Region:Middle East

Author(s):Shubham

Product Code:KRAD1048

Pages:85

Published On:November 2025

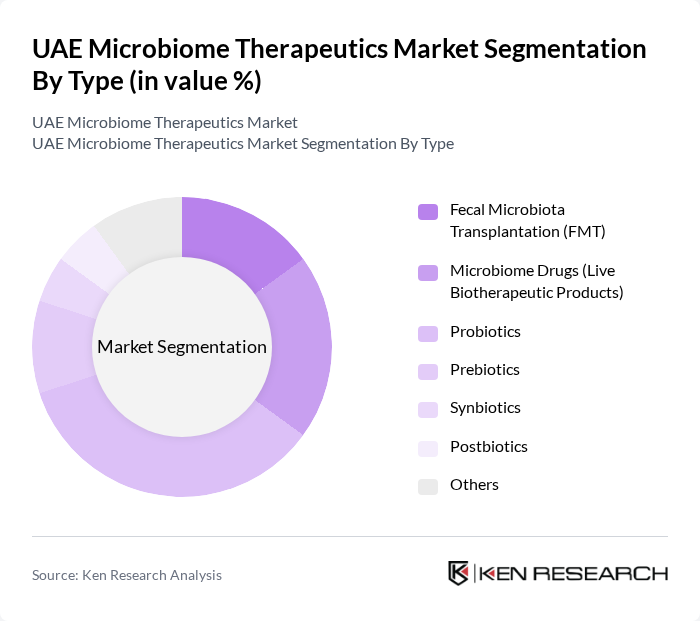

By Type:The market is segmented into various types, including Fecal Microbiota Transplantation (FMT), Microbiome Drugs (Live Biotherapeutic Products), Probiotics, Prebiotics, Synbiotics, Postbiotics, and Others. Among these, Probiotics are currently leading the market due to their widespread acceptance and proven health benefits, particularly in digestive health and immune support. The increasing consumer awareness regarding gut health and the growing trend of preventive healthcare are driving the demand for probiotics. Additionally, the rise in e-commerce platforms has made these products more accessible to consumers. The postbiotics segment is also gaining traction due to its stability and safety profile, with increasing R&D investments in this area .

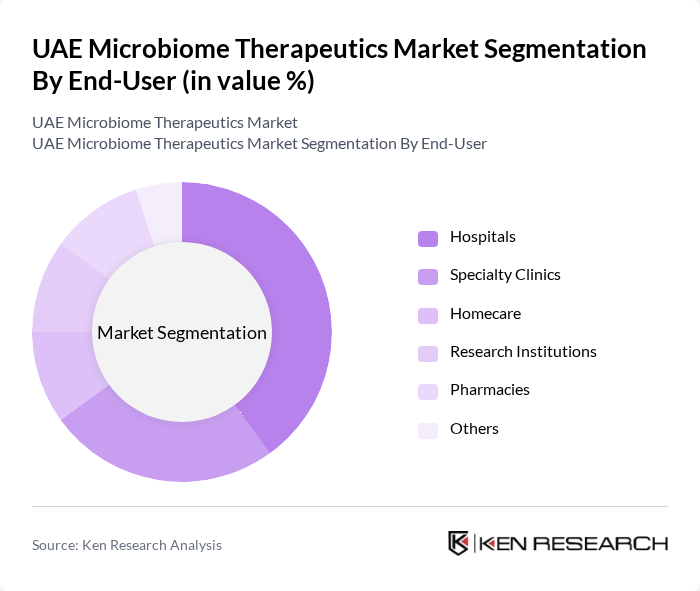

By End-User:The end-user segmentation includes Hospitals, Specialty Clinics, Homecare, Research Institutions, Pharmacies, and Others. Hospitals are the leading end-user segment, primarily due to their capacity to provide comprehensive healthcare services and advanced treatment options. The increasing prevalence of chronic diseases and the need for specialized care in hospitals are driving the demand for microbiome therapeutics. Additionally, the integration of microbiome therapies into standard treatment protocols is enhancing their adoption in hospital settings. Specialty clinics and research institutions are also expanding their roles, particularly in clinical trials and personalized therapy development .

The UAE Microbiome Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Seres Therapeutics, Ferring Pharmaceuticals, Finch Therapeutics, 4D Pharma, Enterome, Vedanta Biosciences, Rebiotix (a Ferring company), MaaT Pharma, Microbiotica, Second Genome, Eligo Bioscience, Evolve BioSystems, AOBiome Therapeutics, Symbiosis Pharmaceutical Services, Gulf Drug LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE microbiome therapeutics market appears promising, driven by ongoing research and increasing consumer demand for personalized healthcare solutions. As the government continues to support innovation through funding and regulatory reforms, the market is likely to see a surge in new product launches. Additionally, the integration of artificial intelligence in microbiome research is expected to enhance diagnostic capabilities, paving the way for more effective treatments tailored to individual needs, thus fostering market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Fecal Microbiota Transplantation (FMT) Microbiome Drugs (Live Biotherapeutic Products) Probiotics Prebiotics Synbiotics Postbiotics Others |

| By End-User | Hospitals Specialty Clinics Homecare Research Institutions Pharmacies Others |

| By Application | Clostridioides difficile Infection (C. difficile) Inflammatory Bowel Disease (IBD) Crohn's Disease Diabetes Metabolic Disorders Immune Disorders Mental Health Others |

| By Distribution Channel | Online Pharmacies Retail Pharmacies Hospital Pharmacies Direct Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) Health Consciousness (High, Medium, Low) Others |

| By Product Formulation | Capsules Powders Liquids Gummies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Providers | 100 | Gastroenterologists, General Practitioners |

| Research Institutions | 60 | Microbiome Researchers, Academic Professors |

| Pharmaceutical Companies | 50 | Product Managers, R&D Directors |

| Patient Advocacy Groups | 40 | Patient Representatives, Health Advocates |

| Health Insurance Providers | 40 | Policy Analysts, Claims Managers |

The UAE Microbiome Therapeutics Market is valued at approximately USD 1.27 billion, reflecting significant growth driven by increased awareness of gut health, rising gastrointestinal disorders, and advancements in microbiome research.