Region:Global

Author(s):Shubham

Product Code:KRAA2483

Pages:95

Published On:August 2025

By Type:The market is segmented into various types of coatings, each catering to specific applications and consumer preferences. The dominant sub-segment iswater-based coatings, favored for their low environmental impact, reduced volatile organic compound (VOC) emissions, and compliance with stringent global regulations.Solvent-based coatingscontinue to hold a significant share due to their strong performance characteristics, especially in demanding industrial applications.UV-cured coatingsare gaining traction for their rapid curing times and high durability, making them suitable for high-speed packaging lines.Specialty coatingsare increasingly used for niche applications requiring enhanced barrier properties or unique finishes. The demand for biodegradable and eco-friendly coatings is rising as manufacturers and consumers prioritize sustainability .

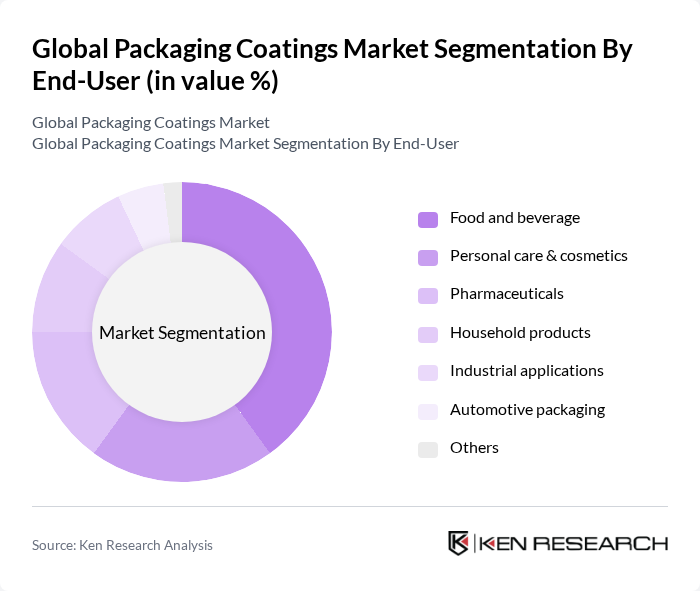

By End-User:The end-user segment includes industries such as food and beverage, personal care, pharmaceuticals, and automotive packaging. Thefood and beveragesector is the largest consumer of packaging coatings, driven by the need for product protection, shelf-life extension, and regulatory compliance.Personal care and cosmeticscontribute significantly due to the demand for visually appealing and protective packaging. Thepharmaceuticalindustry is expanding rapidly, emphasizing tamper-proof, sterile, and compliant packaging solutions.Automotive packagingis also growing, supported by increased automotive production and the need for durable, protective coatings. The household products and industrial applications segments are experiencing steady demand due to the broadening range of packaged goods .

The Global Packaging Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Dow Inc., RPM International Inc., Henkel AG & Co. KGaA, Eastman Chemical Company, Axalta Coating Systems Ltd., Valspar (a Sherwin-Williams brand), Covestro AG, Solvay S.A., Clariant AG, Huntsman Corporation, Stahl Holdings B.V., Weilburger Graphics GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the packaging coatings market in None is poised for transformation, driven by the increasing emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in biodegradable and compostable coatings. Additionally, the rise of e-commerce will necessitate innovative packaging solutions that ensure product safety during transit, further shaping the market landscape. Companies that adapt to these trends will be well-positioned for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based coatings Solvent-based coatings UV-cured coatings Powder coatings Specialty coatings Epoxy coatings Acrylic coatings Polyurethane coatings Polyester coatings Others |

| By End-User | Food and beverage Personal care & cosmetics Pharmaceuticals Household products Industrial applications Automotive packaging Others |

| By Application | Flexible packaging Rigid packaging Metal cans (food & beverage cans) Labels and tags Protective coatings Others |

| By Distribution Channel | Direct sales Distributors Online sales Retail Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-range Premium |

| By Sustainability Level | Conventional coatings Eco-friendly coatings Biodegradable coatings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Coatings | 120 | Packaging Engineers, Product Development Managers |

| Pharmaceutical Coatings | 90 | Regulatory Affairs Specialists, Quality Control Managers |

| Cosmetic Packaging Solutions | 70 | Brand Managers, R&D Chemists |

| Industrial Coatings Applications | 60 | Operations Managers, Supply Chain Analysts |

| Sustainable Coating Innovations | 50 | Sustainability Officers, Innovation Directors |

The Global Packaging Coatings Market is valued at approximately USD 5.2 billion, driven by the demand for sustainable packaging solutions and the growth of e-commerce and packaged goods across various sectors, including food and beverage, pharmaceuticals, and personal care.