Region:Asia

Author(s):Rebecca

Product Code:KRAB1065

Pages:97

Published On:December 2025

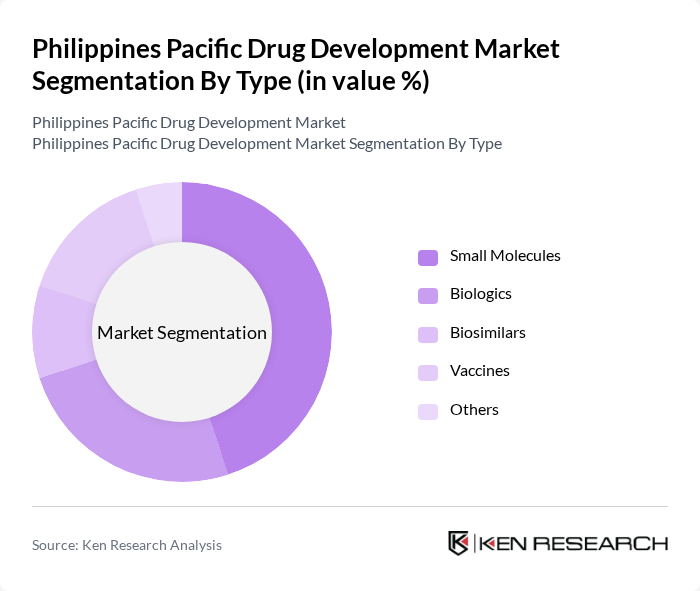

By Type:The market is segmented into various types, including small molecules, biologics, biosimilars, vaccines, and others. Among these, small molecules dominate the market due to their widespread use in treating various diseases, particularly chronic conditions. The increasing prevalence of such diseases drives demand for small molecule drugs, which are often more affordable and easier to manufacture compared to biologics and biosimilars.

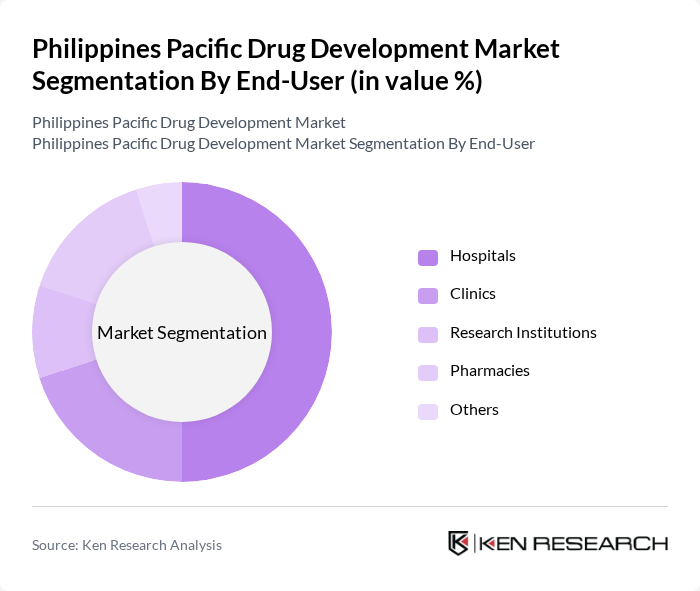

By End-User:The end-user segmentation includes hospitals, clinics, research institutions, pharmacies, and others. Hospitals are the leading end-users, driven by the increasing number of patients requiring advanced medical care and the growing demand for innovative therapies. The expansion of healthcare facilities and the rising number of outpatient services also contribute to the dominance of hospitals in this segment.

The Philippines Pacific Drug Development Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi Philippines, Pfizer Philippines, GlaxoSmithKline Philippines, Novartis Healthcare Philippines, Merck Sharp & Dohme (MSD) Philippines, Roche Philippines, AstraZeneca Philippines, Johnson & Johnson Philippines, Eli Lilly Philippines, Abbott Laboratories Philippines, Bayer Philippines, Amgen Philippines, Takeda Pharmaceuticals Philippines, UCB Pharma Philippines, and Servier Laboratories Philippines contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines Pacific Drug Development Market appears promising, driven by significant investments in healthcare infrastructure and a strong push for local pharmaceutical production. The establishment of pharmaceutical economic zones and innovation hubs is expected to attract both domestic and foreign investments, enhancing the local manufacturing landscape. Additionally, ongoing government initiatives aimed at reducing drug costs and improving regulatory processes will likely foster a more competitive environment, ultimately benefiting consumers and healthcare providers alike.

| Segment | Sub-Segments |

|---|---|

| By Type | Small Molecules Biologics Biosimilars Vaccines Others |

| By End-User | Hospitals Clinics Research Institutions Pharmacies Others |

| By Therapeutic Area | Oncology Cardiovascular Neurology Infectious Diseases Others |

| By Distribution Channel | Direct Sales Wholesalers Online Pharmacies Retail Pharmacies Others |

| By Region | Luzon Visayas Mindanao |

| By Research Phase | Preclinical Clinical Trials Post-Marketing Surveillance |

| By Policy Support | Government Grants Tax Incentives Research and Development Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Managers | 100 | R&D Directors, Clinical Trial Managers |

| Regulatory Affairs Specialists | 80 | Regulatory Managers, Compliance Officers |

| Healthcare Professionals | 120 | Doctors, Pharmacists, Clinical Researchers |

| Market Access Managers | 70 | Market Access Directors, Pricing Analysts |

| Clinical Trial Coordinators | 90 | Clinical Research Associates, Project Managers |

The Philippines Pacific Drug Development Market is valued at approximately USD 3.35 billion, driven by increased healthcare expenditure, government funding, and a growing geriatric population requiring long-term medication for chronic conditions.