Region:Global

Author(s):Rebecca

Product Code:KRAA2902

Pages:92

Published On:August 2025

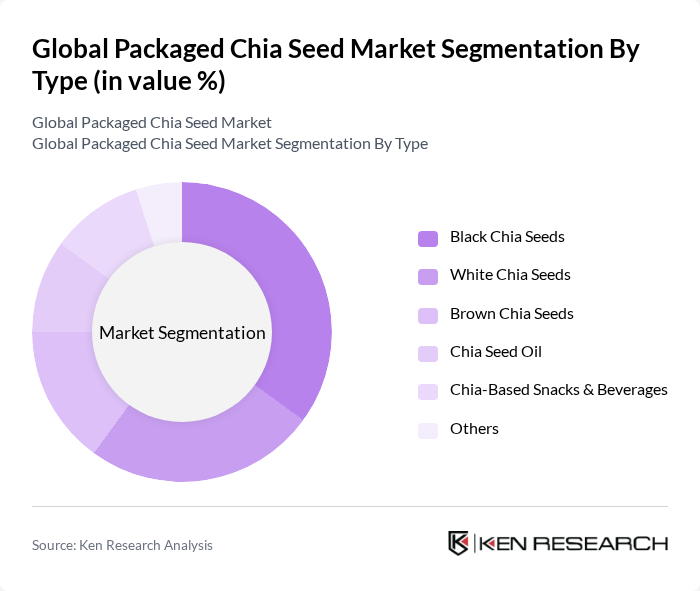

By Type:The market is segmented into black chia seeds, white chia seeds, brown chia seeds, chia seed oil, chia-based snacks & beverages, and others. Each type addresses distinct consumer preferences and applications, influencing market dynamics. Black chia seeds are widely favored for their nutritional profile and versatility, while white and brown variants cater to niche preferences. Chia seed oil and chia-based snacks & beverages are gaining traction as value-added products in the health and wellness sector .

The black chia seeds segment currently leads the market, supported by their broad nutritional value and consumer preference for their flavor and versatility. Black chia seeds are commonly used in smoothies, baked goods, and health bars, and their adaptability has made them a staple in superfood-rich diets. The ongoing trend of integrating nutrient-dense ingredients into daily meals continues to reinforce their dominant market position .

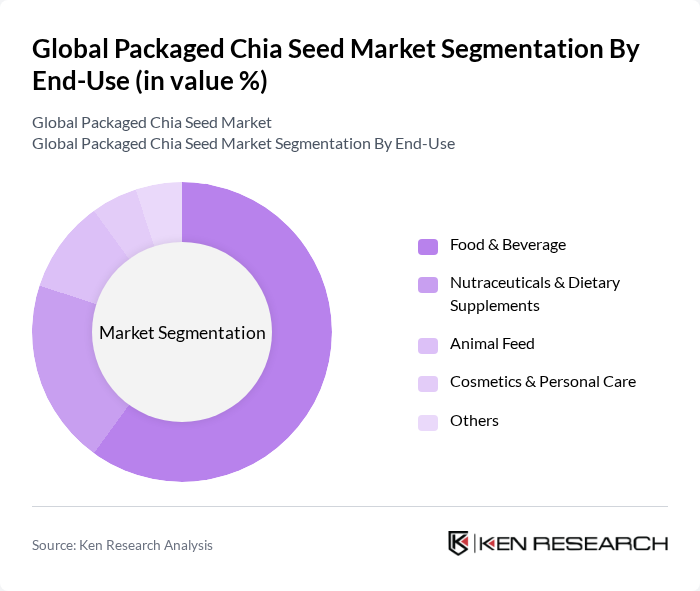

By End-Use:The market is segmented by end-use applications, including food & beverage, nutraceuticals & dietary supplements, animal feed, cosmetics & personal care, and others. This segmentation reflects the diverse applications of chia seeds across industries. The food & beverage sector remains the primary consumer, while nutraceuticals and supplements are significant secondary markets. Chia seeds are also increasingly used in animal feed and cosmetic formulations due to their functional properties .

The food & beverage segment is the leading end-use category, driven by the increasing demand for healthy and nutritious food options. Chia seeds are widely incorporated into products such as smoothies, baked goods, and snack bars, appealing to health-conscious consumers. Their ability to enhance the nutritional profile of foods has made them a key ingredient in the health food sector, while their use in nutraceuticals and supplements continues to expand .

The Global Packaged Chia Seed Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nutiva, Inc., Health Warrior, Inc., Benexia (Functional Products Trading S.A.), The Chia Co., Navitas Organics, BetterBody Foods, Spectrum Organic Products, LLC, Terrasoul Superfoods, Sunfood Superfoods, Organic Traditions, Bob's Red Mill Natural Foods, Food to Live, Viva Naturals, 365 by Whole Foods Market, and Mamma Chia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the packaged chia seed market in None appears promising, driven by increasing health consciousness and the demand for plant-based products. Innovations in product formulations and the rise of e-commerce are expected to enhance market accessibility. Additionally, as consumers prioritize sustainability, brands focusing on eco-friendly packaging and transparent sourcing will likely gain a competitive edge. Overall, the market is poised for growth as awareness and acceptance of chia seeds continue to expand among health-conscious consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Black Chia Seeds White Chia Seeds Brown Chia Seeds Chia Seed Oil Chia-Based Snacks & Beverages Others |

| By End-Use | Food & Beverage Nutraceuticals & Dietary Supplements Animal Feed Cosmetics & Personal Care Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Specialty Stores Others |

| By Packaging Type | Resealable Bags Bulk Packaging Single-Serve Packs Glass Jars & Bottles Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | North America (U.S., Canada, Mexico) Europe (Germany, U.K., France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (GCC, South Africa, Rest of MEA) |

| By Product Form | Whole Seeds Powder Oil Gel/Pudding Mixes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Chia Seed Producers | 60 | Farm Owners, Agricultural Managers |

| Health Food Retailers | 50 | Store Managers, Product Buyers |

| Nutrition Experts | 40 | Dietitians, Health Coaches |

| Food Manufacturers | 45 | Product Development Managers, Quality Assurance Officers |

| Consumers of Health Foods | 100 | Health-Conscious Consumers, Fitness Enthusiasts |

The Global Packaged Chia Seed Market is valued at approximately USD 1.5 billion, driven by increasing consumer awareness of the health benefits of chia seeds, including their high omega-3 fatty acid, fiber, and protein content.