Region:Global

Author(s):Geetanshi

Product Code:KRAA2339

Pages:91

Published On:August 2025

By Type:The market is segmented into various types of plastic bottles, including PET, HDPE, LDPE, PP, PVC, solid containers, dropper bottles, nasal spray bottles, oral care bottles, and others. Among these, PET bottles are the most widely used due to their excellent barrier properties, chemical resistance, and recyclability, making them a preferred choice for pharmaceutical packaging. HDPE bottles are also prominent due to their high impact strength and moisture barrier, especially for solid oral medications .

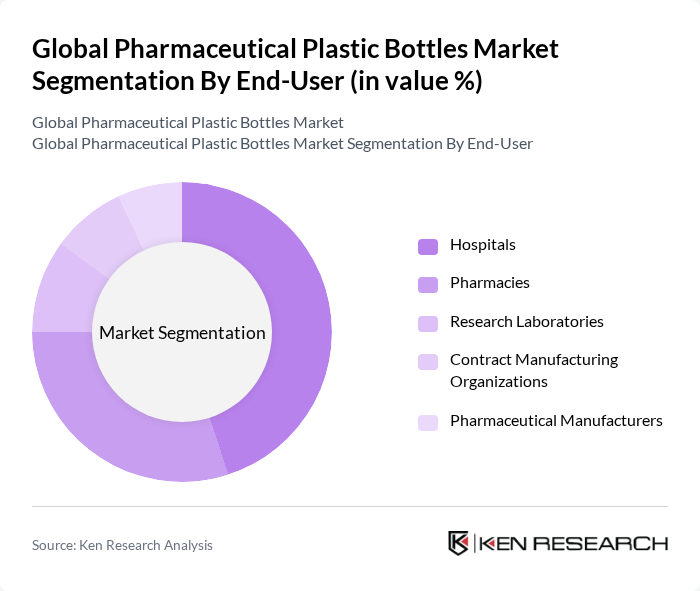

By End-User:The end-user segmentation includes hospitals, pharmacies, research laboratories, contract manufacturing organizations, and pharmaceutical manufacturers. Hospitals are the leading end-users due to the high volume of medications administered and the need for secure and reliable packaging solutions. Pharmacies and contract manufacturing organizations are also significant end-users, driven by the demand for unit-dose and multi-dose packaging formats that enhance medication safety and adherence .

The Global Pharmaceutical Plastic Bottles Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amcor plc, Gerresheimer AG, Berry Global, Inc., RPC Group Plc, AptarGroup, Inc., Silgan Holdings Inc., Alpack Plastics, Inc., CCL Industries Inc., Nampak Ltd., Graham Packaging Company, L.P., Plastipak Holdings, Inc., Schott AG, Sidel Group, Klöckner Pentaplast Group, and Tetra Pak International S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the pharmaceutical plastic bottles market is poised for transformation, driven by sustainability and technological integration. As regulations tighten around plastic use, companies are increasingly investing in eco-friendly materials and innovative packaging solutions. Additionally, the rise of e-commerce in pharmaceuticals is reshaping distribution channels, necessitating more robust and secure packaging. These trends indicate a shift towards sustainable practices and advanced technologies, which will likely define the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | PET Bottles HDPE Bottles LDPE Bottles PP Bottles PVC Bottles Solid Containers Dropper Bottles Nasal Spray Bottles Oral Care Bottles Others |

| By End-User | Hospitals Pharmacies Research Laboratories Contract Manufacturing Organizations Pharmaceutical Manufacturers |

| By Application | Liquid Medications Solid Medications Nutraceuticals Dietary Supplements Others |

| By Distribution Channel | Direct Sales Online Sales Retail Pharmacies Wholesalers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Size of Enterprise | Large Enterprises Medium Enterprises Small Enterprises |

| By Price Range | Economy Mid-Range Premium Others |

| By Closure Type | Screw Cap Crown Cap Friction Fit Child-Resistant Closures Tamper-Evident Closures Others |

| By Capacity | Less Than 10 ml – 30 ml – 50 ml – 100 ml ml and Above |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Manufacturers | 80 | Product Managers, R&D Directors |

| Packaging Suppliers | 60 | Sales Managers, Technical Support Engineers |

| Regulatory Bodies | 40 | Compliance Officers, Policy Makers |

| Healthcare Providers | 50 | Pharmacists, Hospital Administrators |

| Market Research Analysts | 40 | Market Analysts, Industry Consultants |

The Global Pharmaceutical Plastic Bottles Market is valued at approximately USD 9.6 billion, driven by increasing demand for pharmaceutical products, chronic diseases, and advancements in packaging technologies.