Region:Global

Author(s):Rebecca

Product Code:KRAD8196

Pages:80

Published On:December 2025

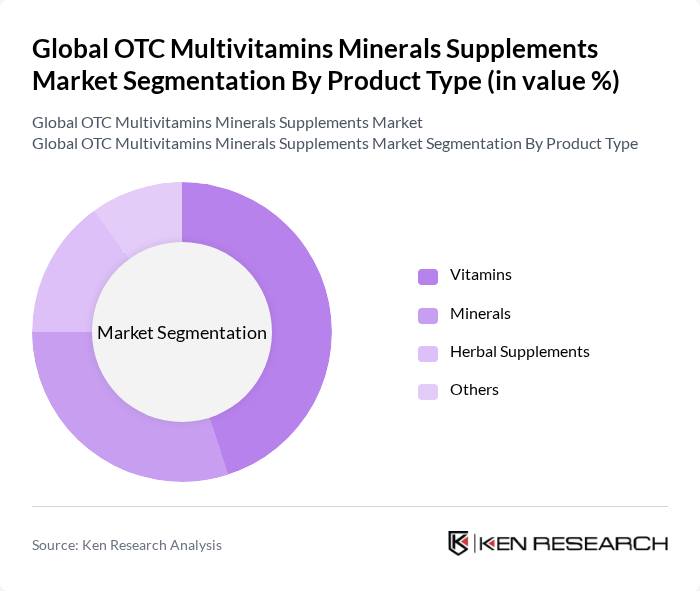

By Product Type:The product type segmentation includes Vitamins, Minerals, Herbal Supplements, and Others. Vitamins are the leading subsegment, driven by their essential role in maintaining health and preventing deficiencies. The increasing awareness of the benefits of vitamins, particularly among health-conscious consumers, has led to a surge in demand. Minerals also hold a significant share, as they are crucial for various bodily functions. Herbal supplements are gaining traction due to the rising trend of natural and organic products.

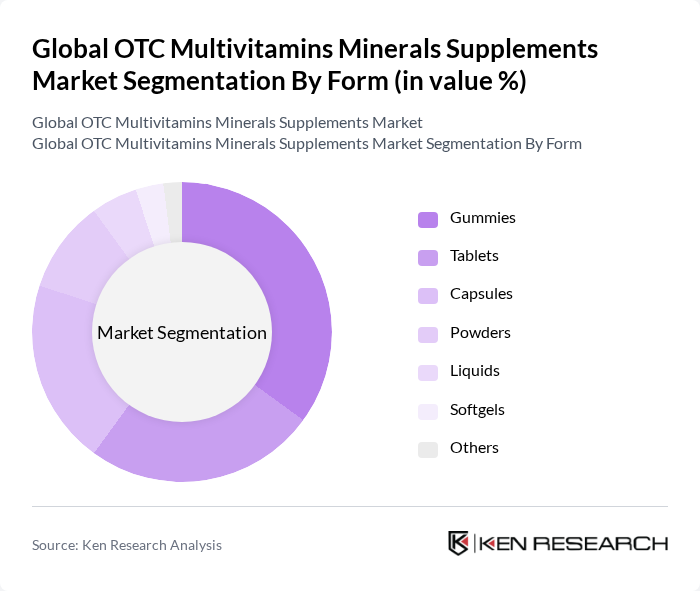

By Form:The form segmentation includes Gummies, Tablets, Capsules, Powders, Liquids, Softgels, and Others. Gummies are currently the most popular form due to their appealing taste and ease of consumption, particularly among children and young adults. Tablets and capsules remain traditional choices, favored for their convenience and dosage accuracy. The demand for powders and liquids is also growing, especially among fitness enthusiasts who prefer customizable intake options.

The Global OTC Multivitamins Minerals Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Allergan (AbbVie Inc.), AstraZeneca PLC, Johnson & Johnson, Abbott Laboratories, Merck & Co. Inc., Roche Holding AG, GlaxoSmithKline plc, Koninklijke DSM N.V., Reckitt Benckiser Group plc, Otsuka Holdings Co., Ltd., CSPC Pharmaceutical Group Limited, Sanofi S.A., Atrium Innovations Inc., DuPont de Nemours, Inc., Pfizer Inc., Lonza Group AG, Herbalife Nutrition Ltd., Amway Corporation, USANA Health Sciences, Inc., Nature Made (Pharmavite LLC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the OTC multivitamins and minerals supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, companies are likely to innovate with personalized supplement offerings tailored to individual health needs. Additionally, the expansion into emerging markets presents significant growth potential, as increasing disposable incomes and health consciousness among consumers create new opportunities for market penetration and product diversification.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vitamins Minerals Herbal Supplements Others |

| By Form | Gummies Tablets Capsules Powders Liquids Softgels Others |

| By Application | Energy & Weight Management Brain Function Eye Health Heart Disease Pain Relief Sexual Wellness Cancer Prevention Others |

| By Consumer Group | Adults Children Seniors Pregnant Women Athletes Others |

| By Distribution Channel | Supermarkets/Hypermarkets Pharmacies Online Retail Health Stores Direct Sales Others |

| By Ingredient Source | Natural Synthetic Organic Others |

| By Packaging Type | Bottles Blister Packs Pouches Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Multivitamins | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Retail Insights on OTC Supplements | 75 | Store Managers, Pharmacy Owners |

| Healthcare Professional Perspectives | 60 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in E-commerce for Supplements | 90 | E-commerce Managers, Digital Marketing Specialists |

| Brand Loyalty and Consumer Behavior | 80 | Regular Supplement Users, Health Bloggers |

The Global OTC Multivitamins Minerals Supplements Market is valued at approximately USD 53 billion, reflecting a significant growth trend driven by increasing health consciousness and preventive healthcare measures among consumers.