Region:Global

Author(s):Shubham

Product Code:KRAA2710

Pages:87

Published On:August 2025

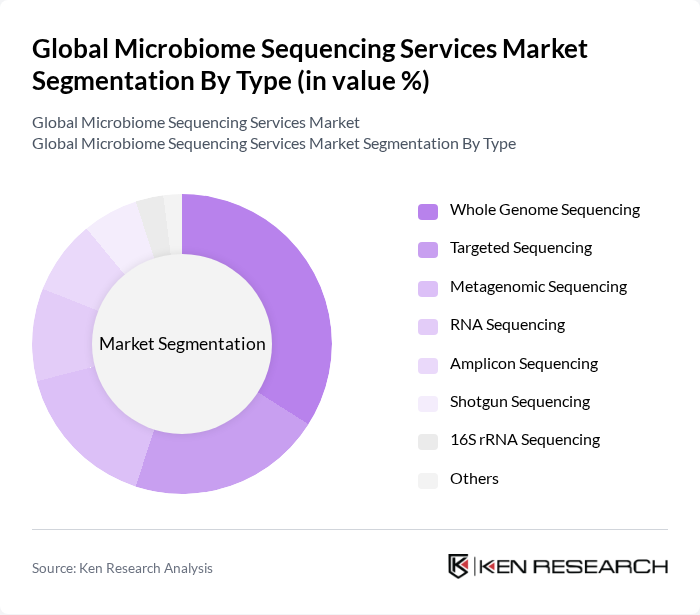

By Type:The market is segmented into various types of sequencing services, including Whole Genome Sequencing, Targeted Sequencing, Metagenomic Sequencing, RNA Sequencing, Amplicon Sequencing, Shotgun Sequencing, 16S rRNA Sequencing, and Others. Among these, Whole Genome Sequencing is currently the dominant sub-segment due to its comprehensive approach in analyzing entire genomes, which is crucial for understanding complex microbial communities. The demand for detailed genetic information in clinical diagnostics and research applications has significantly increased, driving the growth of this segment .

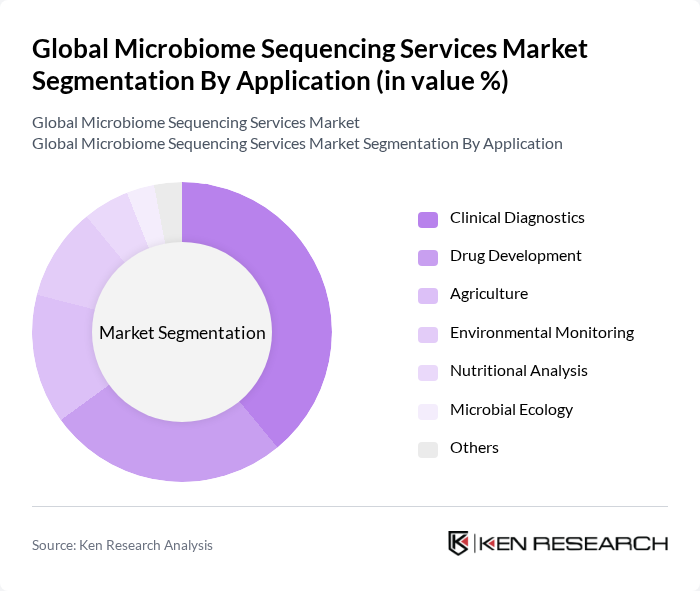

By Application:The applications of microbiome sequencing services include Clinical Diagnostics, Drug Development, Agriculture, Environmental Monitoring, Nutritional Analysis, Microbial Ecology, and Others. Clinical Diagnostics is the leading application area, driven by the increasing need for personalized medicine and the growing understanding of the microbiome's impact on health. The ability to identify microbial profiles associated with various diseases has made this application critical in healthcare, leading to its dominance in the market .

The Global Microbiome Sequencing Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Illumina, Inc., Thermo Fisher Scientific Inc., BGI Genomics Co., Ltd., QIAGEN N.V., Roche Sequencing Solutions, Pacific Biosciences of California, Inc., Oxford Nanopore Technologies Ltd., Zymo Research Corp., CosmosID, Inc., Novogene Co., Ltd., Eurofins Scientific SE, BaseClear B.V., Microba Life Sciences Limited, uBiome, Inc. (Note: company ceased operations in 2019, but historically relevant), Macrogen, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of microbiome sequencing services appears promising, driven by ongoing technological advancements and increasing integration into healthcare practices. As the understanding of the microbiome's role in various diseases deepens, more healthcare providers are likely to adopt these services. Additionally, the rise of direct-to-consumer testing will further democratize access to microbiome analysis, fostering innovation and collaboration across sectors. This evolving landscape presents significant opportunities for growth and development in the microbiome sequencing market.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Genome Sequencing Targeted Sequencing Metagenomic Sequencing RNA Sequencing Amplicon Sequencing Shotgun Sequencing S rRNA Sequencing Others |

| By Application | Clinical Diagnostics Drug Development Agriculture Environmental Monitoring Nutritional Analysis Microbial Ecology Others |

| By End-User | Academic Research Institutes Pharmaceutical Companies Biotechnology Firms Hospitals and Clinics Contract Research Organizations (CROs) Food & Beverage Companies Others |

| By Service Type | Data Analysis Services Sample Preparation Services Sequencing Services Bioinformatics Services Consulting Services Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Project-Based Others |

| By Sample Type | Human Samples Animal Samples Environmental Samples Food Samples Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Applications | 100 | Clinical Lab Managers, Pathologists |

| Research and Development Projects | 80 | Research Scientists, Academic Professors |

| Therapeutic Development Initiatives | 70 | Pharmaceutical Researchers, Biotech Executives |

| Microbiome Data Analysis Services | 50 | Bioinformatics Specialists, Data Analysts |

| Consumer Health Products | 60 | Product Managers, Marketing Directors |

The Global Microbiome Sequencing Services Market is valued at approximately USD 1.7 billion, reflecting significant growth driven by advancements in sequencing technologies and the increasing demand for personalized medicine.