Region:Global

Author(s):Shubham

Product Code:KRAA3152

Pages:96

Published On:August 2025

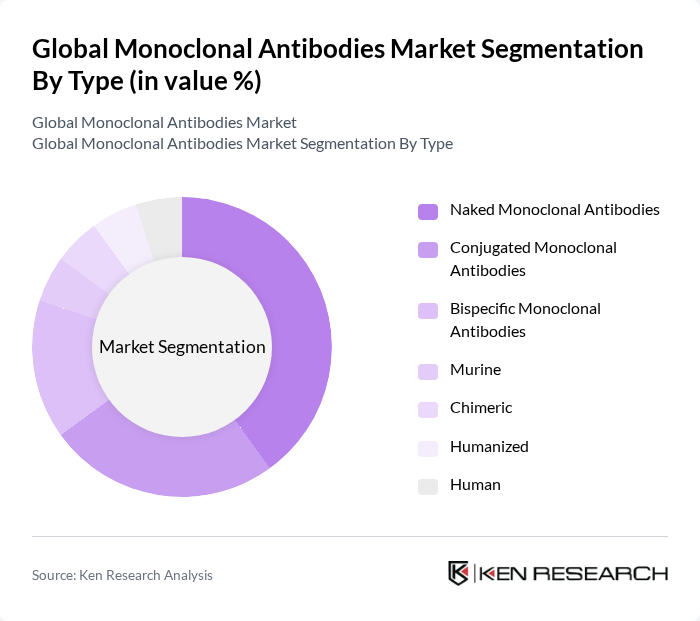

By Type:The monoclonal antibodies market is segmented into various types, including Naked Monoclonal Antibodies, Conjugated Monoclonal Antibodies, Bispecific Monoclonal Antibodies, Murine, Chimeric, Humanized, and Human. Among these,Naked Monoclonal Antibodiesare the most widely used due to their effectiveness in treating various cancers and autoimmune diseases. The increasing focus on personalized medicine and targeted therapies has further propelled the demand for these antibodies, making them a dominant force in the market .

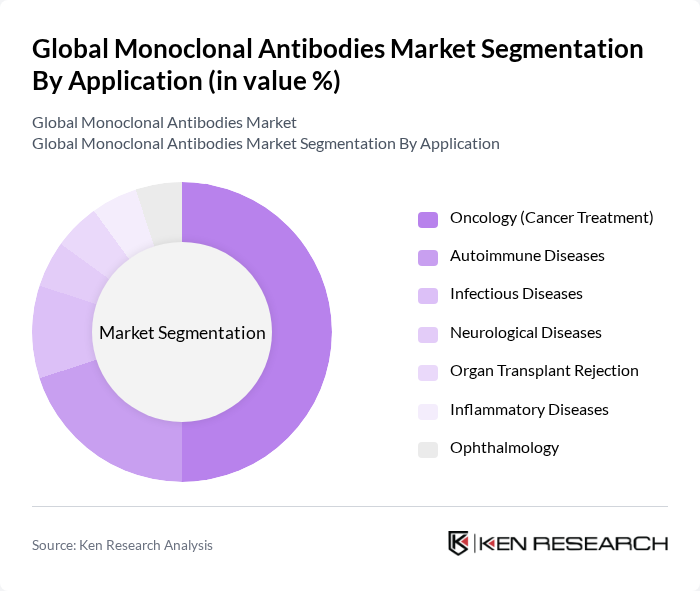

By Application:The applications of monoclonal antibodies span across various medical fields, including Oncology (Cancer Treatment), Autoimmune Diseases, Infectious Diseases, Neurological Diseases, Organ Transplant Rejection, Inflammatory Diseases, Ophthalmology, and others.Oncologyremains the leading application area, driven by the rising incidence of cancer and the growing preference for targeted therapies that minimize side effects compared to traditional treatments. This trend is expected to continue as more innovative therapies are developed .

The Global Monoclonal Antibodies Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amgen Inc., Genentech, Inc. (Roche Group), AbbVie Inc., Johnson & Johnson (Janssen Biotech, Inc.), Merck & Co., Inc., Bristol-Myers Squibb Company, Novartis AG, Pfizer Inc., Sanofi S.A., GSK plc, Regeneron Pharmaceuticals, Inc., Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Bayer AG, AstraZeneca PLC, F. Hoffmann-La Roche Ltd., Biogen Inc., Teva Pharmaceutical Industries Ltd., Eisai Co., Ltd., Lupin Limited, Zydus Lifesciences Limited, Amneal Pharmaceuticals LLC, Mylan N.V. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the monoclonal antibodies market appears promising, driven by ongoing innovations and a shift towards personalized medicine. As the demand for targeted therapies continues to rise, companies are likely to invest heavily in research and development, focusing on next-generation monoclonal antibodies. Additionally, the expansion into emerging markets presents significant growth potential, as healthcare infrastructure improves and access to advanced therapies increases, fostering a more competitive landscape in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Naked Monoclonal Antibodies Conjugated Monoclonal Antibodies Bispecific Monoclonal Antibodies Murine Chimeric Humanized Human |

| By Application | Oncology (Cancer Treatment) Autoimmune Diseases Infectious Diseases Neurological Diseases Organ Transplant Rejection Inflammatory Diseases Ophthalmology Others |

| By End-User | Hospitals Specialty Centers Research Laboratories Pharmaceutical & Biotechnology Companies Diagnostic Centers Others |

| By Distribution Channel | Direct Sales Distributors/Wholesalers Online Sales Retail Pharmacies Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, France, U.K., Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of APAC) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Production Type | In Vivo In Vitro |

| By Source Type | Murine Chimeric Humanized Human |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Treatment Facilities | 100 | Oncologists, Clinical Pharmacists |

| Autoimmune Disease Management | 70 | Rheumatologists, Immunologists |

| Biopharmaceutical Manufacturing | 60 | Production Managers, Quality Control Analysts |

| Healthcare Policy Makers | 40 | Health Economists, Regulatory Affairs Specialists |

| Clinical Research Organizations | 50 | Clinical Research Coordinators, Data Managers |

The Global Monoclonal Antibodies Market is valued at approximately USD 255 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases and advancements in biotechnology.