Region:Middle East

Author(s):Rebecca

Product Code:KRAD8460

Pages:82

Published On:December 2025

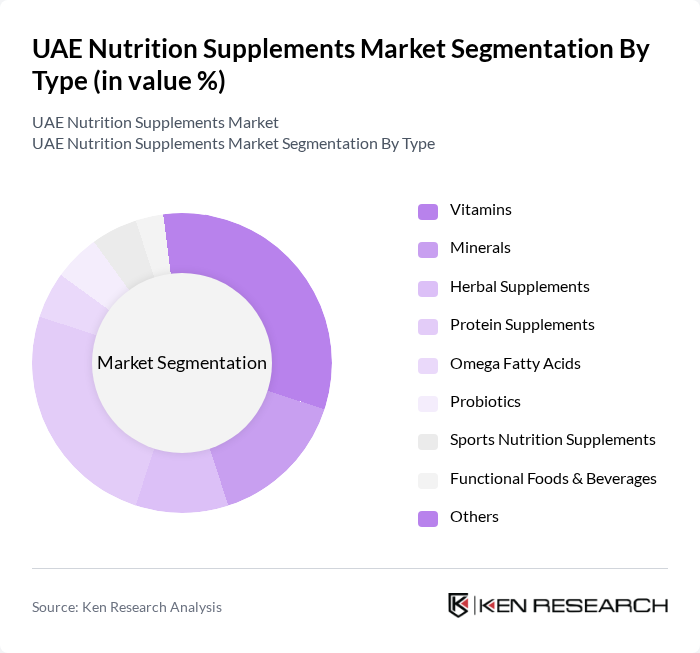

By Type:The market is segmented into various types of nutrition supplements, including Vitamins, Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Probiotics, Sports Nutrition Supplements, Functional Foods & Beverages, and Others. Among these, Vitamins, Proteins & Amino Acids, and Herbal Supplements are particularly popular due to their essential roles in health maintenance, immunity support, fitness enhancement, and addressing nutritional gaps.

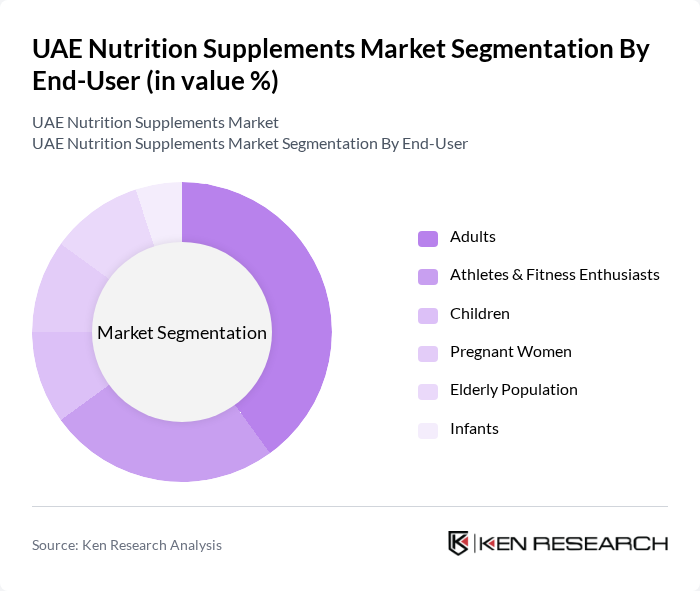

By End-User:The end-user segmentation includes Adults, Athletes & Fitness Enthusiasts, Children, Pregnant Women, Elderly Population, and Infants. Adults and Athletes & Fitness Enthusiasts represent the largest consumer groups, driven by a growing focus on health and fitness, as well as the increasing popularity of sports and active lifestyles.

The UAE Nutrition Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Pfizer Inc., Abbott Laboratories, Nestlé S.A., Glanbia plc, Amway Corporation, GNC Holdings, Inc., Nature's Bounty Co., Blackmores Limited, Swisse Wellness Pty Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE nutrition supplements market is poised for dynamic growth, driven by increasing health consciousness and a shift towards preventive healthcare. As consumers become more discerning, brands that prioritize transparency and scientific validation will likely gain a competitive edge. Additionally, the integration of technology in product development, such as personalized nutrition solutions, will cater to evolving consumer preferences. The focus on sustainability will also shape product offerings, aligning with global trends towards eco-friendly practices in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Sports Nutrition Supplements Functional Foods & Beverages Others |

| By End-User | Adults Athletes & Fitness Enthusiasts Children Pregnant Women Elderly Population Infants |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies & Drug Stores Health Food Stores & Specialty Retailers Direct Sales |

| By Formulation | Tablets Capsules Powders Liquids Soft Gels Gummies Others |

| By Age Group | Infants & Children Adults Seniors (Geriatric) |

| By Application | Energy & Weight Management General Health & Wellness Bone & Joint Health Immunity Support Others |

| By Price Range | Low Price Mid Price Premium Price |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Nutrition Supplement Sales | 150 | Store Managers, Product Buyers |

| Consumer Usage Patterns | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Nutritionists, General Practitioners |

| Market Trends and Innovations | 80 | Product Development Managers, Marketing Executives |

| Regulatory Impact Assessment | 50 | Regulatory Affairs Specialists, Compliance Officers |

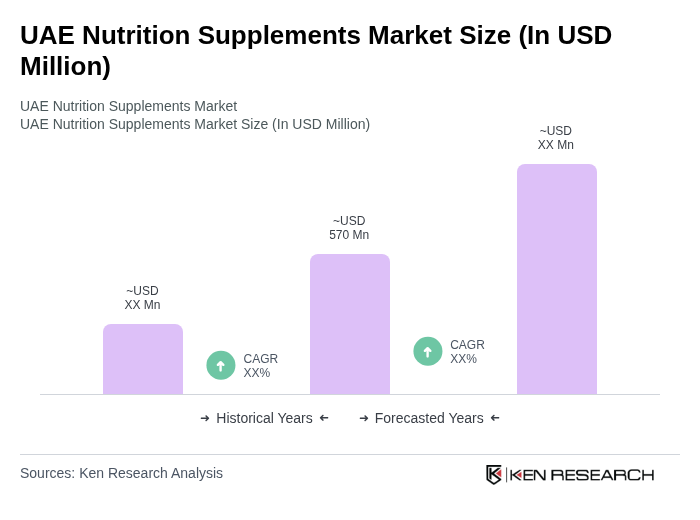

The UAE Nutrition Supplements Market is valued at approximately USD 570 million, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a shift towards preventive healthcare among consumers.