Region:Global

Author(s):Geetanshi

Product Code:KRAA2290

Pages:94

Published On:August 2025

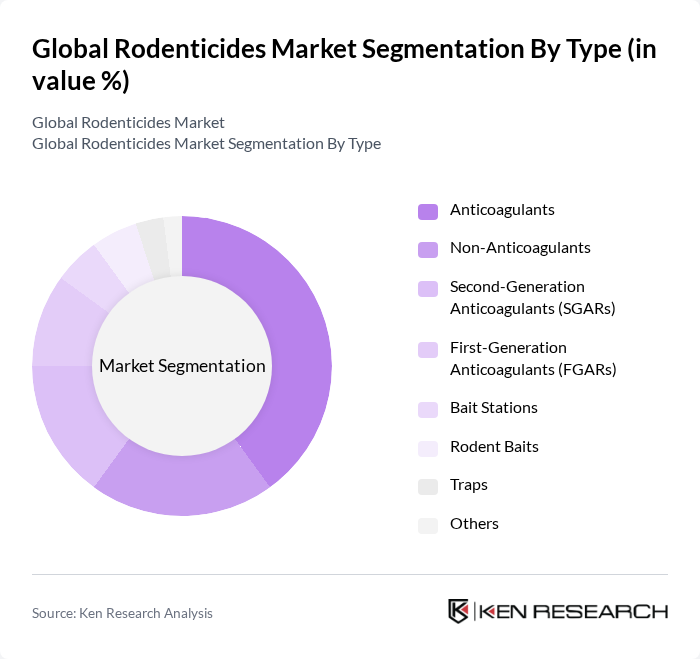

By Type:The market is segmented into various types of rodenticides, including Anticoagulants, Non-Anticoagulants, Second-Generation Anticoagulants (SGARs), First-Generation Anticoagulants (FGARs), Bait Stations, Rodent Baits, Traps, and Others. Among these, Anticoagulants are the most widely used due to their effectiveness and ease of application. The preference for these products is driven by their ability to control rodent populations efficiently, making them a staple in both residential and commercial pest management strategies. Anticoagulant rodenticides accounted for the majority of global sales, supported by their single-dose efficacy against resistant rodent species .

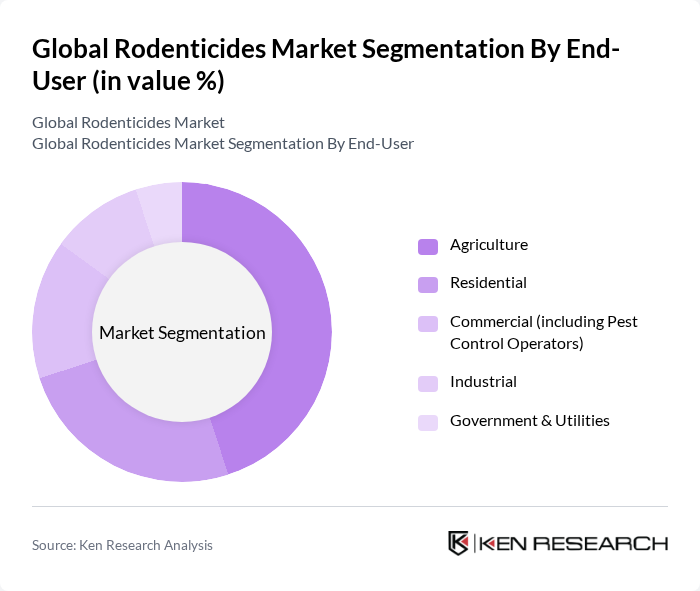

By End-User:The end-user segmentation includes Agriculture, Residential, Commercial (including Pest Control Operators), Industrial, and Government & Utilities. The Agriculture sector is the largest consumer of rodenticides, driven by the need to protect crops from rodent damage and minimize economic losses. Farmers increasingly rely on these products to safeguard their yields, while the residential and commercial sectors also contribute significantly due to the need for effective pest management in urban settings .

The Global Rodenticides Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Bayer AG, Syngenta AG, Rentokil Initial plc, Bell Laboratories, Inc., Neogen Corporation, FMC Corporation, Ecolab Inc., Anticimex AB, UPL Limited, Liphatech, Inc., PelGar International Ltd., Target Specialty Products, Rentokil North America, Sorex Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the rodenticides market is poised for transformation, driven by technological advancements and changing consumer preferences. The increasing demand for eco-friendly products is likely to shape product development, with manufacturers focusing on organic and biodegradable formulations. Additionally, the integration of smart rodent control solutions, utilizing IoT technology, is expected to enhance effectiveness and efficiency in pest management. As urbanization continues, the need for innovative rodent control strategies will become increasingly critical, fostering growth in this sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Anticoagulants Non-Anticoagulants Second-Generation Anticoagulants (SGARs) First-Generation Anticoagulants (FGARs) Bait Stations Rodent Baits Traps Others |

| By End-User | Agriculture Residential Commercial (including Pest Control Operators) Industrial Government & Utilities |

| By Application | Agricultural Fields Urban Areas Warehouses Food Processing Facilities Pest Control Companies |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors/Wholesalers |

| By Formulation | Granular Liquid Pellets Blocks Powders |

| By Packaging Type | Bulk Packaging Retail Packaging Sachets Others |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Rodent Control | 100 | Farm Managers, Agricultural Scientists |

| Urban Pest Control Services | 80 | Pest Control Technicians, Service Managers |

| Retail Distribution of Rodenticides | 60 | Retail Managers, Supply Chain Coordinators |

| Regulatory Compliance in Rodenticide Use | 40 | Regulatory Affairs Specialists, Environmental Consultants |

| Research and Development in Rodent Control | 50 | R&D Managers, Product Development Scientists |

The Global Rodenticides Market is valued at approximately USD 5.8 billion, reflecting a significant demand for effective rodent control solutions driven by urbanization, agricultural expansion, and public health awareness.