Region:Global

Author(s):Shubham

Product Code:KRAD6646

Pages:82

Published On:December 2025

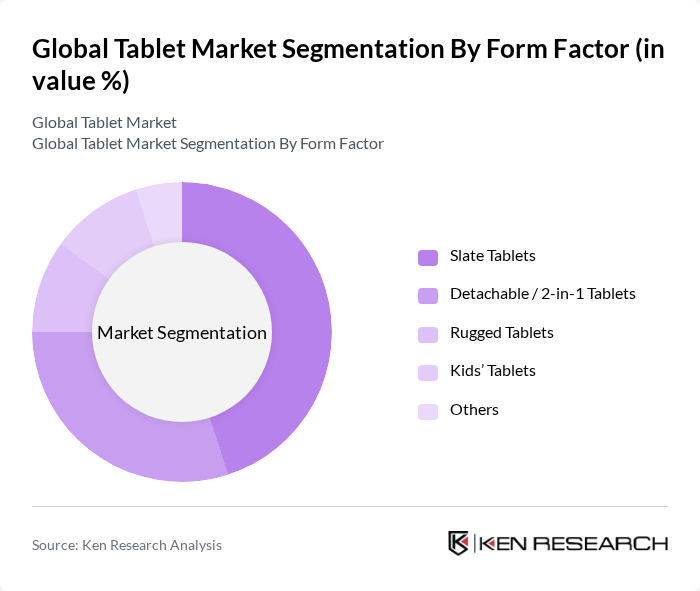

By Form Factor:The form factor segmentation includes various types of tablets that cater to different consumer needs. The primary subsegments are Slate Tablets, Detachable / 2-in-1 Tablets, Rugged Tablets, Kids’ Tablets, and Others. Slate Tablets are popular for their lightweight design, portability, affordability, and ease of use, making them ideal for casual users, schools, and businesses. Detachable tablets are gaining traction among professionals who require versatility, enterprise productivity, and support for creative applications. Rugged tablets are preferred in industrial settings, while Kids’ Tablets are designed specifically for educational purposes and gaming.

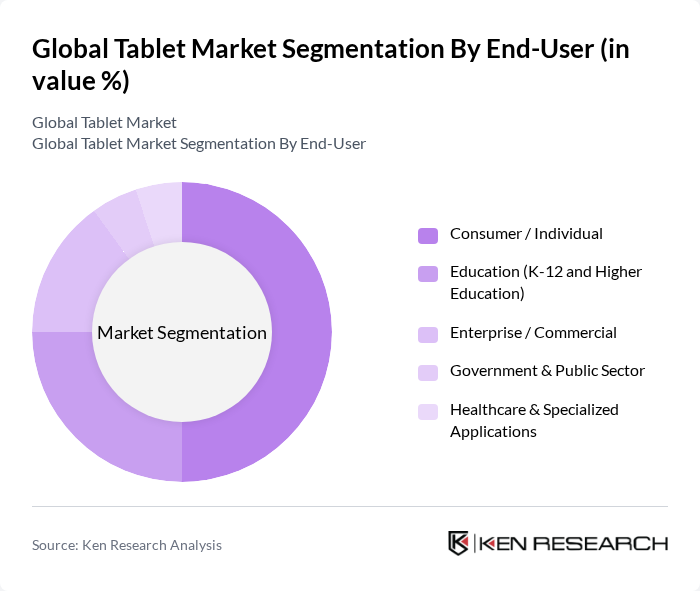

By End-User:The end-user segmentation encompasses various sectors utilizing tablets, including Consumer / Individual, Education (K-12 and Higher Education), Enterprise / Commercial, Government & Public Sector, and Healthcare & Specialized Applications. The Consumer segment leads due to the growing trend of personal device ownership for entertainment, communication, browsing, and light productivity. The Education sector is rapidly expanding as schools adopt tablets for digital learning and government e-learning initiatives, while the Enterprise segment is driven by the need for mobile solutions in business operations with support for productivity tools.

The Global Tablet Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Microsoft Corporation, Lenovo Group Limited, Amazon.com, Inc., Huawei Technologies Co., Ltd., Dell Technologies Inc., ASUSTeK Computer Inc., Acer Inc., Xiaomi Corporation, Google LLC (Pixel Tablet), TCL Technology Group Corporation (Alcatel / TCL Tablets), HP Inc., Chuwi Innovation Technology Co., Ltd., Lenovo-owned Motorola Mobility LLC (Motorola Tablets) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the tablet market appears promising, driven by technological innovations and evolving consumer preferences. The shift towards 5G-enabled tablets is expected to enhance connectivity and user experience, while the rise of detachable tablets caters to the growing demand for versatile devices. As sustainability becomes a priority, manufacturers are likely to focus on eco-friendly materials, aligning with consumer values and regulatory requirements, thus shaping a more responsible market landscape.

| Segment | Sub-Segments |

|---|---|

| By Form Factor | Slate Tablets Detachable / 2?in?1 Tablets Rugged Tablets Kids’ Tablets Others |

| By End-User | Consumer / Individual Education (K?12 and Higher Education) Enterprise / Commercial Government & Public Sector Healthcare & Specialized Applications |

| By Operating System | Android iPadOS (iOS) Windows Others (ChromeOS, HarmonyOS, etc.) |

| By Screen Size | Below 8 inches to 10 inches Above 10 inches Foldable & Large?format (>13 inches) |

| By Connectivity Type | Wi?Fi Only Wi?Fi + 4G/LTE Wi?Fi + 5G Others (Satellite, Private Networks) |

| By Price Range | Entry?Level / Budget Tablets Mid?Range Tablets Premium / Flagship Tablets Rugged & Specialized High?value Tablets |

| By Distribution Channel | Online Marketplaces & Brand E?stores Offline Retail (Electronics & Specialty Stores) Operator / Carrier Channels Enterprise & Government Direct / Tender Sales |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Tablet Usage | 120 | General Consumers, Tech Enthusiasts |

| Educational Tablet Adoption | 100 | Teachers, School Administrators |

| Corporate Tablet Integration | 80 | IT Managers, Business Executives |

| Healthcare Tablet Applications | 70 | Healthcare Professionals, IT Staff in Hospitals |

| Retail Tablet Sales Trends | 90 | Retail Managers, Sales Analysts |

The Global Tablet Market is valued at approximately USD 60 billion, reflecting a significant growth trend driven by advancements in technology, increased demand for portable devices, and the rise of remote work and online education.