Region:Global

Author(s):Shubham

Product Code:KRAA2661

Pages:95

Published On:August 2025

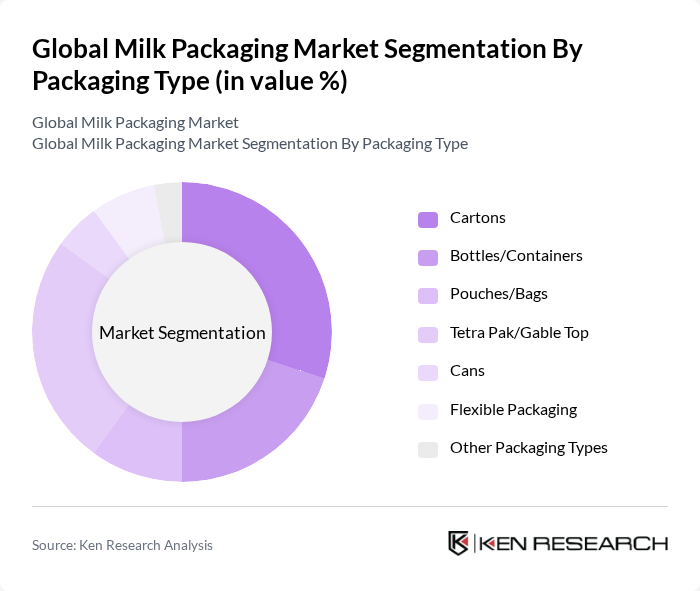

By Packaging Type:The packaging type segment includes various forms such as cartons, bottles/containers, pouches/bags, Tetra Pak/gable top, cans, flexible packaging, and other packaging types. Among these, cartons and Tetra Pak are leading due to their lightweight, durability, and ability to preserve milk quality. The trend towards sustainability has also boosted the demand for recyclable packaging options, making these subsegments particularly popular. Paper-based packaging currently holds the largest market share due to its recyclability and cost-effectiveness, while flexible and aseptic packaging formats are gaining traction for their convenience and extended shelf life .

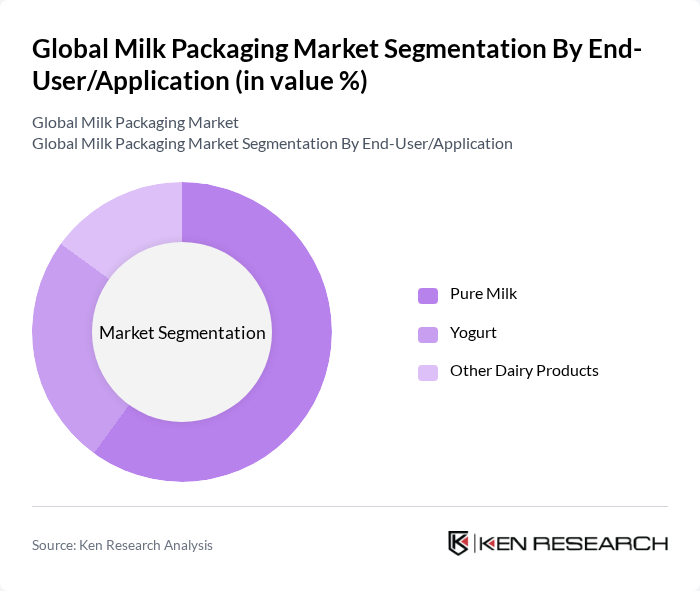

By End-User/Application:This segment encompasses pure milk, yogurt, and other dairy products. The pure milk subsegment is the largest, driven by high consumption rates and the growing trend of health-conscious consumers preferring fresh milk. Yogurt is also gaining traction due to its perceived health benefits, contributing to the overall growth of the dairy packaging market. Pure milk packaging dominates the market, followed by yogurt and other dairy products .

The Global Milk Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tetra Pak International S.A., Elopak ASA, SIG Combibloc Group AG, Amcor plc, Sealed Air Corporation, International Paper Company, Ball Corporation, Crown Holdings, Inc., Scholle IPN, Mondi Group, Smurfit Kappa Group, DS Smith Plc, Huhtamaki Oyj, WestRock Company, Berry Global Group, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the milk packaging industry in None is poised for transformation, driven by technological advancements and a growing emphasis on sustainability. As consumers increasingly demand eco-friendly options, manufacturers are likely to invest in biodegradable materials and innovative packaging solutions. Additionally, the rise of e-commerce is expected to reshape distribution channels, necessitating packaging that ensures product integrity during transit. These trends will create a dynamic environment for growth and innovation in the milk packaging sector.

| Segment | Sub-Segments |

|---|---|

| By Packaging Type | Cartons Bottles/Containers Pouches/Bags Tetra Pak/Gable Top Cans Flexible Packaging Other Packaging Types |

| By End-User/Application | Pure Milk Yogurt Other Dairy Products |

| By Material | Plastic (HDPE, PET, Others) Paperboard Glass Metal Other Materials |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Direct Sales |

| By Region | North America (United States, Canada, Mexico) Europe (United Kingdom, Germany, France, Italy, Spain, Russia, Benelux, Nordics, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, ASEAN, Oceania, Rest of Asia Pacific) Latin America (Brazil, Argentina, Rest of South America) Middle East & Africa (Turkey, Israel, GCC, North Africa, South Africa, Rest of Middle East & Africa) |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Rigidity | Rigid Packaging Flexible Packaging Semi-Rigid Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Milk Packaging Insights | 120 | Store Managers, Category Buyers |

| Dairy Product Manufacturers | 90 | Production Managers, Quality Assurance Managers |

| Packaging Suppliers | 70 | Sales Directors, Product Development Managers |

| Consumer Preferences Survey | 140 | End Consumers, Health-Conscious Shoppers |

| Sustainability Initiatives in Packaging | 60 | Sustainability Officers, Environmental Compliance Managers |

The Global Milk Packaging Market is valued at approximately USD 50 billion, reflecting a significant growth trend driven by increasing demand for dairy products and a shift towards sustainable packaging solutions.