Region:Global

Author(s):Dev

Product Code:KRAA3047

Pages:80

Published On:August 2025

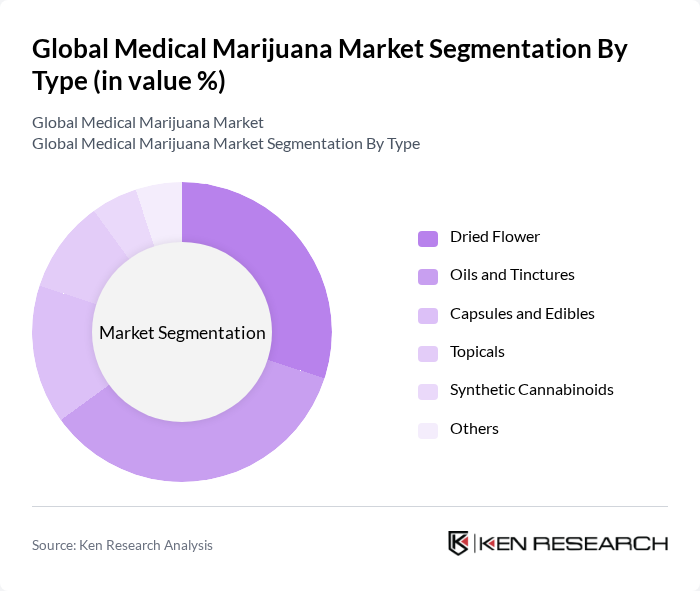

By Type:The market is segmented into Dried Flower, Oils and Tinctures, Capsules and Edibles, Topicals, Synthetic Cannabinoids, and Others. Oils and Tinctures have gained significant traction, accounting for the largest market share due to their ease of use, precise dosing, and versatility in delivery methods. Dried Flower remains popular for traditional and natural consumption, while Capsules and Edibles are increasingly preferred for discreet and convenient use. Topicals and Synthetic Cannabinoids are also gaining attention for targeted therapeutic applications and pharmaceutical development.

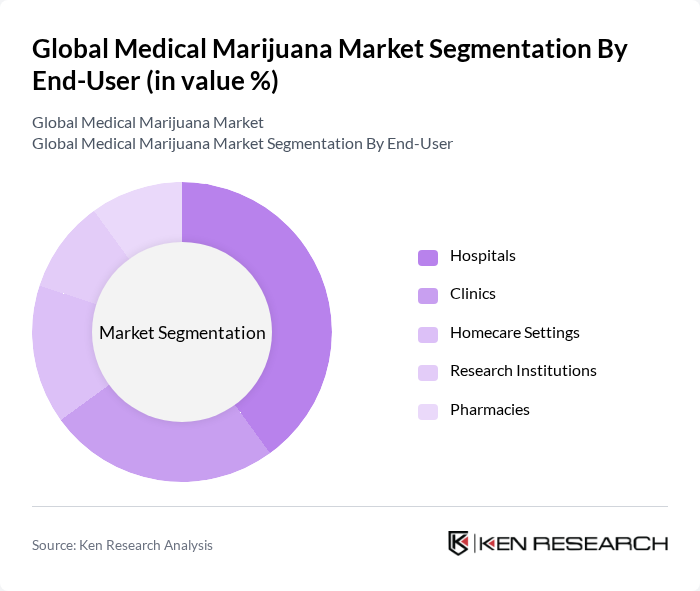

By End-User:The end-user segmentation includes Hospitals, Clinics, Homecare Settings, Research Institutions, and Pharmacies. Hospitals and Clinics are the primary consumers of medical marijuana products, driven by the increasing number of patients seeking alternative treatments for chronic conditions and the expansion of institutional medical cannabis programs. Homecare settings are emerging as significant users, particularly for chronic pain and palliative care. Research Institutions play a vital role in advancing clinical understanding, while Pharmacies are integral to regulated distribution and patient access.

The Global Medical Marijuana Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canopy Growth Corporation, Aurora Cannabis Inc., Tilray Brands, Inc., Cronos Group Inc., Aphria Inc. (now part of Tilray Brands, Inc.), GW Pharmaceuticals plc (now part of Jazz Pharmaceuticals plc), MedMen Enterprises Inc., Curaleaf Holdings, Inc., Trulieve Cannabis Corp., Harvest Health & Recreation Inc. (now part of Trulieve Cannabis Corp.), Green Thumb Industries Inc., Acreage Holdings, Inc., Organigram Holdings Inc., Cresco Labs Inc., Charlotte's Web Holdings, Inc., Jazz Pharmaceuticals plc, HEXO Corp., PharmaCielo Ltd., TerrAscend Corp., VIVO Cannabis Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Sources:

The future of the medical marijuana market appears promising, driven by increasing acceptance and ongoing research. As more countries consider legalization, the market is expected to expand significantly. Innovations in product formulations and delivery methods will likely enhance therapeutic applications, catering to diverse patient needs. Additionally, the integration of technology in cultivation and distribution processes will streamline operations, making medical marijuana more accessible to patients worldwide, thus fostering growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Dried Flower Oils and Tinctures Capsules and Edibles Topicals Synthetic Cannabinoids Others |

| By End-User | Hospitals Clinics Homecare Settings Research Institutions Pharmacies |

| By Application | Pain Management Neurological Disorders (Epilepsy, Multiple Sclerosis, etc.) Cancer Treatment (Nausea, Appetite Stimulation, etc.) Mental Health Disorders (Anxiety, PTSD, etc.) Others |

| By Distribution Channel | Online Pharmacies Retail Pharmacies Dispensaries Hospital Pharmacies |

| By Product Formulation | Full-Spectrum Products Broad-Spectrum Products Isolate Products |

| By Pricing Strategy | Premium Pricing Competitive Pricing Discount Pricing |

| By Regulatory Compliance | FDA/EMA/TGA Approved Products Non-Approved Products Others |

| By Species | Indica Sativa Hybrid |

| By Derivative | CBD-Dominant THC-Dominant Balanced THC & CBD Other Cannabinoids |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Doctors, Nurses, Pharmacists |

| Medical Marijuana Patients | 150 | Chronic Pain Patients, Cancer Patients, Anxiety Disorder Patients |

| Dispensary Owners and Managers | 100 | Retail Managers, Business Owners, Compliance Officers |

| Industry Experts and Analysts | 75 | Market Analysts, Regulatory Experts, Financial Advisors |

| Growers and Cultivators | 50 | Farm Owners, Agricultural Specialists, Supply Chain Managers |

The Global Medical Marijuana Market is valued at approximately USD 21 billion, driven by increasing acceptance for treating various health conditions, expanding legalization, and advancements in cannabinoid formulations and delivery methods.