Region:Global

Author(s):Shubham

Product Code:KRAA3206

Pages:90

Published On:August 2025

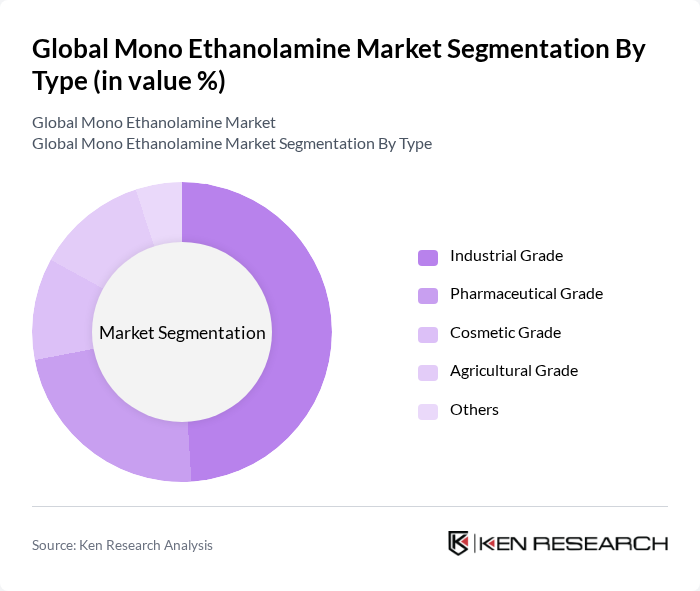

By Type:The market is segmented into Purity 99% and Above, Purity Below 99%, Industrial Grade, Pharmaceutical Grade, Cosmetic Grade, Agricultural Grade, and Others. Among these, the Industrial Grade segment leads due to its extensive use in manufacturing processes across textiles, oil & gas, and chemical industries. The demand for high-purity grades is increasing, particularly in pharmaceuticals and cosmetics, driven by consumer preferences for quality, safety, and regulatory compliance.

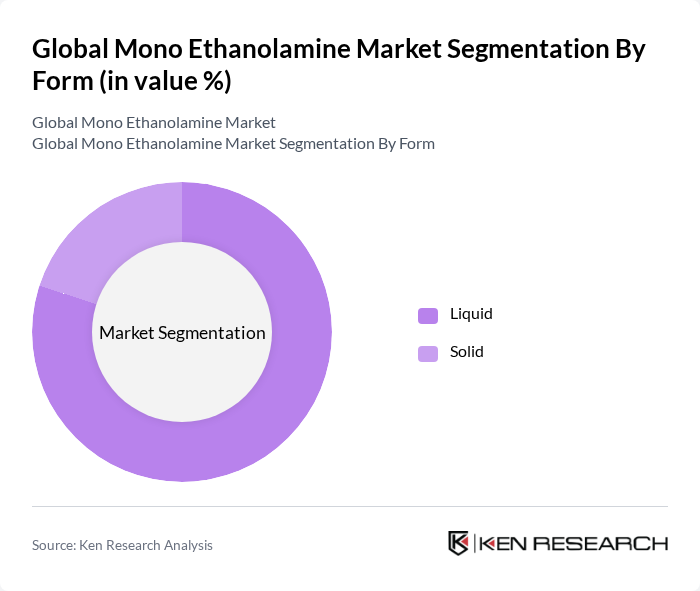

By Form:The market is categorized into Liquid and Solid forms. The Liquid form dominates the market due to its versatility and ease of use in cleaning agents, agricultural products, and chemical manufacturing. The demand for solid forms is present in specific industrial applications where stability, storage, and controlled release are critical.

The Global Mono Ethanolamine Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Dow Chemical Company, Huntsman Corporation, AkzoNobel N.V., INEOS Group, Eastman Chemical Company, Alkyl Amines Chemicals Ltd., Taminco Corporation (now part of Eastman Chemical Company), Solvay S.A., Clariant AG, Merck KGaA, Mitsubishi Gas Chemical Company, Inc., Nippon Shokubai Co., Ltd., Mitsui Chemicals, Inc., KPX Green Corporation, Arak Petrochemical Company, OUCC (Oriental Union Chemical Corporation), Yinyan Specialty Chemicals Co., Ltd., Jiahua Chemicals Inc., Xian Lin Chemical Co., Ltd., Maoming Petro-Chemical Shihua, JLZX Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monoethanolamine market appears promising, driven by the increasing demand for sustainable and bio-based products. Innovations in production processes are expected to enhance efficiency and reduce environmental impact, aligning with global sustainability goals. Additionally, the expansion into emerging markets, particularly in Asia-Pacific and Latin America, will provide new growth avenues. As consumer preferences shift towards eco-friendly products, manufacturers will need to adapt to these trends to remain competitive in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Purity 99% and Above Purity Below 99% Industrial Grade Pharmaceutical Grade Cosmetic Grade Agricultural Grade Others |

| By Form | Liquid Solid |

| By Application | Surfactants Emulsifiers Solvents Corrosion Inhibitors Cement Additives Gas Treatment Herbicides & Pesticides Metalworking Fluids Water Treatment Others |

| By End-User | Agriculture Personal Care Pharmaceuticals Industrial Cleaning Oil & Gas Textile Construction Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Packaging Type | Drums IBC Totes Bulk Others |

| By Price Range | Low Medium High Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chemicals | 100 | Procurement Managers, Product Development Specialists |

| Pharmaceutical Applications | 80 | Regulatory Affairs Managers, R&D Scientists |

| Personal Care Products | 70 | Formulation Chemists, Brand Managers |

| Industrial Cleaning Agents | 60 | Operations Managers, Quality Control Supervisors |

| Textile and Leather Processing | 40 | Production Managers, Supply Chain Coordinators |

The Global Mono Ethanolamine Market is valued at approximately USD 2.4 billion, driven by increasing demand in various sectors such as personal care, agriculture, and industrial cleaning products.