Region:Global

Author(s):Shubham

Product Code:KRAD5348

Pages:82

Published On:December 2025

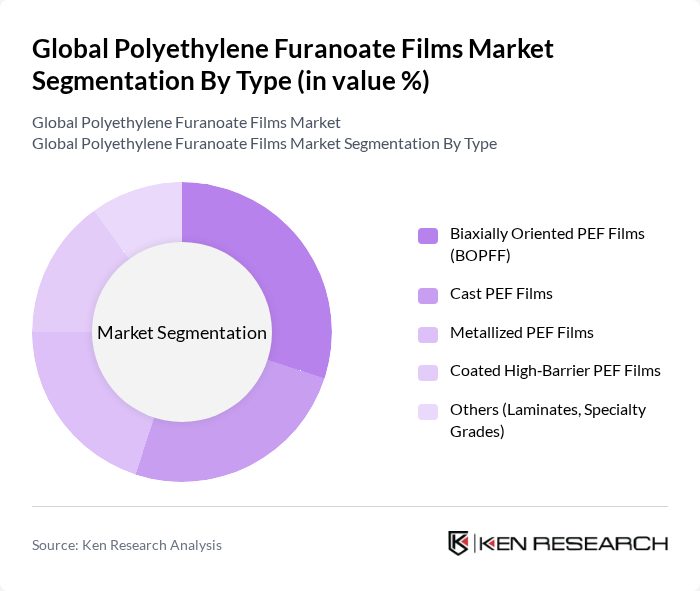

By Type:The market is segmented into various types of polyethylene furanoate films, including Biaxially Oriented PEF Films (BOPFF), Cast PEF Films, Metallized PEF Films, Coated High?Barrier PEF Films, and Others (Laminates, Specialty Grades). Each type serves different applications and industries, contributing to the overall market dynamics, with packaging applications currently representing the primary demand center for PEF?based films.

The Biaxially Oriented PEF Films (BOPFF) segment is currently dominating the market due to its superior mechanical properties and barrier performance, including high tensile strength and excellent oxygen and carbon dioxide barrier, making it particularly suitable for food and beverage packaging applications. The increasing consumer preference for lightweight, recyclable, and high?performance materials is driving the demand for BOPFF, as brand owners seek to reduce material usage while maintaining shelf?life and product protection. Additionally, advancements in production technologies and scale?up efforts in PEF polymerization and film conversion are gradually improving the commercial availability of these films, supporting their role within the high?barrier flexible packaging segment.

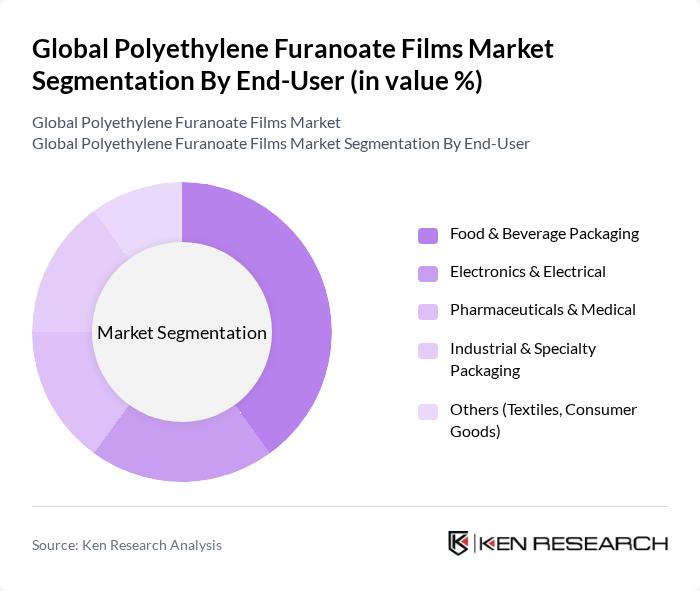

By End-User:The market is segmented based on end-users, including Food & Beverage Packaging, Electronics & Electrical, Pharmaceuticals & Medical, Industrial & Specialty Packaging, and Others (Textiles, Consumer Goods). Each end-user segment has unique requirements and applications for polyethylene furanoate films, ranging from extended shelf?life food packaging to durable insulation and protective films in electronics and industrial uses.

The Food & Beverage Packaging segment leads the market due to the growing demand for sustainable and high?barrier packaging solutions in the food and beverage industry, where PEF films help extend shelf life and reduce product waste through improved gas barrier properties. As consumers become more environmentally conscious and regulations increasingly promote recyclable and bio?based packaging, manufacturers are adopting polyethylene furanoate films to align with corporate sustainability goals and eco?design requirements for packaging. This trend, combined with brand owner initiatives in circular packaging and reduced carbon footprints, is expected to continue supporting growth in this segment.

The Global Polyethylene Furanoate Films Market is characterized by a dynamic mix of regional and international players. Leading participants such as Avantium N.V., ALPLA Werke Alwin Lehner GmbH & Co KG, Toyobo Co., Ltd., Indorama Ventures Public Company Limited, Corbion N.V., Origin Materials, Inc., BASF SE, Mitsubishi Chemical Group Corporation, Teijin Limited, Eastman Chemical Company, Circa Group AS, Danone S.A., The Coca?Cola Company, Nestlé S.A., PTT Global Chemical Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space, with activities spanning PEF monomer and polymer development, film conversion, and brand?owner trials in packaging applications.

The future of the polyethylene furanoate films market appears promising, driven by increasing regulatory support for sustainable materials and a growing consumer base that prioritizes eco-friendly products. As industries adapt to stricter environmental standards, the demand for biodegradable films is expected to rise. Additionally, the integration of smart packaging technologies will likely enhance product appeal, providing opportunities for innovation and differentiation in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Biaxially Oriented PEF Films (BOPFF) Cast PEF Films Metallized PEF Films Coated High?Barrier PEF Films Others (Laminates, Specialty Grades) |

| By End-User | Food & Beverage Packaging Electronics & Electrical Pharmaceuticals & Medical Industrial & Specialty Packaging Others (Textiles, Consumer Goods) |

| By Application | Flexible Packaging (Pouches, Wraps, Sachets) Rigid & Semi?Rigid Packaging (Trays, Blister, Lidding) Labels & Sleeves Technical Films (Solar, Electronic, Barrier Layers) Others |

| By Thickness | Up to 20 Microns –50 Microns Above 50 Microns Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Distribution Channel | Direct Sales to Brand Owners & Converters Contract Manufacturing & Toll Converting Distributor & Resin/Film Traders Others |

| By Sustainability Certification | Biobased Content Certification (e.g., DIN CERTCO, USDA BioPreferred) Compostability Certification (e.g., EN 13432, ASTM D6400) Recyclability & Circularity Certification (e.g., APR, RecyClass) Others (Carbon Footprint, Eco-Label Schemes) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Insights | 120 | Packaging Engineers, Product Development Managers |

| Textile Applications of PEF Films | 90 | Textile Manufacturers, Sustainability Coordinators |

| Automotive Sector Usage | 70 | Automotive Engineers, Procurement Specialists |

| Consumer Preferences in Bioplastics | 110 | Market Researchers, Consumer Behavior Analysts |

| Regulatory Impact Assessment | 80 | Policy Makers, Environmental Compliance Officers |

The Global Polyethylene Furanoate Films Market is valued at approximately USD 0.3 million, based on a five-year historical analysis. This market is experiencing growth due to the rising demand for sustainable packaging solutions.