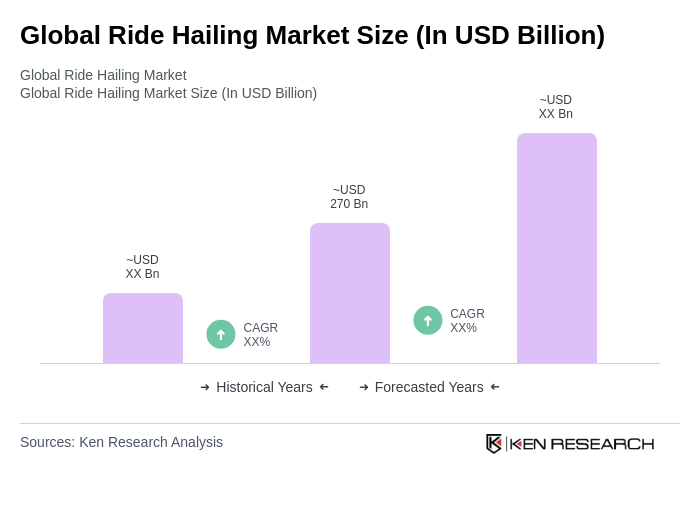

Global Ride Hailing Market Overview

- The Global Ride Hailing Market is valued at USD 270 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of smartphones, the rise of urbanization, and the growing demand for convenient transportation solutions. The market has seen a significant shift towards app-based services, which have made ride-hailing more accessible and user-friendly for consumers. Artificial intelligence integration, multimodal mobility platforms, and sustainability initiatives are increasingly shaping market dynamics .

- Key players in this market include major cities such as New York, London, and Beijing, which dominate due to their large populations, high urban density, and well-developed infrastructure. These cities have embraced ride-hailing services as a solution to traffic congestion and public transport limitations, making them hotspots for ride-hailing activities .

- In 2023, the European Union implemented regulations aimed at enhancing passenger safety and ensuring fair competition in the ride-hailing sector. This includes mandatory background checks for drivers and the establishment of minimum fare standards, which aim to protect both consumers and drivers while promoting a level playing field among service providers. The “Regulation (EU) 2023/650 of the European Parliament and of the Council on common rules for the operation of ride-hailing services,” issued by the European Parliament, mandates comprehensive driver vetting, minimum fare thresholds, and digital platform compliance requirements across member states.

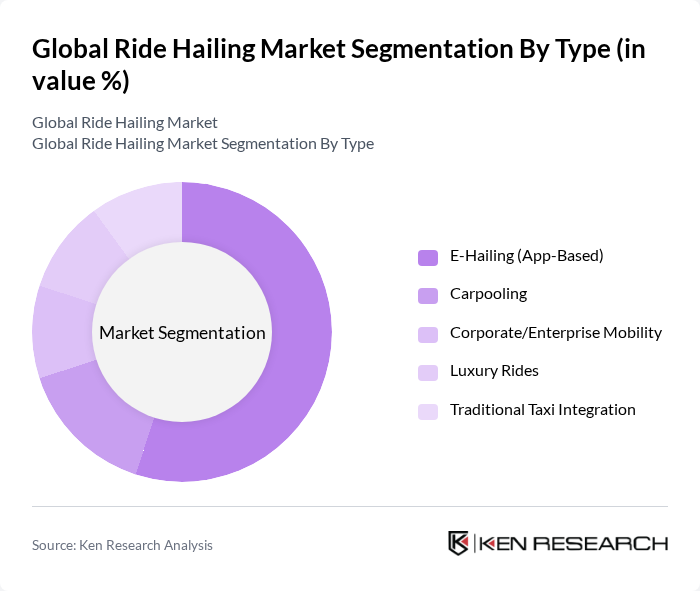

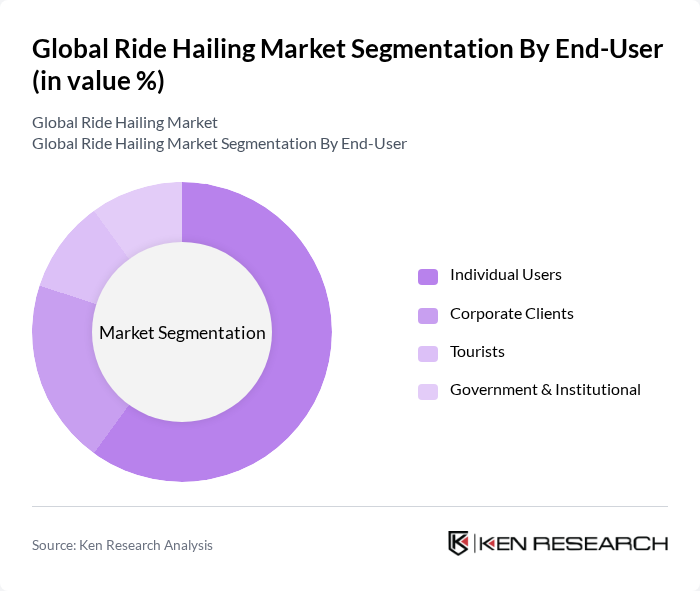

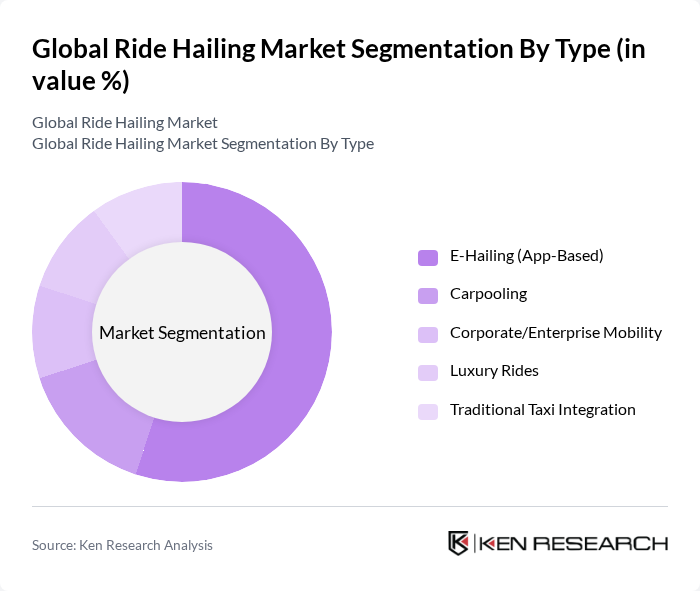

Global Ride Hailing Market Segmentation

By Type:The ride-hailing market can be segmented into various types, including E-Hailing (App-Based), Carpooling, Corporate/Enterprise Mobility, Luxury Rides, and Traditional Taxi Integration. Among these, E-Hailing (App-Based) is the most dominant segment, driven by the convenience of mobile applications and the growing trend of on-demand services. The increasing smartphone penetration, integration of digital payments, and the preference for cashless transactions have further propelled this segment's growth .

By End-User:The end-user segmentation includes Individual Users, Corporate Clients, Tourists, and Government & Institutional users. Individual Users represent the largest segment, as the convenience and flexibility of ride-hailing services appeal to everyday commuters. The rise in urban populations and the increasing preference for shared mobility solutions, especially among younger demographics and urban professionals, have significantly contributed to the growth of this segment .

Global Ride Hailing Market Competitive Landscape

The Global Ride Hailing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Lyft, Inc., DiDi Chuxing Technology Co., Grab Holdings Inc., Ola Cabs (ANI Technologies Pvt. Ltd.), Bolt Technology OÜ, Careem Networks FZ LLC, Gojek, Yandex.Taxi, Via Transportation, Inc., Gett, Curb Mobility, Z?m, FREE NOW, Cabify, Addison Lee, Kakao Mobility, Maxim, inDriver, Easy Taxi contribute to innovation, geographic expansion, and service delivery in this space.

Global Ride Hailing Market Industry Analysis

Growth Drivers

- Increasing Urbanization:Urbanization is a significant driver of the ride-hailing market, with the United Nations projecting that by future, 56.6% of the global population will reside in urban areas. This shift leads to higher demand for efficient transportation solutions, as urban dwellers often lack access to personal vehicles. In cities like New York, ride-hailing services have seen a 21% increase in usage, reflecting the growing reliance on these services for daily commutes and social activities.

- Rising Smartphone Penetration:The proliferation of smartphones is a crucial factor in the ride-hailing market's growth. As of future, global smartphone penetration is expected to reach 80%, with over 6.5 billion users. This widespread access enables consumers to easily book rides through mobile applications. In regions like Southeast Asia, where smartphone adoption is surging, ride-hailing app downloads have increased by 32%, indicating a strong correlation between smartphone usage and ride-hailing service adoption.

- Demand for Convenient Transportation:The demand for convenient transportation options is driving the ride-hailing market forward. In future, the average urban commuter spends approximately 56 minutes daily on transportation, leading to a growing preference for on-demand services. A study by the International Transport Forum found that 42% of commuters in major cities prefer ride-hailing over traditional taxis due to convenience and ease of use, further solidifying the market's growth trajectory.

Market Challenges

- Regulatory Compliance Issues:Regulatory compliance poses a significant challenge for ride-hailing companies. In future, over 32 countries are expected to implement stricter regulations regarding ride-hailing operations, including licensing and insurance requirements. For instance, in London, the Transport for London (TfL) has mandated that all drivers must undergo enhanced background checks, increasing operational costs for companies. This regulatory landscape can hinder market entry and expansion efforts for new players.

- Safety and Security Concerns:Safety and security concerns remain a critical challenge for the ride-hailing industry. In future, it is estimated that 27% of users express apprehension about personal safety when using ride-hailing services. High-profile incidents have led to increased scrutiny and calls for improved safety measures. Companies are investing heavily in driver training and safety technology, but the ongoing concerns can deter potential users and impact overall market growth.

Global Ride Hailing Market Future Outlook

The future of the ride-hailing market appears promising, driven by technological advancements and evolving consumer preferences. As urban populations continue to grow, the demand for efficient and flexible transportation solutions will likely increase. Additionally, the integration of electric vehicles and autonomous technology is expected to reshape the market landscape, enhancing service efficiency and sustainability. Companies that adapt to these trends will be well-positioned to capture market share and meet the changing needs of consumers in urban environments.

Market Opportunities

- Integration of Electric Vehicles:The shift towards electric vehicles (EVs) presents a significant opportunity for ride-hailing companies. By future, the global EV market is projected to grow to 12 million units sold annually. Companies that incorporate EVs into their fleets can reduce operational costs and appeal to environmentally conscious consumers, potentially increasing market share and enhancing brand loyalty.

- Expansion into Emerging Markets:Emerging markets offer substantial growth potential for ride-hailing services. In future, regions like Africa and Southeast Asia are expected to see a 17% increase in urban population, driving demand for affordable transportation options. Companies that strategically enter these markets can capitalize on the growing need for ride-hailing services, establishing a foothold in regions with limited public transport infrastructure.