Region:Global

Author(s):Geetanshi

Product Code:KRAA2084

Pages:94

Published On:August 2025

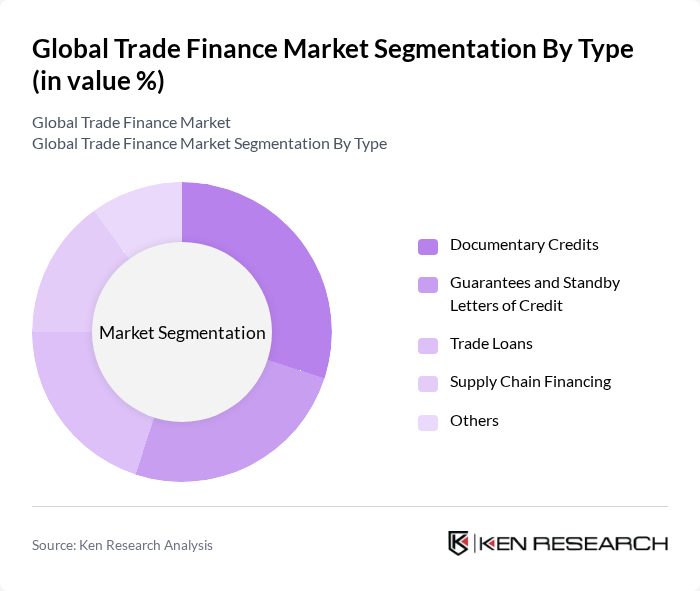

By Type:The trade finance market is segmented into various types, including Documentary Credits, Guarantees and Standby Letters of Credit, Trade Loans, Supply Chain Financing, and Others. Each of these subsegments plays a crucial role in facilitating international trade by providing necessary financial support and risk mitigation strategies. Documentary Credits, such as Letters of Credit, are widely used for securing payment in international transactions. Guarantees and Standby Letters of Credit provide assurance to exporters and importers, while Trade Loans offer working capital for cross-border trade. Supply Chain Financing is gaining traction as companies seek to optimize working capital and improve supplier relationships through early payment solutions .

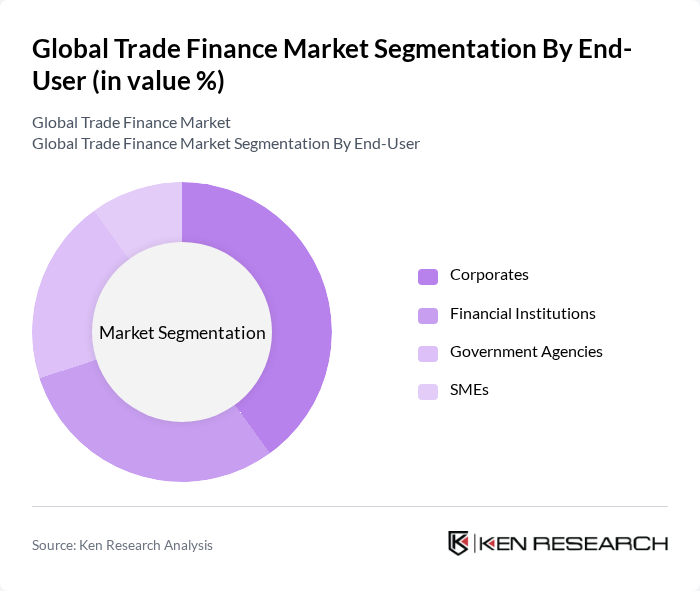

By End-User:The end-user segmentation includes Corporates, Financial Institutions, Government Agencies, and SMEs. Each of these segments has distinct needs and requirements for trade finance solutions, influencing their participation in the market. Corporates and large enterprises are the primary users of trade finance products, leveraging them for large-scale international transactions and supply chain optimization. Financial Institutions play a pivotal role as intermediaries and providers of trade finance instruments. Government Agencies often utilize trade finance for export promotion and infrastructure projects, while SMEs are increasingly adopting trade finance solutions to access global markets and manage cash flow .

The Global Trade Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as HSBC Holdings plc, JPMorgan Chase & Co., Citigroup Inc., Deutsche Bank AG, Standard Chartered PLC, BNP Paribas S.A., Wells Fargo & Company, Bank of America Corporation, ING Groep N.V., Barclays plc, Société Générale S.A., UniCredit S.p.A., Export Development Canada, Euler Hermes Group S.A. (Allianz Trade), Coface S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the trade finance market appears promising, driven by technological innovations and a growing emphasis on sustainability. As businesses increasingly adopt digital solutions, the efficiency of trade finance processes will improve, attracting more participants. Additionally, the focus on sustainable practices will likely lead to the development of green trade finance products, catering to environmentally conscious companies. These trends indicate a dynamic evolution in the trade finance landscape, fostering resilience and adaptability in the face of ongoing challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Documentary Credits Guarantees and Standby Letters of Credit Trade Loans Supply Chain Financing Others |

| By End-User | Corporates Financial Institutions Government Agencies SMEs |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Application | Import Financing Export Financing Domestic Trade Financing |

| By Investment Source | Bank Financing Private Equity Government Grants |

| By Policy Support | Export Credit Agencies Trade Promotion Policies Tax Incentives |

| By Financing Structure | Short-term Financing Medium-term Financing Long-term Financing |

| By Service Provider | Banks Trade Finance Companies Insurance Companies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Corporations' Trade Finance Usage | 100 | CFOs, Treasury Managers |

| SME Trade Finance Needs | 80 | Business Owners, Financial Controllers |

| Banking Sector Insights on Trade Finance | 60 | Trade Finance Officers, Relationship Managers |

| Impact of Digital Solutions on Trade Finance | 50 | IT Managers, Digital Transformation Leads |

| Regulatory Perspectives on Trade Finance | 40 | Compliance Officers, Regulatory Affairs Managers |

The Global Trade Finance Market is valued at approximately USD 9.7 trillion, reflecting significant growth driven by globalization, e-commerce, and the need for efficient financing solutions to manage risks in international transactions.