Region:Global

Author(s):Dev

Product Code:KRAB1896

Pages:91

Published On:January 2026

By Product Type:The product type segmentation includes various categories such as Prescription Spectacles, Non-Prescription / Fashion Spectacles, Reading Glasses, Safety and Protective Spectacles, Sports and Performance Spectacles, Blue-Light Blocking Spectacles, and Others. This taxonomy is consistent with leading eyewear studies that separate corrective eyeglasses, readers, plano/fashion eyewear, and protective or sports eyewear. Among these, Prescription Spectacles dominate the market due to the increasing number of individuals requiring vision correction and the high prevalence of refractive errors such as myopia, hyperopia, and astigmatism. The growing trend of fashion eyewear, driven by brand collaborations, designer frames, and social media visibility, also contributes significantly to the Non-Prescription / Fashion segment.

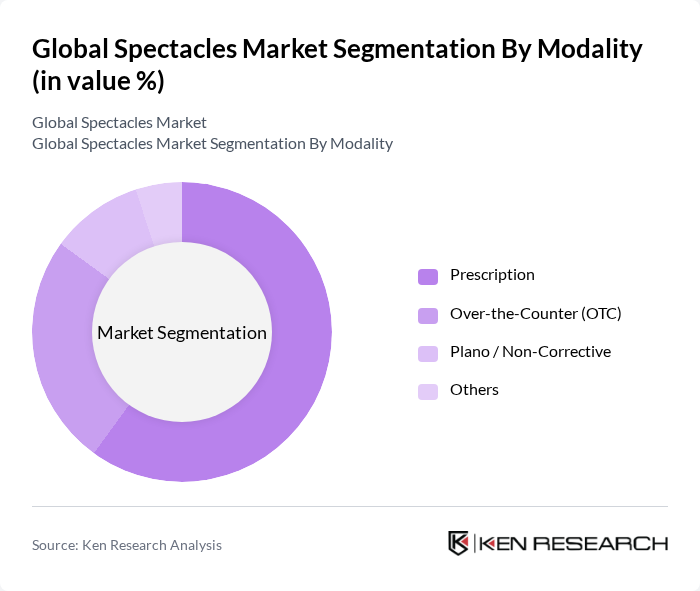

By Modality:The modality segmentation includes Prescription, Over-the-Counter (OTC), Plano / Non-Corrective, and Others. This aligns with industry practice that differentiates prescription-based products from OTC readers and plano eyewear. Prescription spectacles are the leading modality due to the increasing number of people diagnosed with refractive errors and wider access to optometry services and eye examinations. The OTC segment is also growing as consumers seek convenient solutions for presbyopia and minor vision issues, often purchasing ready-to-wear readers through pharmacies, supermarkets, and online channels, while plano / non-corrective spectacles cater mainly to fashion, blue-light filtering, and occupational use.

The Global Spectacles Market is characterized by a dynamic mix of regional and international players. Leading participants such as EssilorLuxottica SA, Luxottica Group S.p.A., Safilo Group S.p.A., HOYA Corporation, Carl Zeiss AG, Fielmann AG, Marchon Eyewear, Inc., Kering Eyewear, Warby Parker Inc., Marcolin S.p.A., De Rigo Vision S.p.A., Charmant Group, Silhouette International Schmied AG, Lenskart Solutions Pvt. Ltd., and others contribute to innovation, geographic expansion, and service delivery in this space, through activities such as brand licensing, vertical integration of retail and manufacturing, digital try-on technologies, and expansion into emerging markets.

The spectacles market is poised for significant transformation, driven by technological innovations and changing consumer preferences. As sustainability becomes a priority, brands are expected to adopt eco-friendly materials, aligning with the growing health and wellness trend. Additionally, the rise of smart eyewear, integrating augmented reality features, is anticipated to attract tech-savvy consumers. These trends indicate a dynamic market landscape, with opportunities for growth and differentiation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Spectacles Non-Prescription / Fashion Spectacles Reading Glasses Safety and Protective Spectacles Sports and Performance Spectacles Blue-Light Blocking Spectacles Others |

| By Modality | Prescription Over-the-Counter (OTC) Plano / Non-Corrective Others |

| By End User | Men Women Unisex Children and Adolescents Elderly Population |

| By Distribution Channel | Optical Stores and Optometry Clinics Online Stores Hospitals & Eye Clinics Specialty Stores & Boutiques Others |

| By Frame Material | Plastic / Acetate Metal Combination & Composite Materials Sustainable / Recycled Materials Others |

| By Lens Type | Single Vision Lenses Bifocal Lenses Progressive / Multifocal Lenses Photochromic Lenses High-Index and Specialty Lenses Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Prescription Glasses Market | 120 | Optometrists, Retail Managers |

| Sunglasses Consumer Preferences | 110 | Fashion Retail Buyers, Marketing Executives |

| Contact Lenses Usage Trends | 90 | Eye Care Professionals, Consumers |

| Online Eyewear Sales Insights | 130 | E-commerce Managers, Digital Marketing Specialists |

| Emerging Technologies in Eyewear | 70 | Product Developers, Tech Innovators |

The Global Spectacles Market is valued at approximately USD 90 billion, reflecting a significant growth trend driven by increasing vision disorders, heightened awareness of eye health, and the popularity of fashion eyewear.