Region:Global

Author(s):Shubham

Product Code:KRAA2693

Pages:98

Published On:August 2025

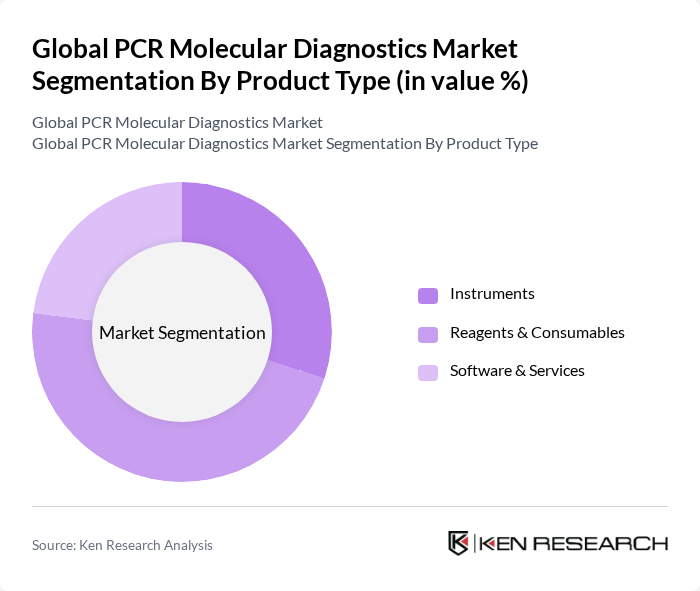

By Product Type:The product type segmentation includes Instruments, Reagents & Consumables, and Software & Services. Among these, Reagents & Consumables lead the market, accounting for the largest share due to their essential role in PCR testing workflows. The growing global volume of diagnostic tests, especially for infectious diseases and genetic screening, has driven significant demand for high-quality reagents and consumables, making them a critical component of the PCR molecular diagnostics landscape .

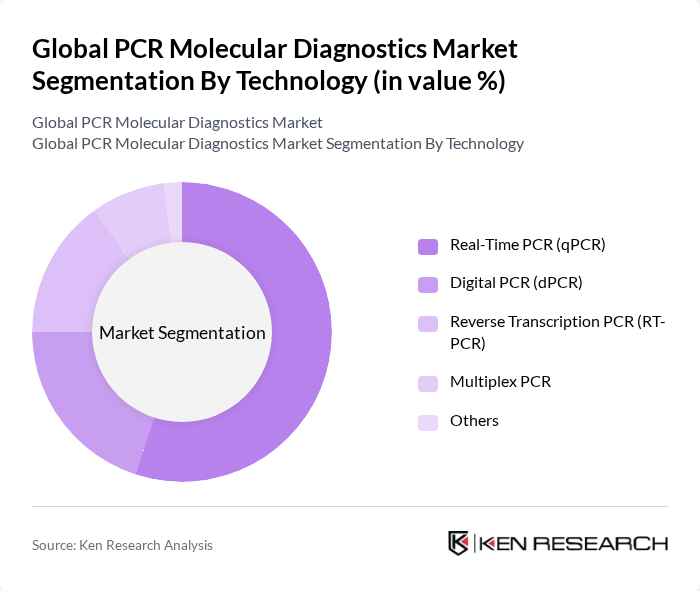

By Technology:The technology segmentation encompasses Real-Time PCR (qPCR), Digital PCR (dPCR), Reverse Transcription PCR (RT-PCR), Multiplex PCR, and Others. Real-Time PCR (qPCR) remains the leading technology segment, favored for its speed, sensitivity, and quantitative capabilities in DNA and RNA analysis. The growing demand for rapid and precise diagnostic solutions, particularly in infectious disease and oncology testing, has solidified qPCR's position as the dominant technology in the PCR molecular diagnostics market .

The Global PCR Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thermo Fisher Scientific Inc., Roche Diagnostics, Abbott Laboratories, QIAGEN N.V., Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., Siemens Healthineers, PerkinElmer, Inc., Hologic, Inc., BGI Genomics, Cepheid, Illumina, Inc., LGC Limited, Mylab Discovery Solutions, and Eiken Chemical Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of PCR molecular diagnostics in None appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency, while the expansion of point-of-care testing solutions will improve accessibility. Additionally, public-private partnerships are likely to foster innovation and research funding, further propelling the market forward as healthcare systems prioritize rapid and reliable diagnostic capabilities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Instruments Reagents & Consumables Software & Services |

| By Technology | Real-Time PCR (qPCR) Digital PCR (dPCR) Reverse Transcription PCR (RT-PCR) Multiplex PCR Others |

| By Application | Infectious Disease Testing (e.g., COVID-19, HIV, Influenza, Tuberculosis, Hepatitis) Oncology Testing Genetic Testing Blood Screening Pharmacogenomics Others |

| By End-User | Hospitals & Clinics Diagnostic Laboratories Research & Academic Institutes Point-of-Care Testing Centers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | North America (U.S., Canada) Europe (Germany, UK, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Mexico, Rest of Latin America) Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA) |

| By Sample Type | Blood Samples Tissue Samples Saliva Samples Urine Samples Others |

| By Pricing Model | Premium Pricing Competitive Pricing Value-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 120 | Laboratory Managers, Clinical Pathologists |

| Healthcare Providers | 90 | Infectious Disease Specialists, General Practitioners |

| Diagnostic Product Manufacturers | 60 | Product Development Managers, Sales Directors |

| Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Research Institutions | 50 | Research Scientists, Molecular Biologists |

The Global PCR Molecular Diagnostics Market is valued at approximately USD 8.8 billion, driven by the increasing prevalence of infectious diseases and advancements in PCR technology, including digital PCR and rapid diagnostic tests.