Region:Global

Author(s):Shubham

Product Code:KRAA2728

Pages:95

Published On:August 2025

By Type:The molluscicides market is segmented into Metaldehyde, Iron phosphate, Ferric sodium EDTA, Biological molluscicides (including biopesticides and natural extracts), and other chemical types (such as copper-based and niclosamide). Metaldehyde remains the leading subsegment due to its proven effectiveness against a wide range of mollusks and its established market presence. Iron phosphate is gaining traction as a safer alternative, especially in organic farming. The demand for biological molluscicides is rising as consumers and farmers increasingly prefer eco-friendly solutions .

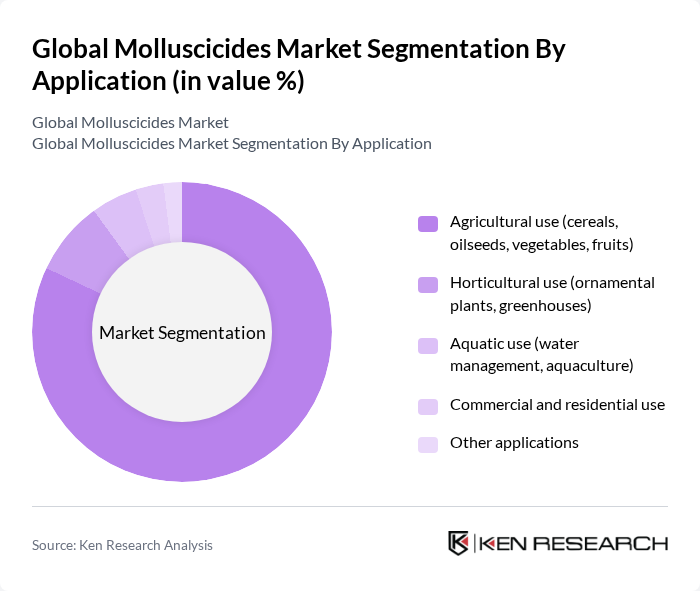

By Application:Molluscicides are used across diverse applications, including agricultural use (cereals, oilseeds, vegetables, fruits), horticultural use (ornamental plants, greenhouses), aquatic use (water management, aquaculture), commercial and residential use, and other applications. Agricultural use is the dominant segment, accounting for the majority of market share, driven by the need to protect crops from mollusk damage and ensure higher yields. Horticultural use is also expanding, particularly in regions with significant ornamental plant production .

The Global Molluscicides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Syngenta AG, Bayer AG, FMC Corporation, ADAMA Agricultural Solutions Ltd., Corteva Agriscience, Nufarm Limited, UPL Limited, Sumitomo Chemical Co., Ltd., Marrone Bio Innovations, Inc., Valent BioSciences LLC, Certis Biologicals, BioWorks, Inc., Isagro S.p.A., Taminco Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the molluscicides market appears promising, driven by the increasing emphasis on sustainable agricultural practices and the integration of digital technologies in pest management. As farmers adopt precision agriculture techniques, the demand for effective and environmentally friendly pest control solutions will likely rise. Additionally, the collaboration between agricultural stakeholders and research institutions is expected to foster innovation, leading to the development of new molluscicides that meet both regulatory standards and consumer preferences for eco-friendly products.

| Segment | Sub-Segments |

|---|---|

| By Type | Metaldehyde Iron phosphate Ferric sodium EDTA Biological molluscicides (e.g., biopesticides, natural extracts) Other chemical types (e.g., copper-based, niclosamide) |

| By Application | Agricultural use (cereals, oilseeds, vegetables, fruits) Horticultural use (ornamental plants, greenhouses) Aquatic use (water management, aquaculture) Commercial and residential use Other applications |

| By Formulation | Granules Liquids Pellets Gels Other formulations |

| By Distribution Channel | Direct sales Retail (agrochemical stores, garden centers) Online sales Distributors/wholesalers |

| By End-User | Farmers Agricultural cooperatives Government agencies Commercial growers Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Low price Mid-range Premium |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chemical Distributors | 60 | Sales Managers, Product Line Managers |

| Farmers Using Molluscicides | 100 | Crop Farmers, Pest Control Specialists |

| Research Institutions Focused on Pest Management | 50 | Research Scientists, Agronomists |

| Regulatory Bodies and Environmental Agencies | 40 | Policy Makers, Environmental Scientists |

| Retailers of Agricultural Products | 45 | Store Managers, Procurement Officers |

The Global Molluscicides Market is valued at approximately USD 720 million, driven by the increasing need for effective pest control in agriculture and horticulture, as well as the rising demand for eco-friendly solutions.