Region:Middle East

Author(s):Rebecca

Product Code:KRAB7383

Pages:89

Published On:October 2025

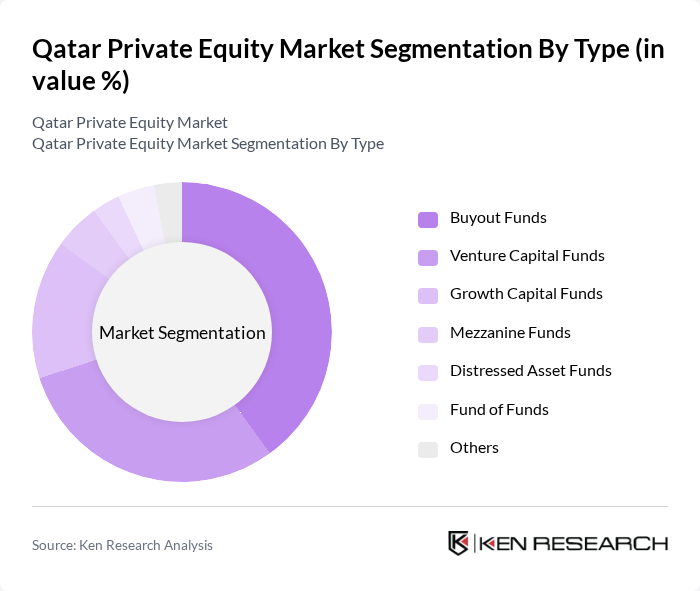

By Type:The Qatar Private Equity Market is segmented into various types, including Buyout Funds, Venture Capital Funds, Growth Capital Funds, Mezzanine Funds, Distressed Asset Funds, Fund of Funds, and Others. Among these, Buyout Funds are currently leading the market due to their ability to acquire established companies and enhance their value through operational improvements. Venture Capital Funds also play a significant role, particularly in the technology sector, where innovation and startup culture are thriving.

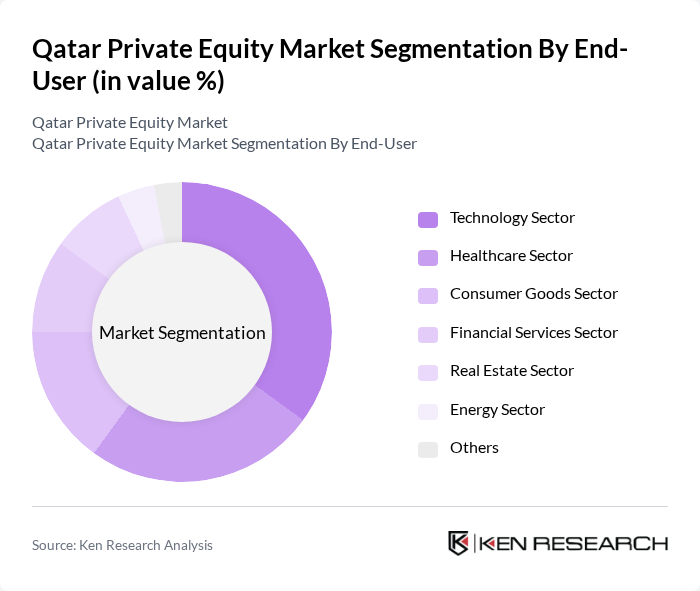

By End-User:The market is also segmented by end-user industries, including Technology Sector, Healthcare Sector, Consumer Goods Sector, Financial Services Sector, Real Estate Sector, Energy Sector, and Others. The Technology Sector is currently the most dominant end-user, driven by rapid digital transformation and innovation, which has attracted significant investments from private equity firms. The Healthcare Sector is also gaining traction, particularly in light of recent global health challenges.

The Qatar Private Equity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Investment Authority, Qatari Diar Real Estate Investment Company, Qatar Development Bank, Doha Venture Capital, Gulf Capital, Amwal Qatar, QInvest, Qatar Holding LLC, Qatar Private Equity Partners, Al Faisal Holding, Qatar Sports Investments, Barwa Real Estate Company, Ooredoo Group, Qatar National Bank, Qatar Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar private equity market appears promising, driven by ongoing economic diversification and increasing foreign investments. As the government continues to implement reforms and enhance the financial ecosystem, private equity firms are likely to find more opportunities in emerging sectors. Additionally, the growing emphasis on sustainable and impact investing will attract a new wave of investors, further enriching the market landscape and fostering innovation across various industries.

| Segment | Sub-Segments |

|---|---|

| By Type | Buyout Funds Venture Capital Funds Growth Capital Funds Mezzanine Funds Distressed Asset Funds Fund of Funds Others |

| By End-User | Technology Sector Healthcare Sector Consumer Goods Sector Financial Services Sector Real Estate Sector Energy Sector Others |

| By Investment Stage | Seed Stage Early Stage Late Stage Expansion Stage Others |

| By Fund Size | Small Funds (Under $50M) Medium Funds ($50M - $250M) Large Funds (Over $250M) Others |

| By Geographic Focus | Domestic Investments Regional Investments (GCC) International Investments Others |

| By Exit Strategy | IPOs Mergers and Acquisitions Secondary Sales Others |

| By Investment Horizon | Short-Term (1-3 years) Medium-Term (3-5 years) Long-Term (5+ years) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Equity Fund Managers | 100 | Managing Partners, Investment Directors |

| Institutional Investors | 80 | Portfolio Managers, Chief Investment Officers |

| Venture Capitalists | 60 | Founders, Investment Analysts |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Industry Experts and Analysts | 70 | Market Researchers, Financial Advisors |

The Qatar Private Equity Market is valued at approximately USD 2.5 billion, reflecting significant growth driven by investments in infrastructure, technology, and healthcare sectors, along with a favorable regulatory environment for foreign investment.