Region:Global

Author(s):Shubham

Product Code:KRAA2669

Pages:86

Published On:August 2025

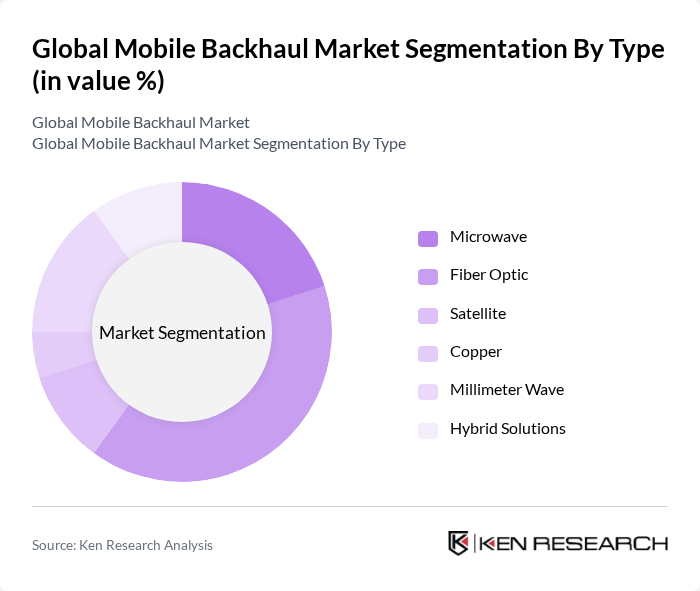

By Type:The mobile backhaul market is segmented into Microwave, Fiber Optic, Satellite, Copper, Millimeter Wave, and Hybrid Solutions. Among these, Fiber Optic remains the leading sub-segment due to its unmatched capacity, reliability, and scalability, making it the preferred choice for telecom operators deploying 5G and high-bandwidth services. Microwave and Millimeter Wave technologies are also gaining traction, particularly in urban and suburban areas, due to their cost-effectiveness, rapid deployment, and suitability for dense small-cell architectures .

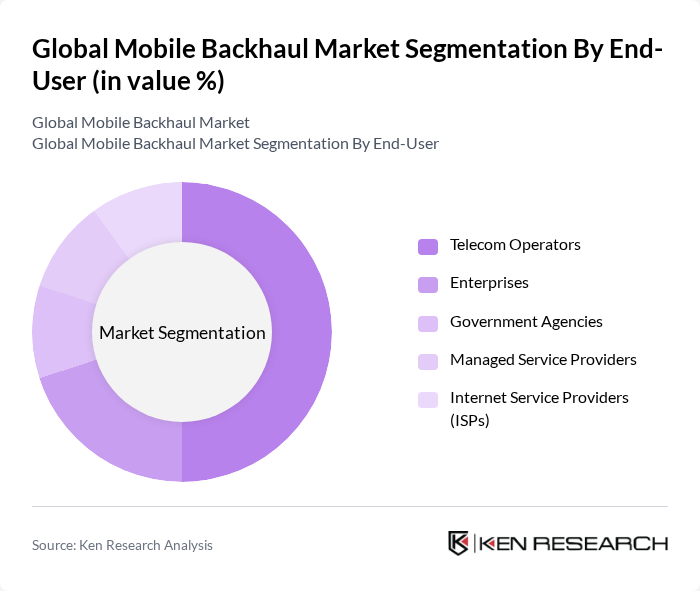

By End-User:The end-user segmentation includes Telecom Operators, Enterprises, Government Agencies, Managed Service Providers, and Internet Service Providers (ISPs). Telecom Operators dominate this segment, driven by the increasing demand for mobile data services, 5G rollouts, and the need for robust, scalable backhaul solutions. Enterprises are also emerging as significant users, seeking reliable and secure connectivity for digital transformation and IoT-driven operations .

The Global Mobile Backhaul Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ericsson, Nokia, Huawei Technologies Co., Ltd., Cisco Systems, Inc., ZTE Corporation, Ciena Corporation, Juniper Networks, Inc., ADVA Optical Networking SE, Infinera Corporation, NEC Corporation, Fujitsu Limited, CommScope Holding Company, Inc., Calix, Inc., Ribbon Communications Inc., and Telstra Corporation Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the mobile backhaul market appears promising, driven by technological advancements and increasing demand for connectivity. The integration of AI and machine learning into network management is expected to optimize performance and reduce operational costs. Additionally, the shift towards cloud-based solutions will facilitate more flexible and scalable backhaul options, enabling operators to meet the growing data demands efficiently. As these trends evolve, the market is likely to witness significant transformations in infrastructure and service delivery.

| Segment | Sub-Segments |

|---|---|

| By Type | Microwave Fiber Optic Satellite Copper Millimeter Wave Hybrid Solutions |

| By End-User | Telecom Operators Enterprises Government Agencies Managed Service Providers Internet Service Providers (ISPs) |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Technology | G LTE G NR MPLS SDN (Software Defined Networking) Ethernet/IP |

| By Application | Mobile Network Operators Internet Service Providers Private Networks Small Cell Backhaul |

| By Investment Source | Private Investments Public Funding Joint Ventures |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operator Infrastructure | 120 | Network Engineers, CTOs |

| Mobile Backhaul Technology Providers | 60 | Product Managers, Sales Directors |

| Regulatory Bodies and Policy Makers | 40 | Regulatory Affairs Specialists, Government Officials |

| Consulting Firms in Telecommunications | 50 | Industry Analysts, Consultants |

| End-User Enterprises Utilizing Mobile Services | 45 | IT Managers, Operations Directors |

The Global Mobile Backhaul Market is valued at approximately USD 10 billion, driven by the increasing demand for high-speed internet, mobile data traffic, and the rapid deployment of 5G networks.