Region:Global

Author(s):Shubham

Product Code:KRAD3598

Pages:99

Published On:November 2025

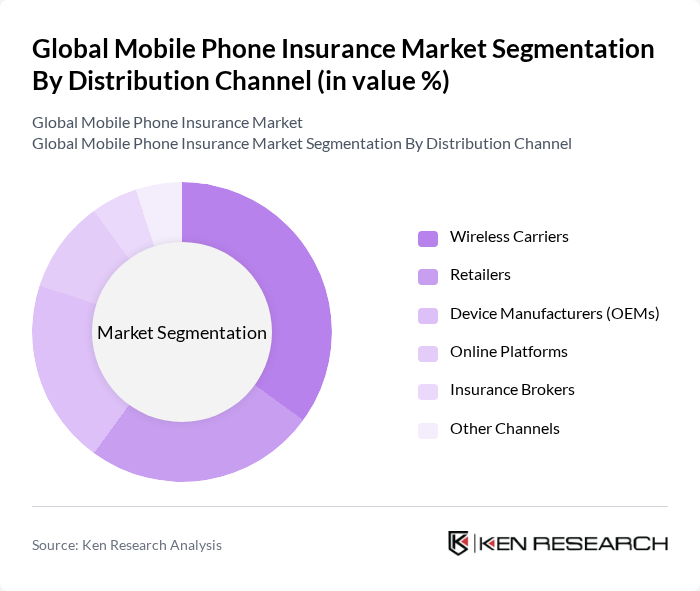

By Distribution Channel:This segmentation includes various channels through which mobile phone insurance is sold. The primary channels are Wireless Carriers, Retailers, Device Manufacturers (OEMs), Online Platforms, Insurance Brokers, and Other Channels. Each channel plays a crucial role in reaching consumers and providing them with insurance options tailored to their needs. Wireless Carriers remain the dominant channel due to their established customer base and ability to bundle insurance with service plans. Retailers and OEMs leverage direct sales and brand loyalty, while Online Platforms are increasingly important due to digital adoption. Insurance Brokers and Other Channels serve niche and specialized markets.

The Wireless Carriers segment is the leading distribution channel, primarily due to their established customer base and the convenience of bundling insurance with mobile plans. Retailers also play a significant role, as they provide direct access to consumers at the point of sale. Device Manufacturers (OEMs) leverage their brand loyalty to offer insurance directly to customers, while Online Platforms are gaining traction due to the increasing trend of digital transactions. Insurance Brokers and Other Channels contribute to the market but hold smaller shares.

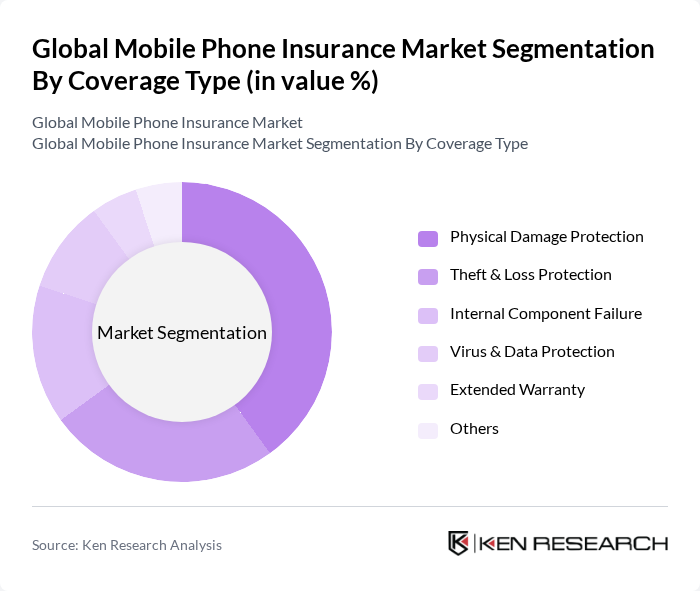

By Coverage Type:This segmentation focuses on the different types of coverage offered in mobile phone insurance. The main coverage types include Physical Damage Protection, Theft & Loss Protection, Internal Component Failure, Virus & Data Protection, Extended Warranty, and Others. Each type addresses specific consumer needs and concerns regarding device protection. Physical Damage Protection remains the most sought-after coverage, followed by Theft & Loss Protection, reflecting consumer priorities for safeguarding devices against common risks. Internal Component Failure and Virus & Data Protection are increasingly relevant with the rise of sophisticated smartphones and cyber threats. Extended Warranty and Other types cater to specialized consumer segments.

Physical Damage Protection is the dominant coverage type, as consumers are primarily concerned about accidental damage to their devices. Theft & Loss Protection follows closely, reflecting the growing concern over device security. Internal Component Failure coverage is also significant, as consumers seek protection against hardware malfunctions. Virus & Data Protection is increasingly relevant in the digital age, while Extended Warranty and Other types cater to niche markets.

The Global Mobile Phone Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asurion LLC, Assurant, Inc., Apple Inc., SquareTrade, Inc. (an Allstate company), Allianz Global Assistance, AXA S.A., American International Group (AIG), Chubb Limited, Liberty Mutual Insurance, Cover Genius, Worth Ave. Group, Protect Your Bubble, Gadget Cover, Trov, Inc., CPP Group Plc contribute to innovation, geographic expansion, and service delivery in this space.

The future of mobile phone insurance is poised for transformation, driven by technological advancements and evolving consumer preferences. As digital platforms become more prevalent, insurers are likely to enhance their online offerings, making it easier for consumers to purchase and manage policies. Additionally, the integration of artificial intelligence in claims processing is expected to streamline operations, reduce fraud, and improve customer satisfaction. These trends indicate a shift towards more personalized and efficient insurance solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Distribution Channel | Wireless Carriers Retailers Device Manufacturers (OEMs) Online Platforms Insurance Brokers Other Channels |

| By Coverage Type | Physical Damage Protection Theft & Loss Protection Internal Component Failure Virus & Data Protection Extended Warranty Others |

| By Device Type | Budget Phones Mid & High-End Phones Premium Smartphones Tablets Wearable Devices Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Educational Institutions Others |

| By Premium Payment Mode | Monthly Payments Annual Payments One-time Payment Others |

| By Policy Duration | Short-term Policies Long-term Policies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Mobile Insurance Purchases | 120 | Smartphone Users, Insurance Policyholders |

| Telecom Operator Partnerships | 60 | Business Development Managers, Product Managers |

| Claims Processing Insights | 50 | Claims Adjusters, Customer Service Representatives |

| Market Trends and Consumer Behavior | 90 | Market Analysts, Consumer Insights Specialists |

| Insurance Regulatory Compliance | 40 | Compliance Officers, Legal Advisors |

The Global Mobile Phone Insurance Market is valued at approximately USD 40 billion, driven by factors such as increasing smartphone penetration, consumer awareness of device protection, and the trend of online insurance purchasing.