Region:Global

Author(s):Dev

Product Code:KRAC4162

Pages:93

Published On:October 2025

By Type:The market is segmented into various types, including Pilgrimages, Spiritual Retreats, Religious Festivals, Heritage Tours, Faith-Based Travel Packages, Educational Religious Tours, Day Trips & Local Gateways, Museums & Religious Heritage Sites, and Others. Each of these segments caters to different traveler preferences and motivations, contributing to the overall growth of the market. The segmentation reflects the diversification of religious tourism beyond traditional pilgrimages to include wellness-oriented and cultural experiences .

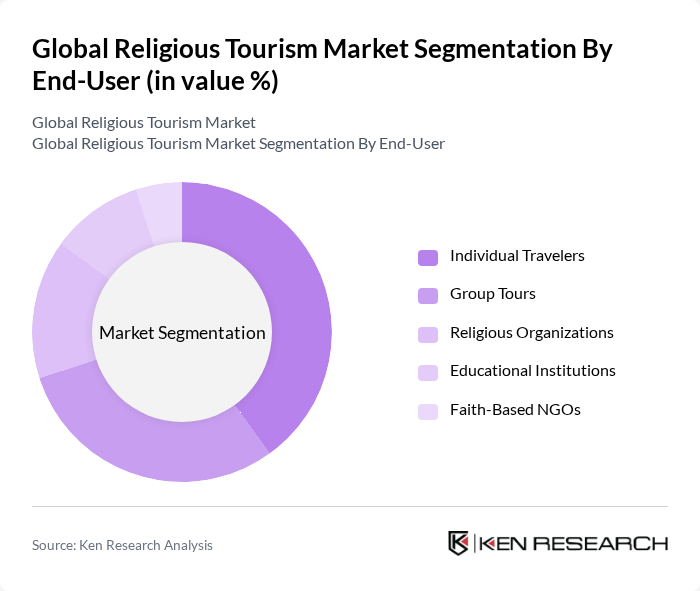

By End-User:The market is further segmented by end-users, including Individual Travelers, Group Tours, Religious Organizations, Educational Institutions, and Faith-Based NGOs. Each segment reflects different travel patterns and preferences, influencing the overall dynamics of the religious tourism market. Individual travelers and group tours together account for the majority of market activity, with religious organizations and educational institutions playing a significant role in organized pilgrimages and educational trips .

The Global Religious Tourism Market is characterized by a dynamic mix of regional and international players. Leading participants such as Thomas Cook Group, TUI Group, Expedia Group, Booking Holdings Inc., Travel Leaders Group, CWT (Carlson Wagonlit Travel), American Express Global Business Travel, Flight Centre Travel Group, G Adventures, Intrepid Travel, Abercrombie & Kent, Insight Vacations, Trafalgar, Globus Family of Brands, Religious Travel Association, Select International Tours & Cruises, Israel Ministry of Tourism, Saudi Arabia Ministry of Hajj and Umrah, Vatican Pilgrimage Office (Opera Romana Pellegrinaggi), TCDD Ta??mac?l?k A.?. contribute to innovation, geographic expansion, and service delivery in this space.

The future of religious tourism is poised for transformation, driven by evolving traveler preferences and technological advancements. As personalization becomes paramount, operators are expected to offer tailored experiences that resonate with individual spiritual needs. Additionally, the integration of technology, such as virtual reality pilgrimages, is likely to enhance accessibility. Sustainable practices will also gain traction, as travelers increasingly seek eco-friendly options, ensuring that religious tourism aligns with broader environmental goals while fostering community engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Pilgrimages Spiritual Retreats Religious Festivals Heritage Tours Faith-Based Travel Packages Educational Religious Tours Day Trips & Local Gateways Museums & Religious Heritage Sites Others |

| By End-User | Individual Travelers Group Tours Religious Organizations Educational Institutions Faith-Based NGOs |

| By Travel Type | Domestic Travel International Travel |

| By Accommodation Type | Hotels Guesthouses Hostels Religious Lodging (Monasteries, Dharamshalas, Pilgrim Houses) |

| By Booking Channel | Online Travel Agencies Direct Bookings Travel Agents In-Person Booking Phone Booking |

| By Duration of Stay | Short-term (1-3 days) Medium-term (4-7 days) Long-term (8+ days) |

| By Purpose of Visit | Pilgrimage Cultural Exploration Educational Purposes Community Service Wellness & Spiritual Renewal |

| By Age Group | Below 20 Years 40 Years 60 Years Years & Above |

| By Religion | Christianity Islam Hinduism Buddhism Judaism Others |

| By Region | North America Europe Asia Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pilgrimage Tourism in India | 120 | Pilgrims, Travel Agents, Tour Operators |

| Religious Festivals and Events | 90 | Event Organizers, Local Authorities, Attendees |

| Spiritual Retreats and Wellness Tourism | 60 | Retreat Leaders, Participants, Wellness Coaches |

| Religious Heritage Sites | 100 | Site Managers, Tour Guides, Visitors |

| International Religious Tourism | 70 | International Tourists, Travel Planners, Cultural Experts |

The Global Religious Tourism Market is valued at approximately USD 286 billion, reflecting a significant growth trend driven by increased interest in spiritual experiences, pilgrimages, and religious events, alongside improved travel infrastructure and rising disposable incomes.