Region:Global

Author(s):Shubham

Product Code:KRAA3191

Pages:91

Published On:August 2025

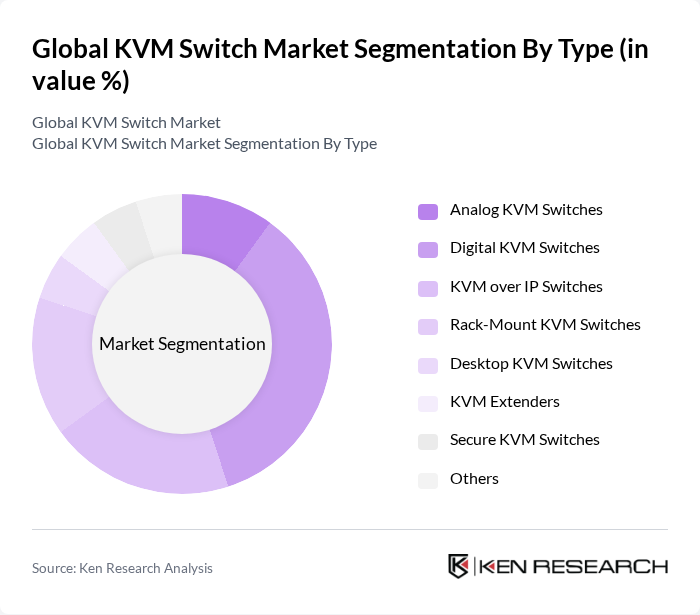

By Type:The KVM switch market is segmented into Analog KVM Switches, Digital KVM Switches, KVM over IP Switches, Rack-Mount KVM Switches, Desktop KVM Switches, KVM Extenders, Secure KVM Switches, and Others. Digital KVM Switches lead the market, driven by their advanced features, compatibility with modern digital systems, and growing adoption in data centers and enterprise IT environments. KVM over IP Switches are also gaining significant traction due to their remote management capabilities and scalability for distributed IT infrastructures .

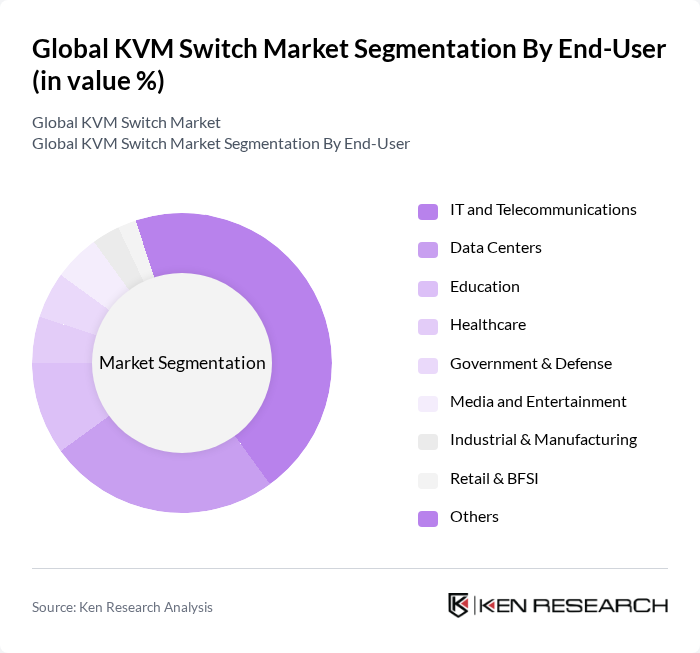

By End-User:The end-user segmentation includes IT and Telecommunications, Data Centers, Education, Healthcare, Government & Defense, Media and Entertainment, Industrial & Manufacturing, Retail & BFSI, and Others. The IT and Telecommunications sector remains the largest consumer of KVM switches, propelled by the need for efficient multi-server management, secure remote access, and compliance with data protection standards. Data centers are the second-largest segment, reflecting ongoing investments in cloud infrastructure and virtualization .

The Global KVM Switch Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raritan, Inc. (Legrand), ATEN International Co., Ltd., Belkin International, Inc., Tripp Lite (Eaton), Black Box Corporation (AGC Networks), IOGEAR (a brand of ATEN Technology, Inc.), StarTech.com Ltd., Avocent (Vertiv Group Corp.), APC by Schneider Electric, Gefen LLC (Nortek Security & Control), Rose Electronics, Guntermann & Drunck GmbH, Lantronix, Inc., D-Link Corporation, Dell Technologies Inc., IHSE GmbH, IBM Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KVM switch market appears promising, driven by technological advancements and evolving user needs. As organizations increasingly prioritize integrated solutions, the demand for KVM switches that combine multiple functionalities is expected to rise. Additionally, the shift towards energy-efficient products will likely influence product development, aligning with global sustainability goals. The growing trend of remote work will further necessitate innovative KVM solutions that enhance remote management capabilities, ensuring businesses can adapt to changing operational landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog KVM Switches Digital KVM Switches KVM over IP Switches Rack-Mount KVM Switches Desktop KVM Switches KVM Extenders Secure KVM Switches Others |

| By End-User | IT and Telecommunications Data Centers Education Healthcare Government & Defense Media and Entertainment Industrial & Manufacturing Retail & BFSI Others |

| By Application | Data Center Management Remote Access Solutions Video Broadcasting Industrial Automation Server Management Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Resellers Value-Added Resellers System Integrators Others |

| By Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Rest of APAC) Latin America (Brazil, Argentina, Rest of LATAM) Middle East and Africa (GCC, South Africa, Rest of MEA) Others |

| By Price Range | Low-End KVM Switches Mid-Range KVM Switches High-End KVM Switches Others |

| By Brand | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Data Center Operations | 90 | Data Center Managers, IT Infrastructure Directors |

| Educational Institutions | 60 | IT Coordinators, Network Administrators |

| Healthcare Facilities | 40 | IT Managers, Biomedical Engineers |

| Corporate IT Departments | 70 | System Administrators, IT Directors |

| Government Agencies | 50 | IT Procurement Officers, Network Managers |

The Global KVM Switch Market is valued at approximately USD 1.2 billion, driven by the increasing demand for efficient data management solutions and the expansion of data centers, particularly in North America and Asia Pacific.