Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3138

Pages:85

Published On:October 2025

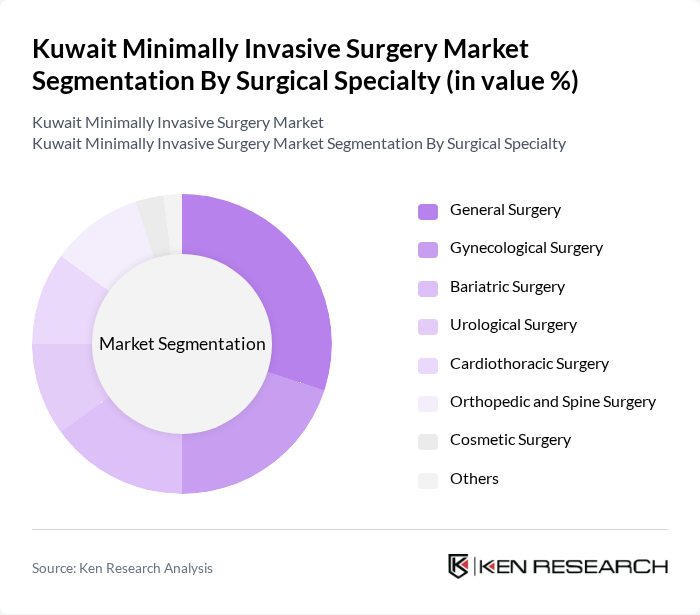

By Surgical Specialty:The surgical specialty segment includes various sub-segments such as General Surgery, Gynecological Surgery, Bariatric Surgery, Urological Surgery, Cardiothoracic Surgery, Orthopedic and Spine Surgery, Cosmetic Surgery, and Others. Among these, Gynecological Surgery is the leading sub-segment, driven by growing surgical volumes and increased awareness of women's health across the Middle East region. Bariatric Surgery represents the fastest-growing segment, fueled by Kuwait's high obesity rates and the increasing recognition of minimally invasive surgical interventions as effective long-term management strategies for obesity-related comorbidities. The trend towards outpatient surgeries and the growing acceptance of minimally invasive techniques are also contributing to the growth of this segment.

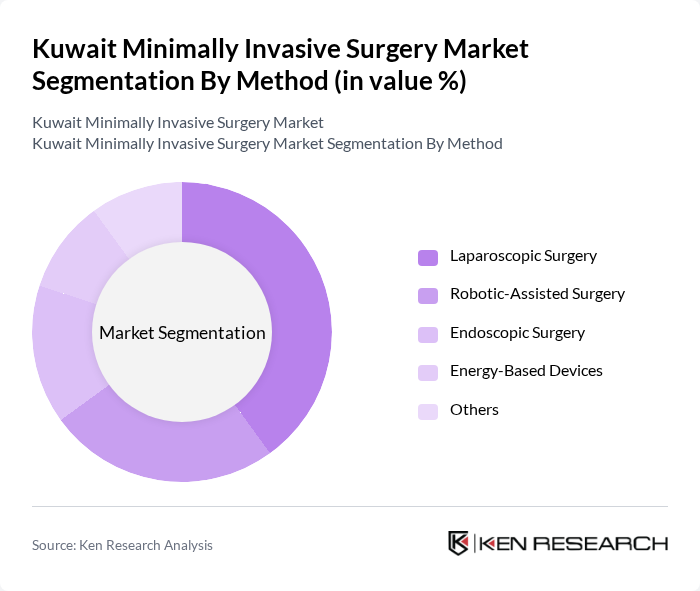

By Method:The method segment encompasses Laparoscopic Surgery, Robotic-Assisted Surgery, Endoscopic Surgery, Energy-Based Devices, and Others. Laparoscopic Surgery is the dominant method, favored for its minimally invasive nature, which results in shorter recovery times and less postoperative pain. The increasing adoption of robotic-assisted systems is notable, as they enhance precision and control during surgical procedures, further driving the growth of this segment. Advanced electrosurgical tools and energy-based devices are experiencing growing demand as they improve efficiency and safety in minimally invasive procedures.

The Kuwait Minimally Invasive Surgery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Intuitive Surgical, Johnson & Johnson (Ethicon), Olympus Corporation, Stryker Corporation, Smith & Nephew plc, Boston Scientific Corporation, Karl Storz SE & Co. KG, B. Braun Melsungen AG, CMR Surgical, Siemens Healthineers, Zimmer Biomet Holdings, ConMed Corporation, Cook Medical, Hologic, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait minimally invasive surgery market appears promising, driven by technological advancements and increasing healthcare investments. As the government focuses on enhancing healthcare infrastructure, the integration of artificial intelligence and telemedicine is expected to revolutionize surgical practices. Furthermore, the growing emphasis on patient-centered care will likely lead to more personalized surgical options, improving patient satisfaction and outcomes. These trends indicate a robust growth trajectory for the market in future.

| Segment | Sub-Segments |

|---|---|

| By Surgical Specialty | General Surgery Gynecological Surgery Bariatric Surgery Urological Surgery Cardiothoracic Surgery Orthopedic and Spine Surgery Cosmetic Surgery Others |

| By Method | Laparoscopic Surgery Robotic-Assisted Surgery Endoscopic Surgery Energy-Based Devices Others |

| By Product Type | Surgical Devices Laparoscopy Devices Monitoring and Visualization Devices Electrosurgical Tools Robotic Systems Others |

| By End-Use | Hospitals Ambulatory Surgical Centers Specialty Clinics Others |

| By Technology | Laser Surgery Electrosurgery Ultrasound Surgery Radiofrequency Ablation Others |

| By Investment Source | Private Healthcare Investments Government Healthcare Funding International Medical Partnerships Medical Tourism Revenue Others |

| By Policy Support | Healthcare Infrastructure Development Initiatives Medical Equipment Import Regulations Surgical Training Programs Hospital Modernization Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| General Surgery Departments | 100 | Surgeons, Department Heads |

| Gynecology and Urology Clinics | 70 | Specialist Surgeons, Clinic Managers |

| Healthcare Equipment Suppliers | 50 | Sales Managers, Product Specialists |

| Patient Experience and Outcomes | 60 | Patients, Healthcare Advocates |

| Regulatory Bodies and Health Authorities | 40 | Policy Makers, Health Administrators |

The Kuwait Minimally Invasive Surgery Market is valued at approximately USD 770 million, reflecting a significant growth driven by advancements in surgical technologies and an increasing preference for minimally invasive procedures among patients.