Region:Global

Author(s):Dev

Product Code:KRAA2581

Pages:95

Published On:August 2025

By Type:The market can be segmented into various types of payment processing solutions, including Online Payment Processors, Mobile Payment Processors, Point of Sale (POS) Systems, Payment Gateways, Digital Wallets, Cryptocurrency Payment Processors, Automated Clearing House (ACH) Processors, and Others. Each of these segments addresses different consumer needs and preferences, with demand patterns shaped by the proliferation of smartphones, the expansion of e-commerce, and the integration of advanced technologies such as artificial intelligence and blockchain into payment platforms .

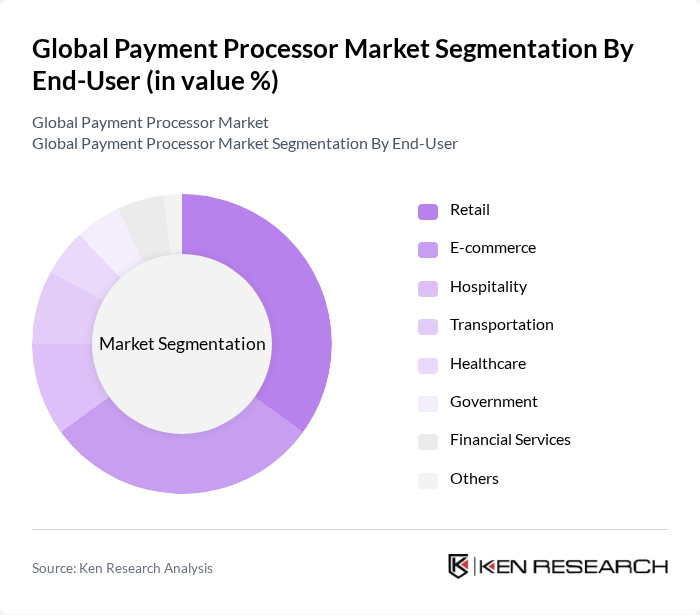

By End-User:The end-user segmentation includes Retail, E-commerce, Hospitality, Transportation, Healthcare, Government, Financial Services, and Others. Each sector has unique requirements and preferences for payment processing solutions, with E-commerce and Retail being the most significant contributors to market growth due to the increasing shift towards online shopping, digital transactions, and demand for real-time, secure payment experiences .

The Global Payment Processor Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayPal Holdings, Inc., Block, Inc. (formerly Square, Inc.), Stripe, Inc., Adyen N.V., Worldpay, Inc. (FIS Global), Fiserv, Inc., Global Payments Inc., PayU, Authorize.Net (a Visa Solution), Braintree Payments (a PayPal Service), Alipay (Ant Group), WeChat Pay (Tencent Holdings Ltd.), Klarna Bank AB, Mollie B.V., Razorpay Software Private Limited, North American Bancard Holdings, LLC, BitPay, Inc., Fattmerchant (Stax Payments), Spreedly, Inc., Secure Payment Systems, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the payment processor market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. As digital transactions continue to rise, payment processors will increasingly focus on enhancing security measures and user experience. The integration of AI and machine learning will streamline operations, while the growth of blockchain technology promises to revolutionize transaction transparency and security. Additionally, partnerships with fintech startups will foster innovation, enabling payment processors to adapt to emerging trends and consumer demands effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Payment Processors Mobile Payment Processors Point of Sale (POS) Systems Payment Gateways Digital Wallets Cryptocurrency Payment Processors Automated Clearing House (ACH) Processors Others |

| By End-User | Retail E-commerce Hospitality Transportation Healthcare Government Financial Services Others |

| By Payment Method | Credit Cards Debit Cards E-Wallet Transactions Bank Transfers Mobile Payments E-checks Cryptocurrency Others |

| By Industry Vertical | Retail Financial Services Telecommunications Travel and Tourism Education Media & Entertainment Real Estate Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa Others |

| By Sales Channel | Direct Sales Online Sales Distributors Retail Partnerships Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Startups Non-profits Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small to Medium Enterprises (SMEs) Payment Solutions | 100 | Business Owners, Financial Officers |

| Large Retail Chains Payment Processing | 80 | IT Managers, Payment Strategy Directors |

| Cross-Border Payment Systems | 60 | International Trade Managers, Compliance Officers |

| Mobile Payment Adoption Trends | 90 | Mobile App Developers, User Experience Designers |

| Consumer Preferences in Payment Methods | 120 | General Consumers, Market Researchers |

The Global Payment Processor Market is valued at approximately USD 80 billion, driven by the increasing adoption of digital and mobile payment solutions, the rise of e-commerce, and the demand for contactless payment methods.