Region:Global

Author(s):Geetanshi

Product Code:KRAA2756

Pages:94

Published On:August 2025

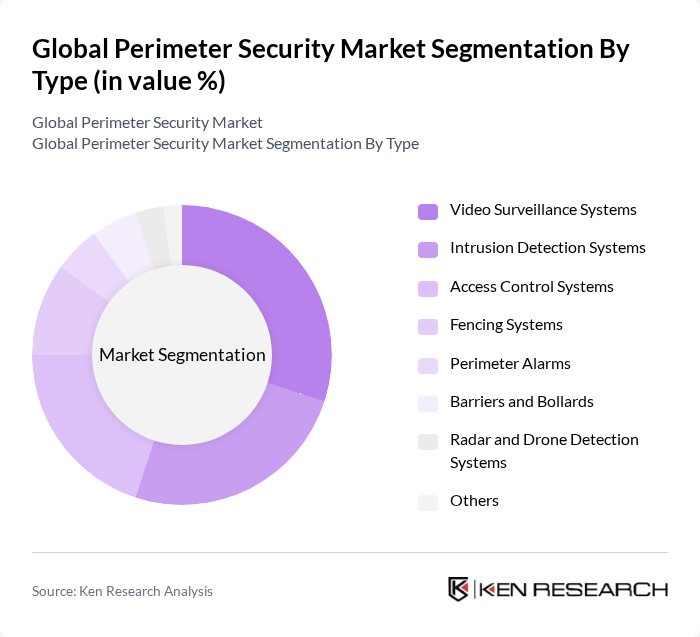

By Type:The market is segmented into various types, including Video Surveillance Systems, Intrusion Detection Systems, Access Control Systems, Fencing Systems, Perimeter Alarms, Barriers and Bollards, Radar and Drone Detection Systems, and Others. Each of these sub-segments plays a crucial role in enhancing security measures, with the adoption of AI-driven video analytics, integrated fiber-optic intrusion detection, and advanced sensor technologies becoming increasingly prevalent .

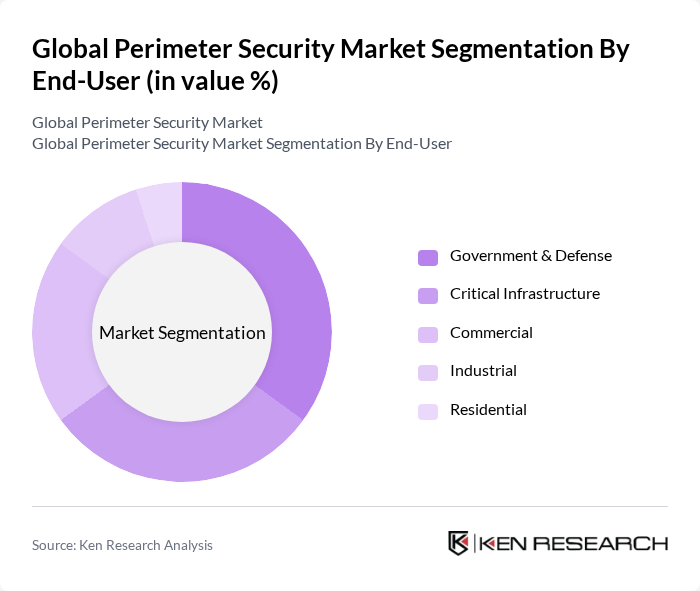

By End-User:The end-user segmentation includes Government & Defense, Critical Infrastructure (Energy, Utilities, Transportation), Commercial (Offices, Data Centers, Retail), Industrial (Manufacturing, Warehousing), and Residential. Each segment has unique security requirements that drive the demand for perimeter security solutions, with government and critical infrastructure segments leading due to regulatory mandates and heightened risk profiles .

The Global Perimeter Security Market is characterized by a dynamic mix of regional and international players. Leading participants such as Axis Communications AB, Honeywell International Inc., Johnson Controls International plc, Bosch Security Systems (Robert Bosch GmbH), Teledyne FLIR LLC, Tyco International (now part of Johnson Controls), Zhejiang Dahua Technology Co., Ltd., Hangzhou Hikvision Digital Technology Co., Ltd., Hanwha Vision Co., Ltd. (formerly Hanwha Techwin), Avigilon Corporation (a Motorola Solutions company), Genetec Inc., Pelco (a Motorola Solutions company), Senstar Corporation, Anixter International Inc. (now part of Wesco International), and ADT Inc. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the perimeter security market appears promising, driven by ongoing technological innovations and increasing security demands. As organizations prioritize integrated security solutions, the adoption of AI and IoT technologies is expected to accelerate. Furthermore, the growing emphasis on data privacy regulations will compel businesses to enhance their security measures. With emerging markets showing a keen interest in adopting advanced security technologies, the landscape is set for significant transformation, fostering a more secure environment across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Surveillance Systems Intrusion Detection Systems Access Control Systems Fencing Systems Perimeter Alarms Barriers and Bollards Radar and Drone Detection Systems Others |

| By End-User | Government & Defense Critical Infrastructure (Energy, Utilities, Transportation) Commercial (Offices, Data Centers, Retail) Industrial (Manufacturing, Warehousing) Residential |

| By Application | Border Security Airport & Seaport Security Critical Infrastructure Protection Event Security Correctional Facilities |

| By Component | Hardware Software Services (Installation, Maintenance, Managed Services) |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Property Security | 100 | Security Managers, Facility Directors |

| Industrial Perimeter Solutions | 80 | Operations Managers, Safety Officers |

| Government Facility Security | 60 | Public Safety Officials, Security Consultants |

| Retail Security Systems | 90 | Loss Prevention Managers, Store Managers |

| Residential Security Solutions | 50 | Homeowners, Security System Installers |

The Global Perimeter Security Market is valued at approximately USD 68 billion, reflecting a significant increase driven by rising security threats and technological advancements in surveillance systems, including AI and IoT integration.