Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4462

Pages:99

Published On:October 2025

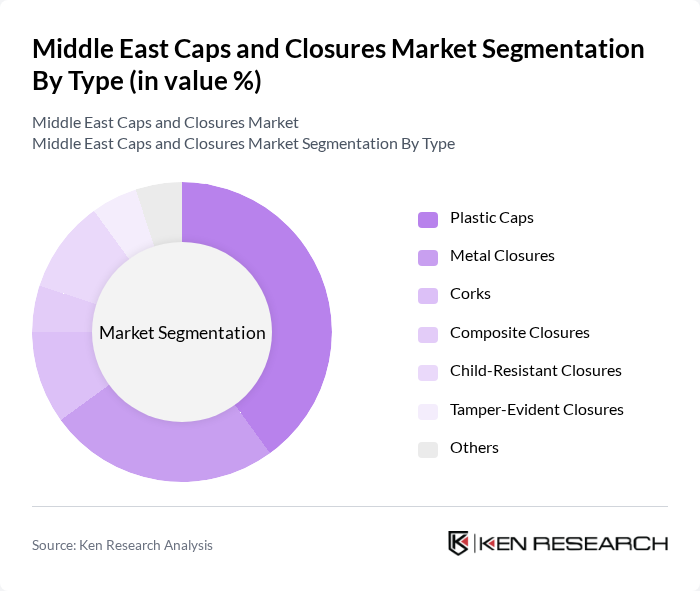

By Type:The market is segmented into various types of closures, including plastic caps, metal closures, corks, composite closures, child-resistant closures, tamper-evident closures, and others. Among these, plastic caps are the most widely used due to their lightweight, cost-effectiveness, and versatility in diverse applications. Metal closures are also significant, particularly in the beverage industry, where they provide superior sealing and preservation. The demand for child-resistant and tamper-evident closures is increasing due to regulatory requirements and heightened consumer safety concerns. The adoption of composite closures is rising in premium beverage and specialty food segments, driven by the need for enhanced aesthetics and performance .

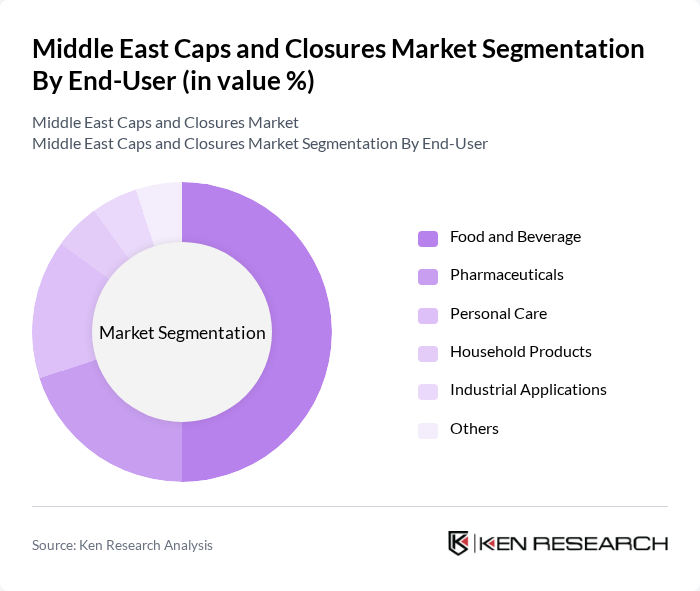

By End-User:The market is segmented based on end-user applications, including food and beverage, pharmaceuticals, personal care, household products, industrial applications, and others. The food and beverage sector is the largest consumer of caps and closures, driven by the increasing demand for packaged food products, bottled water, and soft drinks. The pharmaceutical industry is also a significant contributor, with a growing need for secure and reliable packaging solutions to ensure product safety and compliance with evolving regulatory standards. The personal care segment is expanding due to the rising consumption of cosmetics and hygiene products, while industrial and household applications continue to adopt specialized closures for chemical and cleaning products .

The Middle East Caps and Closures Market is characterized by a dynamic mix of regional and international players. Leading participants such as Berry Global, Inc., AptarGroup, Inc., Crown Holdings, Inc., Bericap GmbH & Co. KG, Silgan Holdings Inc., Guala Closures S.p.A., Alpla Group, United Caps, Closure Systems International, Inc., Zamil Plastic Industries Ltd., Al Bayader International, Al-Amoudi Plastic & Packaging Factory, Al Watania Plastics, Al Rawabi Dairy Company (for captive closures), and Al Jabr Trading Company contribute to innovation, geographic expansion, and service delivery in this space .

The Middle East caps and closures market is poised for significant transformation, driven by evolving consumer preferences and regulatory frameworks. As sustainability becomes a priority, manufacturers are likely to invest in innovative materials and production techniques. The integration of smart packaging technologies will enhance product tracking and consumer engagement. Additionally, the rise of e-commerce will necessitate more efficient packaging solutions, further shaping the market landscape and encouraging companies to adapt to these emerging trends for sustained growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Plastic Caps Metal Closures Corks Composite Closures Child-Resistant Closures Tamper-Evident Closures Others |

| By End-User | Food and Beverage Pharmaceuticals Personal Care Household Products Industrial Applications Others |

| By Material | Polyethylene Terephthalate (PET) Polypropylene (PP) Low-Density Polyethylene (LDPE) and High-Density Polyethylene (HDPE) Metal Other Materials |

| By Closure Type | Screw Caps Snap-On Caps Flip-Top Caps Crown Caps Others |

| By Distribution Channel | Direct Sales Retail E-commerce Distributors Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain) Levant Region (Jordan, Lebanon, Syria, Palestine, Iraq) North Africa (Egypt, Libya, Algeria, Morocco, Tunisia) Rest of Middle East |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Leads |

| Pharmaceutical Packaging Solutions | 60 | Regulatory Affairs Specialists, Quality Control Managers |

| Cosmetic and Personal Care Packaging | 50 | Brand Managers, R&D Directors |

| Industrial Packaging Applications | 40 | Supply Chain Managers, Procurement Officers |

| Consumer Goods Packaging Trends | 45 | Market Analysts, Sales Directors |

The Middle East Caps and Closures Market is valued at approximately USD 2.65 billion, driven by increasing demand for packaging solutions in sectors such as food and beverage, pharmaceuticals, and personal care.