc., QlikTech International AB, Informatica LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the integration platform as a service market is poised for significant evolution, driven by technological advancements and changing business needs. As organizations increasingly adopt low-code/no-code platforms, the demand for user-friendly integration solutions will rise. Additionally, the emphasis on data privacy regulations will shape the development of compliant integration strategies. Companies will also focus on enhancing customer experiences through seamless integrations, positioning themselves to leverage emerging technologies effectively in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based Integration On-Premises Integration Hybrid Integration API-Centric Integration Others |

| By End-User | IT & Telecommunications Healthcare and Life Sciences Retail & E-commerce Financial Services (BFSI) Manufacturing Media & Entertainment Government Education Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Application | Data Integration Application Integration B2B Integration API Management Cloud Service Orchestration Data Transformation Others |

| By Industry Vertical | Manufacturing Education Government Media & Entertainment Others |

| By Service Type | Managed Services Professional Services |

| By Pricing Model | Subscription-Based Pay-As-You-Go Others |

| By Geography | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Integration Platforms | 100 | IT Directors, Healthcare Administrators |

| Financial Services Cloud Solutions | 90 | Chief Technology Officers, Compliance Officers |

| Retail Integration Systems | 80 | Operations Managers, E-commerce Directors |

| Manufacturing Cloud Integration | 70 | Supply Chain Managers, Production Supervisors |

| Telecommunications Integration Services | 60 | Network Engineers, Product Managers |

The Global Integration Platform as a Service Market is valued at approximately USD 12.9 billion, reflecting significant growth driven by the demand for seamless data integration across cloud and on-premises applications, as well as the rise of automation and real-time analytics.