Region:Global

Author(s):Geetanshi

Product Code:KRAA2337

Pages:99

Published On:August 2025

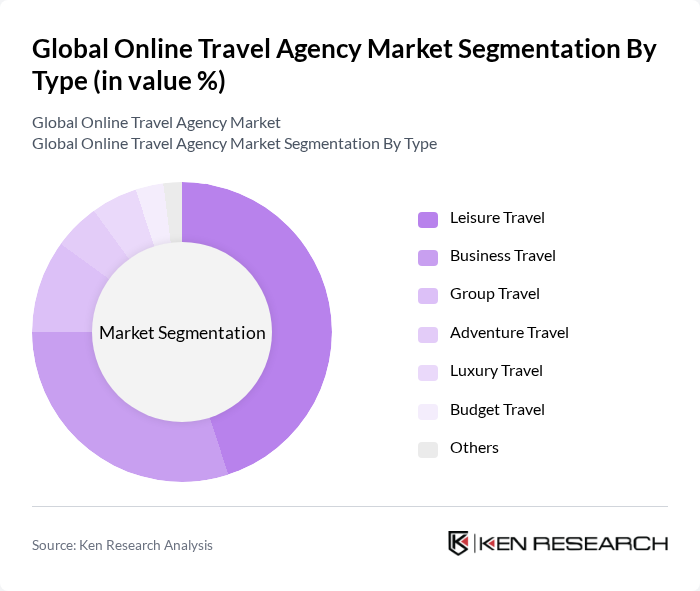

By Type:The market is segmented into various types, including Leisure Travel, Business Travel, Group Travel, Adventure Travel, Luxury Travel, Budget Travel, and Others. Among these,Leisure Travelis the most dominant segment, driven by the increasing number of travelers seeking vacation experiences, the surge in demand for flexible and personalized travel packages, and the influence of digital content and social media. Business Travel follows, as companies continue to invest in travel for meetings and conferences, reflecting the ongoing importance of face-to-face interactions in the corporate world, despite the rise of virtual meetings .

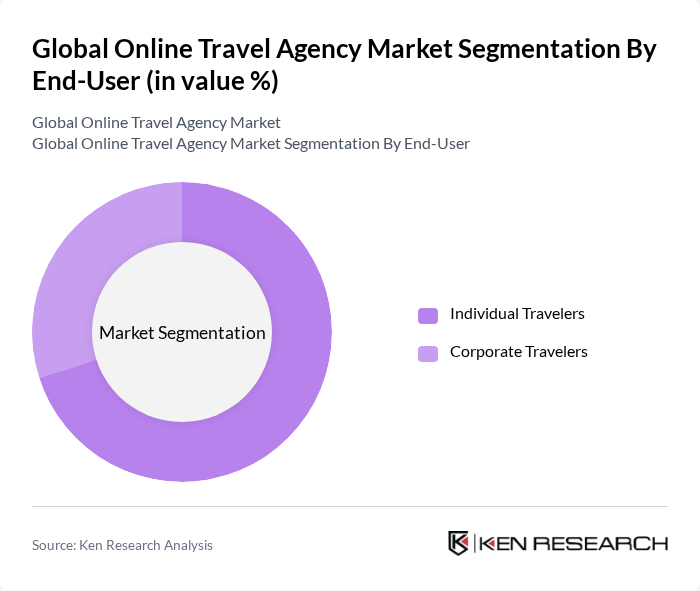

By End-User:The market is divided into Individual Travelers and Corporate Travelers.Individual Travelersdominate the market, driven by the increasing trend of solo and personalized travel, the influence of social media and travel influencers, and the growing demand for flexible, self-service booking experiences. Corporate Travelers remain significant, as businesses continue to prioritize travel for networking, client engagement, and business development, supported by streamlined booking and expense management tools offered by online travel agencies .

The Global Online Travel Agency Market is characterized by a dynamic mix of regional and international players. Leading participants such as Expedia Group, Booking Holdings Inc., Trip.com Group Limited, Tripadvisor LLC, Trivago N.V., Agoda Company Pte. Ltd., MakeMyTrip Limited, eDreams ODIGEO, Despegar.com Corp., Webjet Limited, Lastminute.com Group, TUI Group, Airbnb, Inc., Kayak Software Corporation, Orbitz Worldwide contribute to innovation, geographic expansion, and service delivery in this space.

The future of the online travel agency market in None appears promising, driven by technological advancements and evolving consumer preferences. As personalization becomes a key focus, agencies are expected to leverage data analytics to enhance customer experiences. Additionally, the integration of AI and machine learning will streamline operations and improve service delivery. The growing trend towards sustainable travel will also shape offerings, as consumers increasingly seek eco-friendly options, creating new avenues for growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Leisure Travel Business Travel Group Travel Adventure Travel Luxury Travel Budget Travel Others |

| By End-User | Individual Travelers Corporate Travelers |

| By Booking Channel | App-Based Web-Based Voice & Conversational Booking Social Media & Emerging Channels |

| By Service Type | Accommodation Booking Flight Booking & Airline Services Ground Transportation & Car Rental Activities, Experiences & Tours Travel Packages & Bundles |

| By Age Group | Up to 29 Years 44 Years 59 Years Years and Above |

| By Geographic Region | North America (U.S., Canada, Mexico) Europe (UK, Germany, France, Italy, Rest of Europe) Asia-Pacific (China, India, Japan, South Korea, Rest of Asia-Pacific) South America (Brazil, Rest of South America) Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Travel Preferences | 100 | Frequent Travelers, Travel Bloggers |

| International Travel Trends | 80 | Travel Agency Owners, Tour Operators |

| Online Booking Behavior | 90 | Millennial Travelers, Business Travelers |

| Impact of Technology on Travel | 60 | Technology Specialists, Travel Industry Analysts |

| Customer Satisfaction in Online Travel Services | 70 | Customer Experience Managers, User Experience Designers |

The Global Online Travel Agency Market is valued at approximately USD 900 billion, reflecting significant growth driven by digital platform adoption, increased disposable incomes, and a trend towards personalized travel experiences among consumers.