Region:Global

Author(s):Rebecca

Product Code:KRAA2434

Pages:95

Published On:August 2025

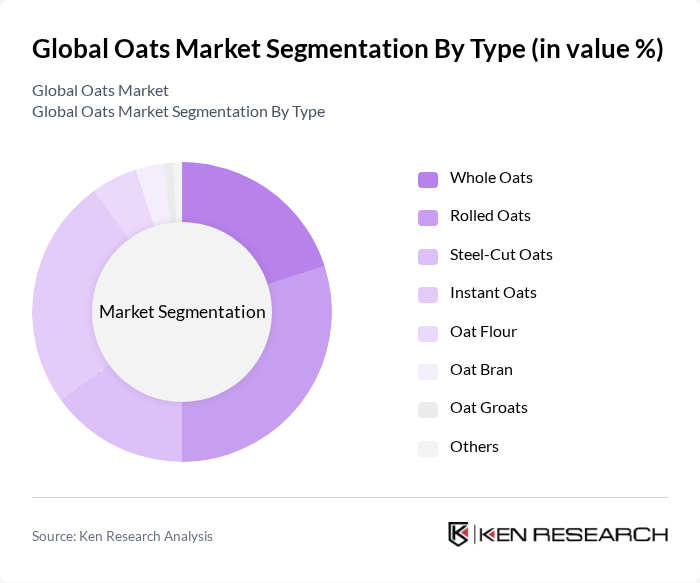

By Type:The oats market can be segmented into various types, including Whole Oats, Rolled Oats, Steel-Cut Oats, Instant Oats, Oat Flour, Oat Bran, Oat Groats, and Others. Among these,Rolled OatsandInstant Oatsare particularly popular due to their convenience and versatility in meal preparation. The demand for Whole Oats is also rising as consumers become more health-conscious and seek minimally processed options. The growing trend of healthy eating, the increasing use of oats in innovative food products such as oat-based beverages and protein bars, and the expansion of gluten-free offerings are driving the market forward .

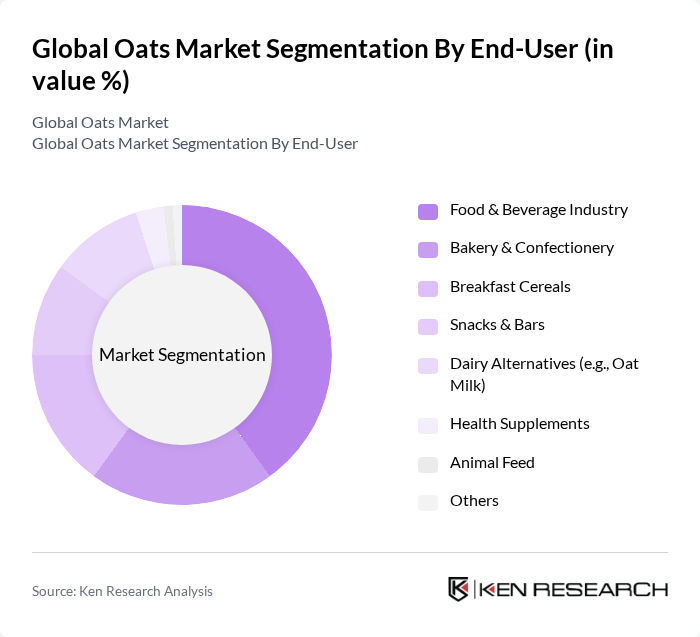

By End-User:The oats market is segmented by end-user into the Food & Beverage Industry, Bakery & Confectionery, Breakfast Cereals, Snacks & Bars, Dairy Alternatives (e.g., Oat Milk), Health Supplements, Animal Feed, and Others. TheFood & Beverage Industryis the leading segment, driven by the increasing incorporation of oats in various food products, including breakfast cereals, snacks, and oat-based beverages. The rise in health-conscious consumers is also boosting the demand for oat-based dairy alternatives, such as oat milk, which is gaining popularity as a lactose-free and plant-based option .

The Global Oats Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Quaker Oats Company (PepsiCo, Inc.), General Mills, Inc., Kellogg Company, Bob's Red Mill Natural Foods, Inc., Nature's Path Foods, Inc., B&G Foods, Inc., Post Holdings, Inc., The Hain Celestial Group, Inc., Blue Diamond Growers, Oatly AB, Grain Millers, Inc., SunOpta Inc., Avena Foods Limited, Blue Lake Milling Pty Ltd, Morning Foods Ltd, Richardson International Limited, and Nestlé S.A. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the oats market appears promising, driven by ongoing trends in health and wellness. As consumers increasingly prioritize nutritious and sustainable food options, the demand for oats is expected to rise. Innovations in product development, such as oat-based snacks and beverages, will likely capture consumer interest. Additionally, the expansion into emerging markets, particularly in Asia and Africa, presents significant growth potential, as these regions adopt healthier dietary habits and seek gluten-free alternatives.

| Segment | Sub-Segments |

|---|---|

| By Type | Whole Oats Rolled Oats Steel-Cut Oats Instant Oats Oat Flour Oat Bran Oat Groats Others |

| By End-User | Food & Beverage Industry Bakery & Confectionery Breakfast Cereals Snacks & Bars Dairy Alternatives (e.g., Oat Milk) Health Supplements Animal Feed Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Specialty Stores Convenience Stores Direct Sales Foodservice/HoReCa Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Single-Serve Packaging Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Product Form | Whole Grain Flakes Granola Powder/Flour Beverage (Oat Milk) Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oat Farmers | 100 | Farm Owners, Agricultural Managers |

| Food Manufacturers | 60 | Product Development Managers, Quality Assurance Specialists |

| Retail Buyers | 50 | Category Managers, Procurement Officers |

| Health and Nutrition Experts | 40 | Dietitians, Nutritionists |

| Export and Import Traders | 45 | Trade Analysts, Logistics Coordinators |

The Global Oats Market is valued at approximately USD 6.7 billion, reflecting a significant growth trend driven by increasing consumer demand for healthy and nutritious food options, as well as the rising popularity of plant-based and gluten-free diets.