Region:Europe

Author(s):Shubham

Product Code:KRAA1095

Pages:94

Published On:August 2025

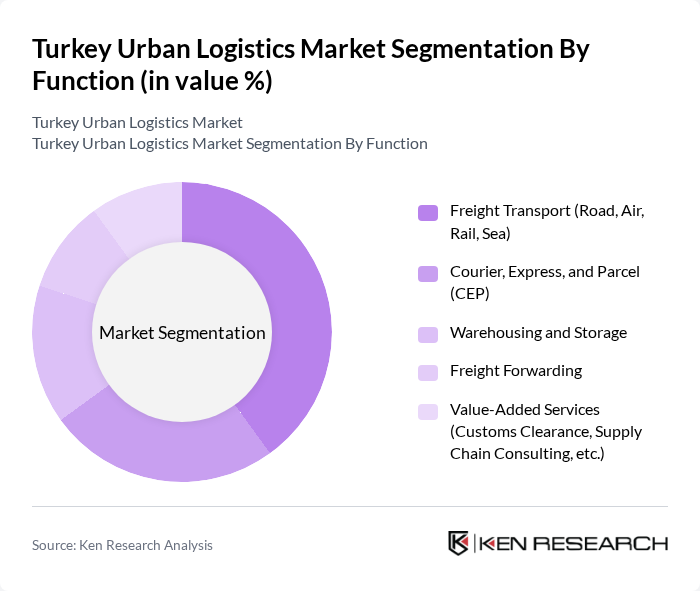

By Function:The market can be segmented into various functions that include Freight Transport (Road, Air, Rail, Sea), Courier, Express, and Parcel (CEP), Warehousing and Storage, Freight Forwarding, and Value-Added Services (Customs Clearance, Supply Chain Consulting, etc.). Each of these functions plays a crucial role in the overall logistics ecosystem, supporting the movement, storage, and management of goods across urban areas and catering to diverse operational requirements .

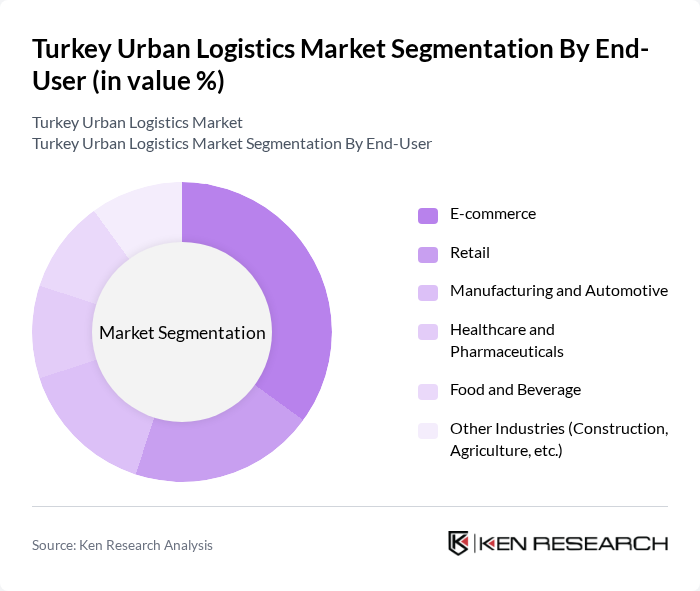

By End-User:The end-user segmentation includes E-commerce, Retail, Manufacturing and Automotive, Healthcare and Pharmaceuticals, Food and Beverage, and Other Industries (Construction, Agriculture, etc.). Each sector has unique logistics requirements, influencing the demand for specific services and solutions. E-commerce and retail drive demand for last-mile delivery and rapid fulfillment, while manufacturing and automotive sectors require robust freight and warehousing solutions. Healthcare and pharmaceuticals prioritize temperature-controlled logistics, and food and beverage sectors demand timely and safe delivery .

The Turkey Urban Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aras Kargo, MNG Kargo, Yurtiçi Kargo, PTT Kargo, DHL Express Turkey, UPS Turkey, FedEx Turkey, Kargoist, Hepsijet, Getir, Trendyol Express, T?rport, Ekol Lojistik, Netlog Lojistik, Borusan Lojistik contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's urban logistics market appears promising, driven by technological advancements and increasing consumer expectations. As urban areas continue to expand, logistics companies are likely to invest in innovative solutions, such as autonomous delivery vehicles and AI-driven route optimization. Furthermore, the integration of sustainable practices will become essential, as consumers increasingly demand environmentally friendly delivery options. Overall, the market is poised for transformation, with significant opportunities for growth and efficiency improvements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Function | Freight Transport (Road, Air, Rail, Sea) Courier, Express, and Parcel (CEP) Warehousing and Storage Freight Forwarding Value-Added Services (Customs Clearance, Supply Chain Consulting, etc.) |

| By End-User | E-commerce Retail Manufacturing and Automotive Healthcare and Pharmaceuticals Food and Beverage Other Industries (Construction, Agriculture, etc.) |

| By Transport Mode | Road Transport Air Transport Sea Transport Rail Transport Multimodal Transport |

| By Service Type | Last-Mile Delivery Third-Party Logistics (3PL) Freight Forwarding Warehousing & Distribution Cold Chain Logistics Reverse Logistics |

| By Region | Istanbul Ankara Izmir Other Major Urban Centers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Freight Transportation | 60 | Logistics Coordinators, Fleet Managers |

| Last-Mile Delivery Services | 50 | Operations Managers, Delivery Supervisors |

| Warehouse Management in Urban Areas | 40 | Warehouse Managers, Inventory Control Specialists |

| Public Policy Impact on Urban Logistics | 45 | City Planners, Policy Analysts |

| Technology Adoption in Logistics | 50 | IT Managers, Technology Officers |

The Turkey Urban Logistics Market is valued at approximately USD 45 billion, driven by the growth of e-commerce, urbanization, and advancements in logistics technology and infrastructure.