Region:Asia

Author(s):Rebecca

Product Code:KRAD2721

Pages:83

Published On:November 2025

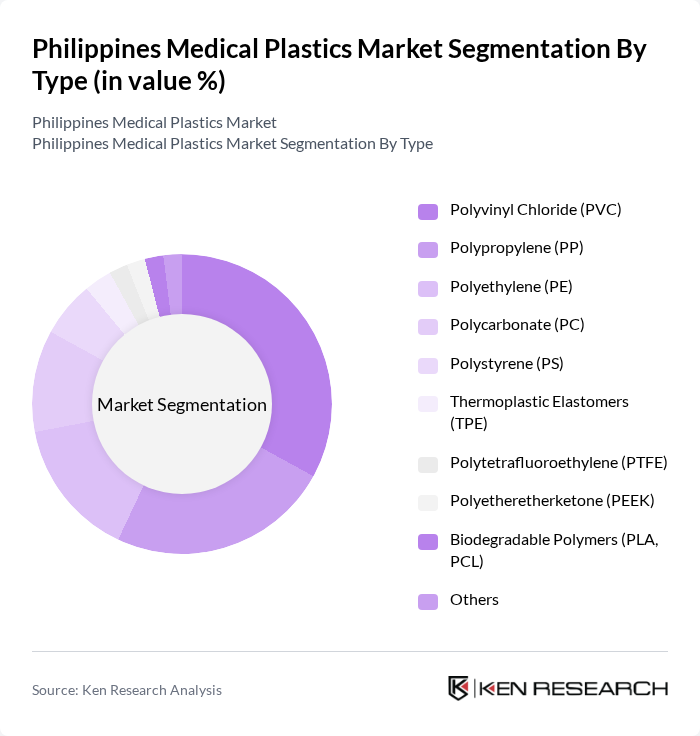

By Type:The market is segmented into various types of medical plastics, including Polyvinyl Chloride (PVC), Polypropylene (PP), Polyethylene (PE), Polycarbonate (PC), Polystyrene (PS), Thermoplastic Elastomers (TPE), Polytetrafluoroethylene (PTFE), Polyetheretherketone (PEEK), Biodegradable Polymers (PLA, PCL), and Others. Among these, Polyvinyl Chloride (PVC) is the leading subsegment due to its versatility, cost-effectiveness, and widespread use in medical applications such as tubing and bags. The demand for PVC is driven by its excellent chemical resistance and ease of processing, making it a preferred choice for manufacturers.

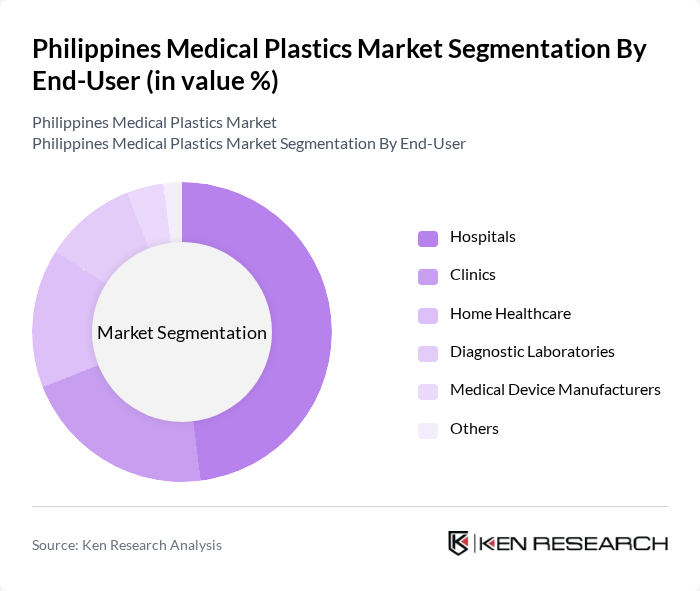

By End-User:The end-user segmentation includes Hospitals, Clinics, Home Healthcare, Diagnostic Laboratories, Medical Device Manufacturers, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of surgical procedures and the need for sterile and disposable medical products. The growing trend towards outpatient care and home healthcare services is also contributing to the demand for medical plastics in these settings.

The Philippines Medical Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sanofi Philippines, Johnson & Johnson Medical Philippines, Medtronic Philippines, B. Braun Medical Inc., Philips Healthcare Philippines, Stryker Philippines, 3M Philippines, Baxter Healthcare Corporation, Cardinal Health Philippines, Terumo Philippines Corporation, Smith & Nephew Philippines, GE Healthcare Philippines, Fresenius Kabi Philippines, Abbott Laboratories Philippines, Olympus Medical Systems Philippines, Zuellig Pharma, Metro Drug Inc., Unilab (United Laboratories Inc.), Lifeline Diagnostics Supplies Inc., and MedChoice Pharma contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines medical plastics market appears promising, driven by ongoing technological advancements and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the demand for innovative medical devices is expected to rise. Additionally, the integration of smart technologies in medical devices will likely create new opportunities for manufacturers. The focus on sustainability will also shape product development, encouraging the adoption of eco-friendly materials in the medical plastics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyvinyl Chloride (PVC) Polypropylene (PP) Polyethylene (PE) Polycarbonate (PC) Polystyrene (PS) Thermoplastic Elastomers (TPE) Polytetrafluoroethylene (PTFE) Polyetheretherketone (PEEK) Biodegradable Polymers (PLA, PCL) Others |

| By End-User | Hospitals Clinics Home Healthcare Diagnostic Laboratories Medical Device Manufacturers Others |

| By Application | Surgical Instruments Drug Delivery Systems Medical Packaging In-vitro Diagnostics Implants Disposable Medical Devices (syringes, IV tubes, gloves) Others |

| By Material Properties | Biocompatible Plastics Antimicrobial Plastics High-Temperature Resistant Plastics Smart Plastics (sensor-embedded) Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Luzon Visayas Mindanao |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 45 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Distributors | 38 | Sales Managers, Distribution Heads |

| Manufacturers of Medical Devices | 32 | Production Managers, Quality Assurance Officers |

| Healthcare Policy Makers | 25 | Regulatory Affairs Specialists, Health Economists |

| End-users in Healthcare Facilities | 42 | Doctors, Nurses, Medical Technologists |

The Philippines Medical Plastics Market is valued at approximately USD 320 million, reflecting a significant growth driven by the expansion of healthcare infrastructure and increased demand for medical devices in the country.