Global Tissue Engineering Market Overview

- The Global Tissue Engineering Market is valued at approximatelyUSD 22 billion, based on a five-year historical analysis. This valuation reflects the rapid expansion of the market, primarily driven by advancements in regenerative medicine, the increasing prevalence of chronic diseases such as diabetes and cardiovascular conditions, and rising demand for organ transplants. Recent technological innovations—including 3D bioprinting, stem cell therapy, and artificial intelligence-driven design—have further accelerated market growth, positioning tissue engineering as a transformative area in healthcare.

- Key players in this market includethe United States, Germany, and Japan. The United States maintains market leadership due to its robust healthcare infrastructure, substantial investment in research and development, and high prevalence of chronic diseases. Germany and Japan are also significant contributors, supported by advanced medical technology sectors and regulatory frameworks that foster innovation in tissue engineering. North America as a region holds the largest market share globally.

- In 2023, the U.S. Food and Drug Administration (FDA) issued the“Regulatory Considerations for Human Cells, Tissues, and Cellular and Tissue-Based Products (HCT/Ps)”guidance, which outlines requirements for tissue-engineered products. This regulation mandates rigorous clinical testing, safety evaluations, and compliance with Good Manufacturing Practices (GMP), ensuring that all tissue-engineered products meet high safety and efficacy standards prior to market entry. These measures are designed to enhance consumer confidence and promote responsible innovation across the industry.

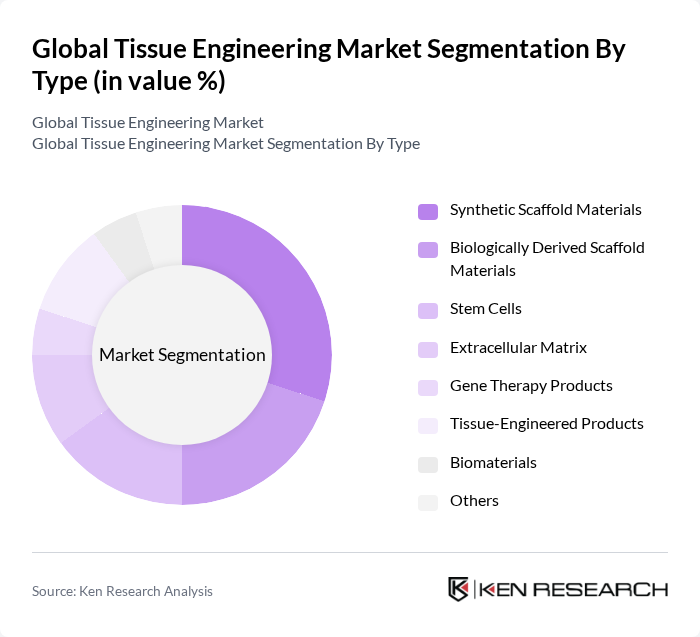

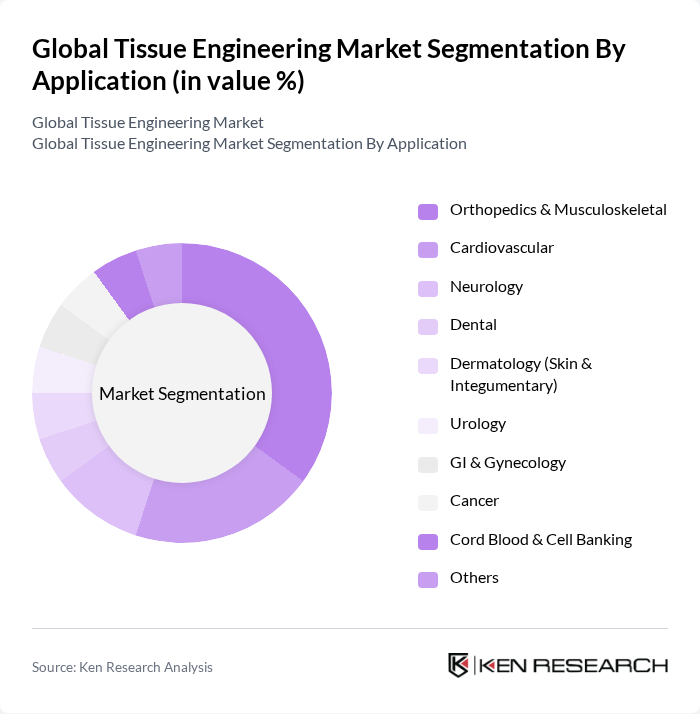

Global Tissue Engineering Market Segmentation

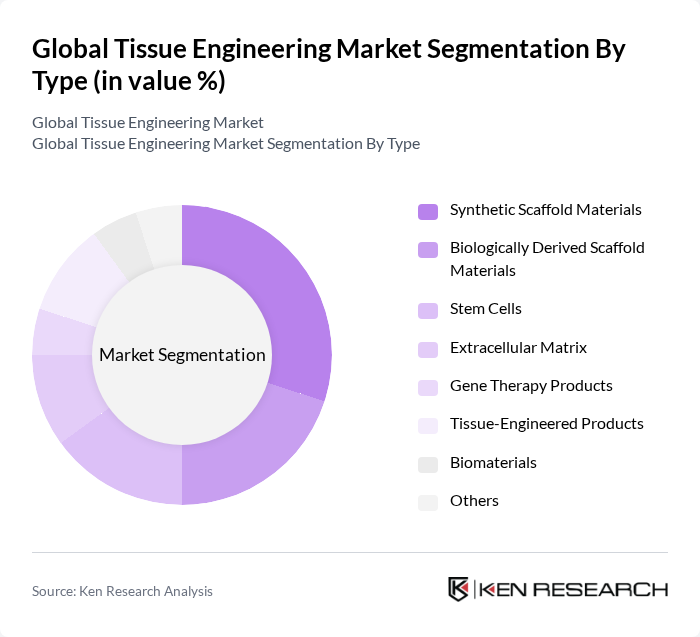

By Type:The tissue engineering market is segmented into synthetic scaffold materials, biologically derived scaffold materials, stem cells, extracellular matrix, gene therapy products, tissue-engineered products, biomaterials, and others.Synthetic scaffold materialsare gaining traction due to their customizable properties, biocompatibility, and ability to support diverse cell types, making them suitable for a wide range of regenerative medicine applications. Biologically derived scaffold materials also hold a significant share, favored for their natural compatibility and effectiveness in tissue regeneration.

By Application:Tissue engineering applications span orthopedics & musculoskeletal, cardiovascular, neurology, dental, dermatology, urology, GI & gynecology, cancer, cord blood & cell banking, and others. Theorthopedics and musculoskeletalsegment is the largest, driven by the high incidence of bone and joint disorders and the demand for advanced surgical solutions. Cardiovascular applications are also expanding rapidly, supported by ongoing innovation in vascular grafts and heart tissue regeneration.

Global Tissue Engineering Market Competitive Landscape

The Global Tissue Engineering Market is characterized by a dynamic mix of regional and international players. Leading participants such as Organogenesis Inc., Acelity L.P. Inc. (now part of 3M), Medtronic plc, Integra LifeSciences Corporation, Stryker Corporation, Tissue Regenix Group plc, Osiris Therapeutics, Inc. (now part of Smith & Nephew), MiMedx Group, Inc., Vericel Corporation, AlloSource, EpiBone, Inc., ReproCell, Inc., Episkin (a subsidiary of L'Oréal), Zimmer Biomet Holdings, Inc., Becton, Dickinson and Company (BD), AbbVie Inc., Advanced BioHealing, Inc. (now part of Shire/Takeda), Collagen Solutions plc contribute to innovation, geographic expansion, and service delivery in this space.

Global Tissue Engineering Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases, such as diabetes and cardiovascular conditions, is a significant growth driver for tissue engineering. According to the World Health Organization, chronic diseases accounted for approximately 71% of all deaths globally, with projections indicating that by the future, the number of people living with diabetes will reach 537 million. This growing patient population necessitates innovative treatment solutions, including tissue-engineered products, to improve health outcomes and quality of life.

- Advancements in Regenerative Medicine:The field of regenerative medicine is rapidly evolving, with significant advancements in techniques and technologies that enhance tissue engineering. For instance, the National Institutes of Health reported a 15% increase in funding for regenerative medicine research in the future, totaling approximately $1.5 billion. These advancements facilitate the development of more effective tissue-engineered products, driving market growth as healthcare providers seek innovative solutions to treat complex injuries and diseases.

- Rising Demand for Organ Transplants:The demand for organ transplants is escalating, with the United Network for Organ Sharing reporting over 40,000 transplants performed in the U.S. in the future. This figure is expected to rise by 5% annually, highlighting the urgent need for alternatives like tissue engineering. As the gap between organ supply and demand widens, tissue-engineered solutions are increasingly viewed as viable options to address this critical healthcare challenge, further propelling market growth.

Market Challenges

- High Costs of Tissue Engineering Products:The high costs associated with tissue engineering products pose a significant challenge to market growth. For instance, the average cost of developing a tissue-engineered product can exceed $1 million, which limits accessibility for many healthcare providers. Additionally, the high price of advanced biomaterials and manufacturing processes can deter investment and adoption, particularly in regions with constrained healthcare budgets, impacting overall market expansion.

- Regulatory Hurdles and Compliance Issues:Navigating the complex regulatory landscape is a major challenge for tissue engineering companies. The FDA and other regulatory bodies impose stringent guidelines that can delay product approvals. For example, the average time for FDA approval of tissue-engineered products can take up to 10 years, significantly hindering market entry. These regulatory hurdles can discourage innovation and investment, ultimately affecting the growth potential of the tissue engineering market.

Global Tissue Engineering Market Future Outlook

The future of the tissue engineering market appears promising, driven by technological advancements and increasing healthcare demands. Innovations such as 3D bioprinting and AI integration are expected to enhance product development and efficiency. Furthermore, the growing focus on personalized medicine will likely lead to tailored tissue-engineered solutions, improving patient outcomes. As regulatory frameworks evolve to accommodate these advancements, the market is poised for significant growth, attracting investments and fostering collaborations across the healthcare sector.

Market Opportunities

- Expansion in Emerging Markets:Emerging markets present substantial opportunities for tissue engineering growth. Countries like India and Brazil are experiencing rapid healthcare advancements, with healthcare spending projected to reach $300 billion in the future. This growth creates a demand for innovative medical solutions, including tissue-engineered products, as healthcare providers seek to improve patient care and outcomes in these regions.

- Development of Personalized Medicine:The shift towards personalized medicine offers significant opportunities for tissue engineering. With the global personalized medicine market expected to reach $2.5 trillion in the future, there is a growing demand for customized tissue-engineered solutions tailored to individual patient needs. This trend encourages innovation and collaboration among biotech firms, enhancing the potential for breakthroughs in treatment options and patient care.