Region:Global

Author(s):Dev

Product Code:KRAB0373

Pages:80

Published On:August 2025

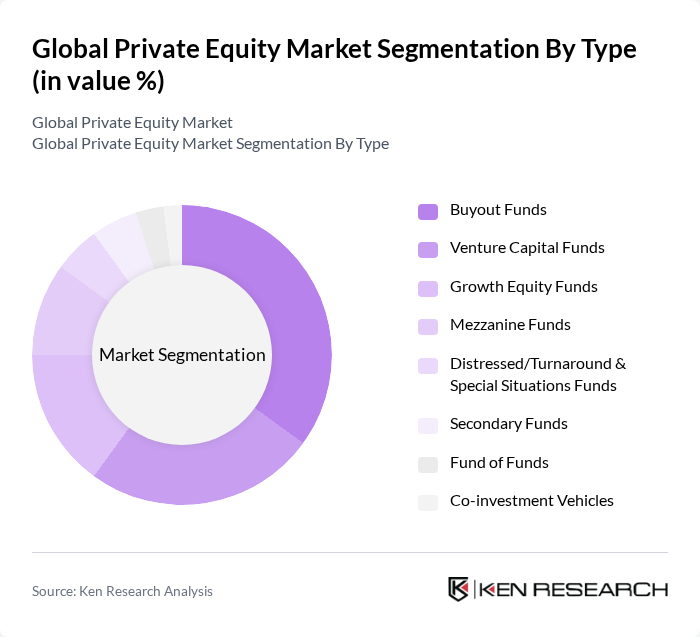

By Type:The private equity market is segmented into various types, including Buyout Funds, Venture Capital Funds, Growth Equity Funds, Mezzanine Funds, Distressed/Turnaround & Special Situations Funds, Secondary Funds, Fund of Funds, and Co-investment Vehicles. Each type serves different investment strategies and risk profiles, catering to a diverse range of investors.

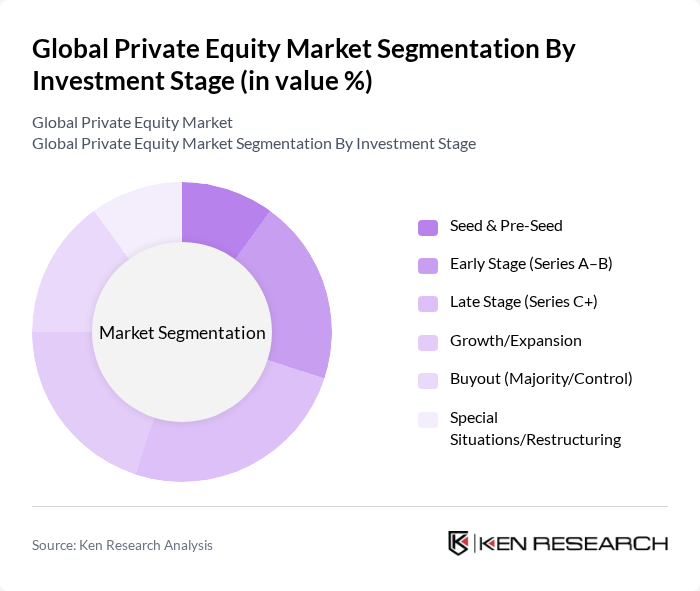

By Investment Stage:The investment stage segmentation includes Seed & Pre-Seed, Early Stage (Series A–B), Late Stage (Series C+), Growth/Expansion, Buyout (Majority/Control), and Special Situations/Restructuring. Each stage represents a different phase in the lifecycle of a company, influencing the type of investment and expected returns.

The Global Private Equity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blackstone Inc., KKR & Co. Inc., The Carlyle Group Inc., Apollo Global Management, Inc., Bain Capital, LP, TPG Inc., Warburg Pincus LLC, Vista Equity Partners Management, LLC, EQT AB, CVC Capital Partners plc, Advent International Corporation, Brookfield Asset Management Ltd., Permira Advisers LLP, Neuberger Berman Group LLC, General Atlantic Service Company, L.P., Hellman & Friedman LLC, Thoma Bravo, LP, Leonard Green & Partners, L.P., Silver Lake Management Company, L.L.C., Ardian contribute to innovation, geographic expansion, and service delivery in this space.

The future of the private equity market appears promising, driven by a combination of technological innovation and evolving investor preferences. As firms increasingly adopt digital tools and data analytics, operational efficiencies are expected to improve significantly. Furthermore, the growing emphasis on environmental, social, and governance (ESG) criteria will likely shape investment strategies, attracting a new wave of socially conscious investors. This evolving landscape presents opportunities for private equity to adapt and thrive in a competitive environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Buyout Funds Venture Capital Funds Growth Equity Funds Mezzanine Funds Distressed/Turnaround & Special Situations Funds Secondary Funds Fund of Funds Co-investment Vehicles |

| By Investment Stage | Seed & Pre-Seed Early Stage (Series A–B) Late Stage (Series C+) Growth/Expansion Buyout (Majority/Control) Special Situations/Restructuring |

| By Fund Size | Small Funds (< USD 500 million) Mid-Market Funds (USD 500 million–USD 5 billion) Large/ Mega Funds (> USD 5 billion) |

| By Sector Focus | Technology Healthcare & Life Sciences Consumer & Retail Financial Services & Fintech Industrials & Manufacturing Energy & Energy Transition Business Services Infrastructure-Adjacencies (Digital/Logistics) Others |

| By Geographic Focus | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Exit Strategy | IPO Secondary Sale (to PE/GPs) Trade Sale (to Strategic Buyers) Sponsor-to-Sponsor Recapitalization/Dividend Recap Management Buyback |

| By Investor Type | Institutional Investors (Pension, Sovereign, Endowments) High-Net-Worth & Ultra-HNW Individuals Family Offices Corporates/Strategic Investors Wealth/Retirement Platforms & Intermediaries |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Venture Capital Investments | 120 | Venture Capitalists, Investment Analysts |

| Buyout Fund Strategies | 100 | Private Equity Fund Managers, Financial Advisors |

| Sector-Specific Investments (Tech) | 80 | Sector Analysts, Portfolio Managers |

| Impact Investing Trends | 60 | Sustainability Officers, Impact Fund Managers |

| Exit Strategies and Trends | 90 | Corporate Development Executives, M&A Advisors |

The Global Private Equity Market is valued at approximately USD 4.3 trillion, reflecting cumulative net asset value and uncalled capital across various private equity strategies, including buyouts, growth, and venture capital.