Region:Global

Author(s):Dev

Product Code:KRAA3016

Pages:92

Published On:August 2025

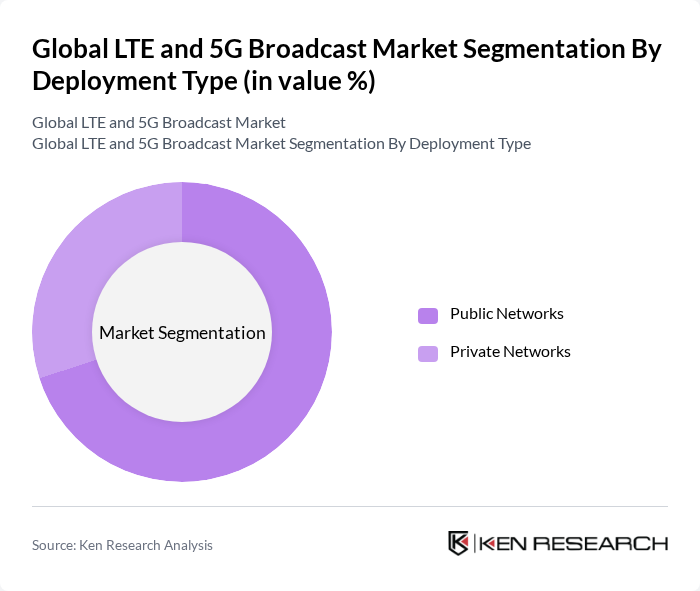

By Deployment Type:

The deployment type segment is crucial in understanding how LTE and 5G broadcast technologies are implemented. The two primary subsegments are Public Networks and Private Networks. Public Networks dominate the market due to their extensive reach and ability to serve a large number of users simultaneously. These networks are essential for providing widespread access to mobile broadband services, particularly in urban areas where demand is high. Private Networks, while growing, are primarily utilized by enterprises for specific applications, such as secure communications and dedicated services, which limits their overall market share compared to public networks .

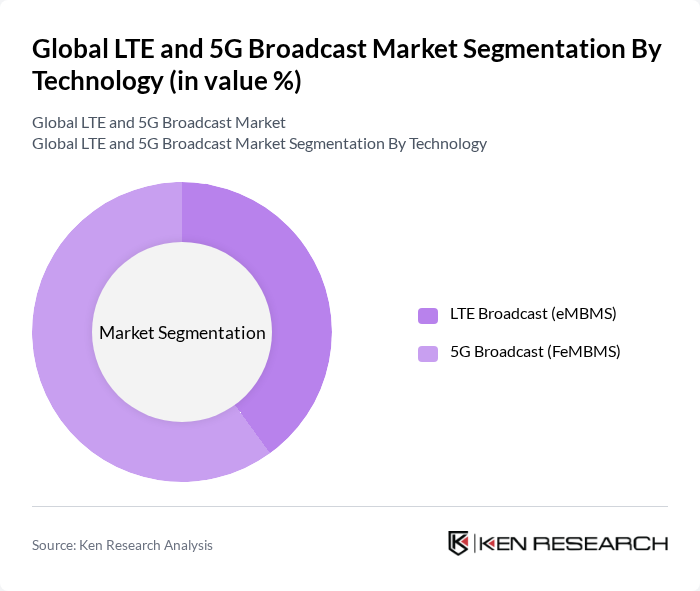

By Technology:

The technology segment encompasses LTE Broadcast (eMBMS) and 5G Broadcast (FeMBMS). LTE Broadcast has been a significant player in the market, providing efficient content delivery for media and entertainment applications. However, 5G Broadcast is rapidly gaining traction due to its enhanced capabilities, such as lower latency and higher data rates. The growing demand for immersive experiences in areas like augmented reality and virtual reality is driving the adoption of 5G Broadcast, positioning it as the leading technology in the market .

The Global LTE and 5G Broadcast Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Qualcomm Technologies, Inc., Huawei Technologies Co., Ltd., Samsung Electronics Co., Ltd., AT&T Inc., Verizon Communications Inc., T-Mobile US, Inc., Cisco Systems, Inc., ZTE Corporation, Deutsche Telekom AG, Vodafone Group Plc, BT Group plc, Telefónica S.A., Orange S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the LTE and 5G broadcast market appears promising, driven by technological advancements and increasing consumer expectations. As operators continue to invest in infrastructure, the integration of AI and edge computing will enhance service delivery and operational efficiency. Additionally, the focus on sustainability will lead to the development of energy-efficient broadcasting solutions. These trends indicate a dynamic market landscape, with significant potential for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Deployment Type | Public Networks Private Networks |

| By Technology | LTE Broadcast (eMBMS) G Broadcast (FeMBMS) |

| By Application | Media and Entertainment Public Safety and Emergency Alerts Automotive (Infotainment, V2X) Digital Signage Others |

| By End-User | Telecom Operators Broadcasters & Content Providers Government & Public Safety Agencies Enterprises |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Network Operators | 100 | Network Engineers, Operations Managers |

| Broadcast Service Providers | 60 | Product Managers, Technical Directors |

| Telecom Equipment Manufacturers | 50 | Sales Executives, R&D Managers |

| Regulatory Bodies | 40 | Policy Analysts, Regulatory Affairs Specialists |

| Industry Analysts and Consultants | 45 | Market Researchers, Strategic Advisors |

The Global LTE and 5G Broadcast Market is valued at approximately USD 890 million, reflecting significant growth driven by the demand for high-speed mobile data services and the expansion of mobile broadband infrastructure.