Region:Middle East

Author(s):Dev

Product Code:KRAC2009

Pages:90

Published On:October 2025

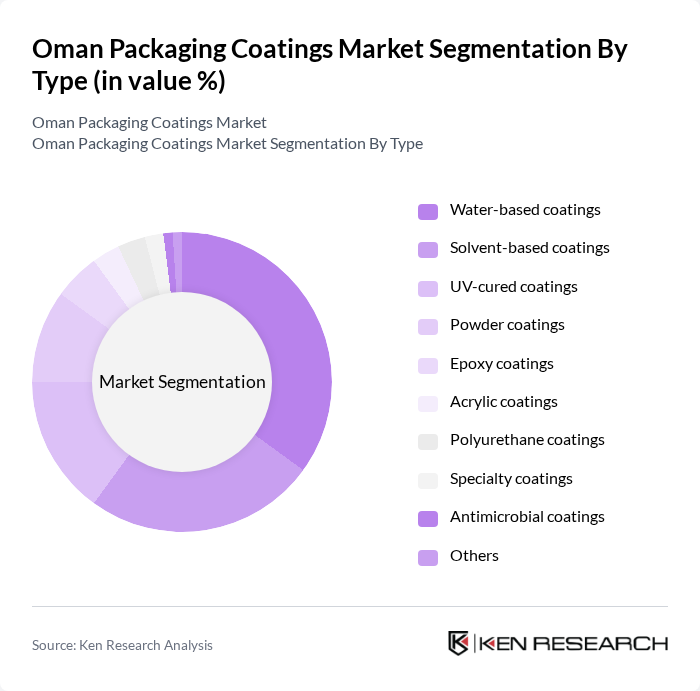

By Type:The market is segmented into various types of coatings, including water-based coatings, solvent-based coatings, UV-cured coatings, powder coatings, epoxy coatings, acrylic coatings, polyurethane coatings, specialty coatings, antimicrobial coatings, and others.Water-based coatingsare gaining traction due to their low environmental impact and compliance with stringent regulations, particularly regarding VOC emissions. Solvent-based coatings, while still significant, are gradually being replaced by more sustainable options such as water-based and powder coatings, in line with regional and global trends.

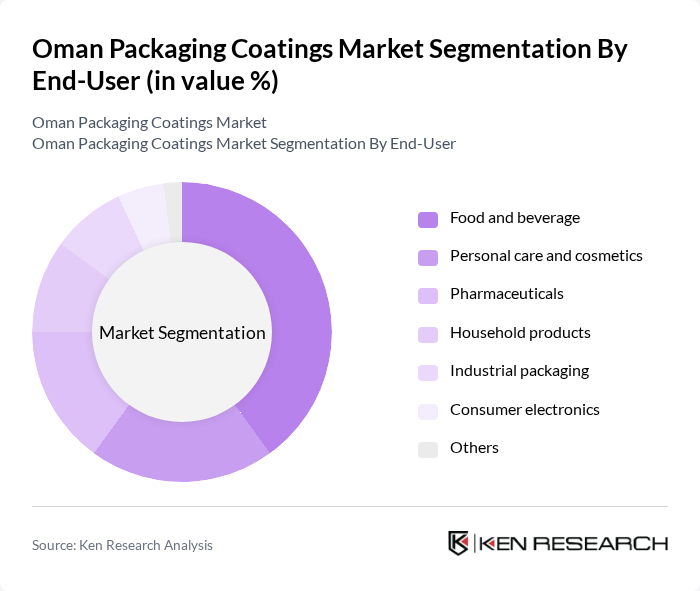

By End-User:The end-user segments include food and beverage, personal care and cosmetics, pharmaceuticals, household products, industrial packaging, consumer electronics, and others. Thefood and beverage sectoris the largest consumer of packaging coatings, driven by the need for product safety, shelf life extension, and regulatory compliance. The personal care segment is also growing, as manufacturers seek innovative packaging solutions to enhance product appeal and meet consumer expectations for sustainability and aesthetics.

The Oman Packaging Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel N.V., PPG Industries, Inc., The Sherwin-Williams Company, BASF SE, Jotun Group, National Paints Factories Co. Ltd., Oman Chromite Company SAOG, Axalta Coating Systems Ltd., Kansai Paint Co., Ltd., Henkel AG & Co. KGaA, Dow Inc., Eastman Chemical Company, Berger Paints Oman SAOG, Al Jazeera Paints, Hempel A/S contribute to innovation, geographic expansion, and service delivery in this space.

**Sources:**

The Oman packaging coatings market is poised for significant transformation, driven by the increasing emphasis on sustainability and technological innovation. As consumer preferences shift towards eco-friendly solutions, manufacturers are likely to invest in research and development to create advanced coatings that meet these demands. Additionally, the integration of smart technologies in packaging is expected to enhance product safety and consumer engagement, paving the way for a more dynamic and responsive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Water-based coatings Solvent-based coatings UV-cured coatings Powder coatings Epoxy coatings Acrylic coatings Polyurethane coatings Specialty coatings Antimicrobial coatings Others |

| By End-User | Food and beverage Personal care and cosmetics Pharmaceuticals Household products Industrial packaging Consumer electronics Others |

| By Application | Cans and containers Bottles Caps and closures Labels Flexible packaging Rigid packaging Others |

| By Distribution Channel | Direct sales Distributors Online sales Retail Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Al Sharqiyah Others |

| By Price Range | Economy Mid-range Premium |

| By Sustainability Level | Biodegradable coatings Recyclable coatings Low-VOC coatings Conventional coatings |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 100 | Packaging Managers, Quality Assurance Officers |

| Cosmetics and Personal Care Coatings | 80 | Product Development Managers, Brand Managers |

| Pharmaceutical Packaging Solutions | 70 | Regulatory Affairs Specialists, Production Supervisors |

| Industrial Coatings for Packaging | 50 | Operations Managers, Supply Chain Coordinators |

| Sustainable Packaging Initiatives | 60 | Sustainability Officers, R&D Managers |

The Oman Packaging Coatings Market is valued at approximately USD 160 million, reflecting a five-year historical analysis and normalization from regional paints and coatings market data. This valuation highlights the market's growth driven by various factors, including sustainability and technological advancements.