Region:Global

Author(s):Shubham

Product Code:KRAA2482

Pages:94

Published On:August 2025

By Type:The market is segmented into various types of packaging, including flexible packaging, rigid packaging, paperboard packaging, metal packaging, glass packaging, stand-up pouches, semi-rigid packaging, cans, boxes/cartons, and others. Flexible packaging holds the largest share due to its lightweight, cost-effective, and versatile properties, making it the preferred choice for many pet food manufacturers. Rigid packaging remains important for premium and specialty products that require enhanced protection and shelf appeal. The adoption of stand-up pouches and resealable formats is also rising, driven by consumer demand for convenience and portion control.

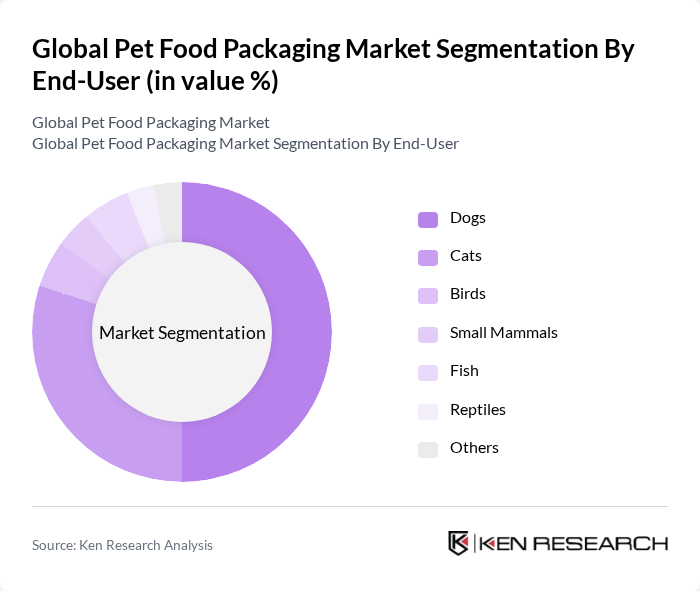

By End-User:The end-user segmentation includes dogs, cats, birds, small mammals, fish, reptiles, and others. The dog food segment is the largest, driven by the high number of dog owners and the increasing trend of premium dog food products. Cat food packaging also represents a significant portion of the market, as cat ownership continues to rise globally. Specialized packaging for birds, small mammals, fish, and reptiles is growing in demand, but these segments remain smaller compared to dogs and cats.

The Global Pet Food Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Mondi plc, Berry Global Group, Inc., Huhtamaki Oyj, Sonoco Products Company, Constantia Flexibles Group GmbH, ProAmpac LLC, Smurfit Kappa Group plc, Sealed Air Corporation, Tetra Pak International S.A., Coveris Holdings S.A., DS Smith plc, Printpack, Inc., Winpak Ltd., Silgan Holdings Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pet food packaging market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to invest in eco-friendly materials and innovative packaging solutions. Additionally, the rise of e-commerce will further influence packaging design, emphasizing convenience and product protection. These trends suggest a dynamic market landscape where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Packaging Rigid Packaging Paperboard Packaging Metal Packaging Glass Packaging Stand-Up Pouches Semi-Rigid Packaging Cans Boxes/Cartons Others |

| By End-User | Dogs Cats Birds Small Mammals Fish Reptiles Others |

| By Packaging Material | Plastic Paper & Paperboard Metal Glass Biodegradable/Compostable Materials Composites Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Pet Specialty Stores Convenience Stores Veterinary Clinics Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium Luxury |

| By Application | Dry Food Packaging Wet Food Packaging Treats and Snacks Packaging Frozen Food Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pet Food Manufacturers | 100 | Product Development Managers, Packaging Engineers |

| Retailers of Pet Products | 60 | Store Managers, Category Buyers |

| Packaging Suppliers | 50 | Sales Directors, Technical Support Managers |

| Pet Owners | 120 | Pet Owners, Pet Care Enthusiasts |

| Industry Experts | 40 | Market Analysts, Sustainability Consultants |

The Global Pet Food Packaging Market is valued at approximately USD 12.97 billion, reflecting a significant growth trend driven by increasing pet ownership and demand for premium pet food products.